Accounting software in 1s. Accounting for expenses for an accounting program

Expenses for the purchase of 1C programs are considered expenses for ordinary activities and cannot be attributed to intangible assets.

Accounting

Since 1C software products are often used by organizations for more than one month, and their payment is made in the form of a one-time fixed payment, it is reflected in accounting as deferred expenses with subsequent write-off to expenses over the life of the program. If the term of use of the program is not specified in the contract, it should be set independently, based on the useful life of the program on the 1C: Enterprise platform or based on a letter from 1C, where the recommended service life of the program is 24 months. In this case, the maximum period during which the company will write off expenses is 5 years.

During this period, the amount of a one-time payment is evenly included in the composition of expenses of the current period on account 26 "General business expenses", since PP "1C: Enterprise 8" was purchased for the needs of the accounting department (clause 18, paragraph 3, clause 19 PBU 10/99, Instructions for the use of the Chart of Accounts).

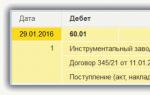

The following entries should be generated in accounting:

- Debit account 60.01 - Credit account 51

- Account debit 97.21 - Account credit 60.01

- Account debit 26 - Account credit 97.21

In the program "1C: Accounting" (rev. 3.0), the operation of acquiring a non-exclusive right to use the software is reflected in the document "Receipt (act, invoice)" as a service, since the software product cannot be entered into the warehouse as a commodity or material.

To view the transactions, click the button "Show transactions and other document movements" (Dt / Kt)

To view the transactions, click the button "Show transactions and other document movements" (Dt / Kt)

To perform the operation of including part of the expenses in the current month, it is necessary to create a document "Routine operation" with the operation type "Write-off of deferred expenses". As a result of posting the document, the corresponding postings will be generated.

Amount of expenses written off:

- 10800/2/12 = 450 rubles. per month

- 450 rubles / 31 = 14, 52 rubles. in a day

- 14.52 * (31-5) = 377.42 rubles. for december

Expenses related to the acquisition of the right to use computer programs under license and sublicense agreements are included in other expenses related to production and sales (clause 26, clause 1, article 264 of the Tax Code of the Russian Federation).

If the terms of the license agreement establish the term for the use of computer programs, expenses are accounted for evenly during this period. If the license term has not been established, the organization can independently set the deadline for writing off the costs of the program (paragraph 2 of clause 1 of article 272 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of the Russian Federation dated 31.08.2012 No. 03-03-06 / 2/95, dated 18.03. 2014 No. 03-03-06 / 1/11743) or take it equal to 5 years (letter of the Ministry of Finance of the Russian Federation dated 04.23.2013 No. 03-03-06 / 1/14039).

As a rule, the useful life of the BPO for software in the BU and NU is set to be the same so that the cost is repaid in equal shares:

VAT deductions for deferred expenses (for the purchase of 1C programs) are carried out in accordance with the generally established procedure if the following conditions are met:

- The goods are accepted for accounting;

- VAT amounts paid to the supplier;

- The purchased goods are intended for use in activities subject to VAT;

- Availability of a vendor invoice with a dedicated VAT amount.

If the program of the 1C: Enterprise family is received by the taxpayer, then he has the right to deduct the entire amount of “input” VAT related to them, regardless of when their cost is attributed to expenses. Those. the amount of VAT can be deducted in full in the period when the program was purchased and accepted for accounting on account 97.21.

Application of PBU 18/02 standards

In accounting, the costs of purchasing 1C: Enterprise programs will be written off to expenses during the specified period of using the program, and in tax accounting - at a time during the acquisition period. The reflection of such a difference occurs according to the rules regulated by the norms of PBU 18/02.

In accounting (for the period in which the programs were purchased), it is necessary to reflect the taxable temporary difference in an amount equal to the difference between the entire amount of expenses for the acquisition of programs and the amount that participates in the formation of the accounting profit of the reporting period. The identified taxable temporary difference will be paid off gradually, as the costs of purchasing programs are written off from account 97.21 (during the established period of using the program).

