Accounting info. Accounting info How to deliver goods for arrival

If the organization has a debt to the supplier counterparty, it can provide services to the counterparty on account of the debt or deliver goods. Also, the counterparty-buyer can supply services or goods on account of its debt. For the correct display of such transactions in accounting, you need to carry out the offsetting procedure.

The process of offsetting in 1C 8.3 is automated and performed by means of a standard document "".

Offsetting in 1C 8.3 between counterparty contracts

Example. Our organization owes the supplier 88,500 rubles. for the supply of materials. On account of the debt, we rendered services to the supplier in the amount of 70,800 rubles. You need to offset.

The netting act can be found in the "Purchases" section or the "Sales" section, the "Settlements with counterparties" subsection. Let's create a document "Debt adjustment" and fill in the details of the "header":

- field "Type of adjustment" - in our case, select "Debt offset";

- field "Set off debt" - indicate "Supplier";

- field "On account of debt" - indicate "Supplier to our organization";

- field "Supplier (lender)" - select the required counterparty.

Get 267 1C video tutorials for free:

Data on payables and receivables are entered in tabular sections on the appropriate tabs. To automatically fill them in, you need to click in the document the button "Fill - Fill all debts with balances on mutual settlements" or the button "Fill" on each tab. The program analyzes mutual settlements with the supplier and shows the debt for each contract.

For offsetting between contracts in 1C 8.3, it is required that in the document the amounts of the supplier's debt and the debt to the supplier are the same. This amount is offset. For this purpose, we correct the value in the "Amount of calculations" column. At the bottom of the document, the difference between receivables and payables is displayed, this difference must be zero. As seen in our example:

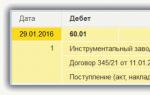

From the document, you can print the form of the Offsetting Act. The document, when posted, will make a posting on the transfer of the amount of debt from the credit of account 62 to the debit of account 60:

The offsetting with the counterparty-buyer is made in the same way. To do this, you need to specify the following details: type of operation - select "Debt offset", offset debt - select "Buyer", on account of debt - "Our organization to the buyer".

Offsetting between organizations

The program "1C Accounting 8" was created to automate accounting and tax accounting. Suitable for various businesses:

- trading companies (wholesale, retail, commission trade),

- organizations involved in the service sector,

- industrial organizations.

Basic actions in Accounting 8.3

First, you should familiarize yourself with the basic actions available in the program. After all, Accounting 8.3 is a unique product that can notice several employees at once. Of course, it is necessary