The 1C software package is used by almost all accountants to maintain financial documentation of their enterprises. This is a very powerful and convenient complex, which includes many programs specially adapted for use in enterprises and companies conducting various types of activities. There are versions for trade, manufacturing, construction, agricultural, educational, budgetary, utilities and many other institutions and companies.

The capitalization of programs in 1C differs from the reflection of the purchase of ordinary goods.

Since the program is complex and far from the simplest, even the most experienced accountant may not be able to understand the technical intricacies of entering some operations for their accounting in financial documents. In this article, we will consider how the purchase of 1C software should be correctly reflected in the menu of the program itself. That is, you and I will learn to indicate in the program menu that it was purchased for use at the enterprise. This is very important, because if you do not do this, or do it incorrectly, then problems may arise when checking the financial records of your activities.

Let us warn you right away that our goal is to show the process from a technical point of view, so that you know what and where to click. We will not delve into the intricacies of accounting, there are other specialized resources for this.

Brief legal note

Let's start with a brief legal note. According to Russian law, software is classified as an intangible asset. But, in the case of 1C, the program is an intangible asset only for the 1C company, which developed it and receives some benefit from its sale. Since the company that acquired the license did not acquire the distribution rights and does not receive material benefits from it, the transaction of purchasing this software cannot be recorded as an acquisition of intangible assets.

By purchasing the 1C program, you acquire the non-exclusive right to use the product of intellectual activity. That is, your rights are limited, since the license only allows you to use the software on a certain number of computers without the right to change the program code and receive additional income from resale or other operations. Accordingly, for the program posting to be reflected, the procedure must be specified as other production-related services.

Another point worth mentioning is the period during which the costs of purchasing intangible rights will be taken into account. According to the legislation, there are several options for such accounting. If the term is not specified in the contract, then the owner either independently chooses such a period, or any open-ended contracts are considered concluded for a period of five years. We will not recommend you which option is better; for this, consult with lawyers or more experienced fellow accountants. In one of the letters, 1C recommended specifying the contract term of two years.

After a short legal digression, let's look at how the procedure is formalized from the technical point of view. We will consider the whole process on the latest version of 1C: Accounting 8. If you are using the previous version, the procedure may differ.

Reflection of purchase of the program

To enter the data correctly, you must have the following documents on hand:

- License agreement.

- The act of acceptance and transfer of the rights to use the software.

For example, you bought the 1C program and transferred 13 thousand rubles to the seller's account once. You need to specify and configure the following operations and payments:

- Direct purchase of software.

- Write-off of deferred expenses.

It will be more convenient to first create an expense for the future period, and only then - purchase the program. Let's get started.

- Launch the main menu of the program by logging into it under your account.

- On the right side of the screen, select from the References menu - Deferred expenses - Create. In the form that opens, you will need to fill in the correct data.

- Indicate the following indicators:

- Name - enter the name of your regular expense, for example, 1C: Accounting 8.

- Group - can be left empty.

- View for NU - Others (select from the list).

- Asset type in the balance sheet - Other current assets (select from the list).

- Amount - enter the purchase amount, for example, 13,000 rubles.

- Recognition of expenses - Monthly.

- Write-off period - the first date is when you bought the product, and the second is the end of the contract. For example, you bought the program on 02/17/2017 with a two-year contract. This means that you need to specify 02/17/2019.

- Cost account - 26. Click on the drop-down list icon - Show all, enter 26 in the search field, select the desired item with the cursor, click the "Select" button in the upper part of the window.

- Cost Items - Read the costs. Choose in the same way as the cost account.

- Confirm your entry by clicking "Save and Close".

- In the side menu, go to Purchases - Receipt (acts, invoices) - “Receipt” button with a green plus - Services (act).

- Specify the following information:

- Act No. from - enter the data specified in the act of acceptance and transfer of the rights to use the software received during the transaction.

- The number - do not fill in, as it is calculated by the program automatically, but indicate only the date. You can choose the same as in the act.

- Organization - select the name of the company in whose name the contract was drawn up.

- Counterparty - the name of the company with which you entered into an agreement reflecting the purchase of the use rights. First you need to create it. Click on the list icon and click on the green plus sign. Enter the name of the company, if it is in the register of companies, all data will be entered automatically. Otherwise, add all the information manually. Confirm your entry with the "Save and Close" button.

- Agreement - in the list of available ones, click the green plus, in the window that opens, enter the type, number, date and name of the agreement, indicate the organization and the counterparty.

- Fill in the table with details:

- click the "Add" button, after which you will see how the fields in the "Nomenclature" column have become active.

- Click on the bottom field "Service content", enter the name of the program, for example, 1C: Accounting 8.

- In the next column, enter the price of 13,000 rubles.

- In the last column, indicate the accounting accounts - 97.21 - click on the link in the form of red arrows.

- In the window that opens in the line "Cost account" click on the drop-down list - Show all - enter 97 in the search - select 97.21 "Other deferred expenses" - click "Select" in the top menu bar.

- In the line "Deferred expenses" select the one you created at the very beginning (steps 2-4).

- On the line Cost department - "Main costs".

- In the menu for adding an act, information about the calculations, automatically displayed by the program, will appear. If you wish, you can change them, but if everything suits you, end the entry with the "Post and Close" button.

- In the future, every month, when it is closed, there will be an automatic accounting of the debiting of funds for the right to use the program. The first month will be taken into account the number of days, and in the future, the amount will be divided into equal parts.

Conclusion

Now you know how the reflection of the 1C purchase in the program itself should be formalized technically. We hope that you will not have any difficulties filling out the data. If you have any questions, ask them in the comments.

As a rule, by purchasing an accounting software, an organization gets the right to use it on the basis of a non-exclusive license. Let's see how to reflect the costs of an accounting program in accounting and tax accounting.

Accounting for program costs

There are two approaches to reflecting the cost of purchasing an accounting software.

Approach 1. The right to use the program can be recognized as an intangible asset (if the program will be used for more than 12 months) (clause 3 of PBU 14/2007). The asset is taken into account based on all costs of its acquisition. And then the cost of the program is repaid by calculating depreciation over the life of the program (clause 23 of PBU 14/2007). Moreover, the recognition of the program as an intangible asset does not depend on its value.

Approach 2. If the license fee is paid as a one-time payment, then the program costs are recorded as deferred expenses (on account 97) and then written off to current expenses during the term of the license agreement. If such a term is not spelled out in the contract, then the costs are written off within 5 years (clause 4 of article 1235 of the Civil Code of the Russian Federation). The balance sheet shows the cost of the program:

- or in section I “Non-current assets” if the period for writing off expenses exceeds 12 months after the reporting date;

- or in section II "Current assets" on the line "Inventories", if the period for writing off expenses is less than 12 months.

Accounting software for income tax

Since when purchasing a program, the exclusive right to the program does not pass to the buyer (clause 1 of article 1233 of the Civil Code of the Russian Federation), it is impossible to reflect the accounting program as an intangible asset. The costs of the program are related to other costs (subparagraphs 26, 49, paragraph 1 of article 264 of the Tax Code of the Russian Federation). But how to take them into account if a one-time payment has been paid under a license agreement? According to the Ministry of Finance, these expenses should be written off during the term of the license agreement. If such a term is not specified in the contract, then the organization can set the deadline for writing off the costs of the program independently (Letter of the Ministry of Finance dated March 18, 2014 No. 03-03-06 / 1/11743) or accept it equal to 5 years (Letter of the Ministry of Finance dated April 23, 2013 No. 03-03-06 / 1/14039).

Accounting for expenses for an accounting program under the simplified tax system

When simplified with the object "income minus expenses", license payments for the program can be taken into account in reducing the tax base in the payment period (

It is necessary in the 1C Accounting 8.3 program to issue the purchase of software (software), how to do it?

Contrary to the usual expression "buy 1C Accounting 8.3", the user acquires under the license not the software itself, but the right to use the results of intellectual activity. This right is usually non-exclusive. In Russian accounting, according to Regulation PBU 14/2007, such a right is not recognized as an intangible asset.

If the payment for it was a one-time, then the cost of the non-exclusive right must be attributed to deferred expenses (abbreviated name - RBP), then it is subject to a gradual write-off to expenses during the term of the contract.

It happens that there is no information about the validity period in the license agreement. Then the organization has the right to set the operating life of the software itself, this should be indicated in the accounting policy. It is recommended, according to the information letter of the 1C company, that the term of use of the software products of this company be set at 2 years.

Example. The organization acquired from a partner of 1C a license to use the computer program 1C: Accounting 8.3 (rev. 3.0), version of the PROF, worth 13,000 rubles. It is necessary to reflect in the same program the purchase of a non-exclusive right to use the software, attribute its cost to deferred expenses, and then write off the cost to expense account 26 "General business expenses" in two years using monthly write-off operations.

Purchase of software in 1C 8.3

Let's register this operation with a standard document “Receipt of goods and services”, indicating the type of document - “Services (act)”. When specifying the item, we will add a new item to the directory, call it "Purchase of 1C Accounting 8 PROF program", the item type should be "Service".

When filling in the "Deferred expenses" variable, you need to create a new directory element - a new item of deferred expenses, indicating the program cost and write-off parameters (procedure for recognizing expenses, start date of write-off, end date of write-off of BPO, account and cost analytics):

Thus, the cost of the purchased program will be immediately included in the BPO. Let's hold the document "Receipt of goods and services", while it will generate a posting to Dt of account 97.21 under the introduced article "1C Accounting". (In this example, the purchasing organization is a VAT payer, so the posting was made for the amount of the program cost without VAT, and the VAT amount was charged to Dt 19.04):

Write-off of prepaid expenses

The operation is routine. It will be performed according to the specified parameters (procedure for recognizing expenses, period, write-off account) automatically when the monthly "Close of the month" processing is performed. The program will itself determine the need to write off the BPO and calculate the amount.

When performing the operation, a posting is generated according to the specified cost account (in our example, account 26), the amount is calculated based on the selected start date of the write-off and the end date.

In the form of document movements on the tab "Calculation of write-off of deferred expenses", the user can see the calculation of write-off of BPO, write-off parameters, the amount of written off BPO and the balance.

Automatic write-off of deferred expenses will be performed by month-end processing until the end of the specified write-off period.

The operation to write off the BPO created at the end of the month is saved together with other period-closing operations in the routine operations journal (section "Operations" - Period-end closing - Scheduled operations). The program allows you to create this operation manually, without using the "Close of the month" processing.

Based on materials: programmist1s.ru

Have purchased the 1C Enterprise 8. How can it be attributed to costs correctly?

Answer

When purchasing the 1C program, exclusive rights do not pass to the organization. This means that it cannot be taken into account as part of intangible assets. In accounting, the costs of acquiring the program are reflected as deferred expenses. In this case, the posting is made: Debit 97 Credit 60 (76) - a fixed one-time payment for the use of a computer program is taken into account. After the computer program is put into operation, the costs of its acquisition, accounted for as deferred expenses, are subject to write-off. The organization establishes the procedure for writing off expenses related to several reporting periods independently. For example, an organization can write off a one-time one-time payment for the use of a computer program evenly during the period approved by the order of the head. Fix the applied option of writing off deferred expenses in the accounting policy for accounting purposes. Write off the costs of acquiring a computer program, accounted for as deferred expenses, reflect the posting: Debit 20 (23, 25, 26, 44 ...) Credit 97 - the costs of acquiring a computer program have been written off. In tax accounting, the cost of the program is accounted for as part of other expenses evenly (for reporting periods). The period for writing off expenses is determined by an agreement or other document, for example, a license form, which indicates its validity period.

The rationale for this position is given below in the materials of the Glavbukh System

An organization can not only create a computer program on its own, but also buy it.

By purchasing a computer program, an organization can purchase: *

- to her under an alienation agreement;

- (non-exclusive right, license) by.

In accounting, at the same time, make the following entries: *

Debit 97 Credit 60 (76)

- a fixed one-time payment for the use of a computer program is taken into account;

Debit (20, 23, 25, 26, 44 ...) Credit 60 (76)

- periodical payments for the use of a computer program are taken into account.

After the computer program is put into operation, the costs of its acquisition, accounted for as deferred expenses, are subject to write-off. The organization establishes the procedure for writing off expenses related to several reporting periods independently. For example, an organization can write off a one-time one-time payment for the use of a computer program evenly over the period approved by the manager. The applicable option for writing off deferred expenses (p. And PBU 1/2008). Write-off of the cost of acquiring a computer program, accounted for as deferred expenses, reflect the entries: *

Debit 20 (23, 25, 26, 44 ...) Credit 97

- expenses for the purchase of a computer program have been written off.

The chief accountant advises *: in the accounting policy for accounting purposes, fix the same procedure for writing off expenses related to several reporting periods, as in tax accounting. In this case, organizations will not appear in the accounting records.

In addition, if the organization has transferred the rights to a computer program under a license agreement, it is recognized as an intangible asset received for use. Consider such a computer program on an off-balance sheet account. This is stated in PBU 14/2007. The chart of accounts does not provide for a separate off-balance sheet account for accounting for intangible assets received for use. Therefore, the organization needs to independently open an off-balance sheet account and fix this in the accounting policy for accounting purposes. For example, it can be account 012 "Intangible assets received for use": *

Debit 012 "Intangible assets received for use"

- the cost of the rights to a computer program received for use (on the basis of a license agreement) is taken into account.

Income tax

Consider the cost of purchasing a computer program when calculating income tax in the following order. *

If an organization purchases a computer program together with a computer, the cost of the program does not need to be allocated from the cost of the computer. If the computer was purchased without the minimum software, include the costs of purchasing and installing such programs in the initial cost of the computer as the cost of bringing it to a usable condition (). Such clarifications are contained in the letters of the Federal Tax Service of Russia,.

In other cases, consider the computer program as an intangible asset if the following conditions are simultaneously met:

- the organization has the exclusive right to a computer program; *

- the exclusive right and existence of the computer program itself are documented;

- a computer program is used in the manufacture of products (when performing work, rendering services) or for management needs;

- the use of a computer program can bring economic benefits (income);

- the useful life of a computer program is over 12 months.

Such requirements are listed in article 257 of the Tax Code of the Russian Federation.

Expenses for the acquisition of exclusive rights to a computer program worth 40,000 rubles. or less, as well as for programs that cannot be accounted for as intangible assets (for example, when obtaining the right to use it under license and sublicense agreements), reflect in other expenses * (). At the same time, the organization has the right to take into account the costs associated with the use of the program under a license agreement when calculating income tax, regardless of whether the program is registered with Rospatent or not ().

If the entity uses an accrual basis, account for recurring payments for the use of a computer program as they are accrued ().

Situation: whether it is necessary, when calculating income tax, to distribute a one-time one-time payment for the use of non-exclusive rights to a computer program. Organization uses accrual * method

Yes need.

This is explained by the fact that on the accrual basis, expenses are recognized in the period to which they relate. If expenses relate to several accounting periods, they need to be distributed.

Expenses are written off evenly (for reporting periods). The period for writing off expenses is determined by an agreement or other document, for example, a license form, which indicates its validity period * ().

But what if the contract does not specify the term of its validity? Then write off the one-time payment for the use of non-exclusive rights to a computer program as an expense, taking into account the principle of uniformity. This can be done in one of the ways.

The first way. Consider a one-time payment during the period established by Article 1235 of the Civil Code of the Russian Federation. That is, within five years * (see, for example,). Therefore, if, when purchasing a computer program under a license agreement, an invoice is received from the seller with the allocated amount of input tax, VAT deduction for such a document is not legal (Tax Code of the Russian Federation). This is explained by the fact that organizations that implement computer programs under such agreements are recognized as payers of VAT ().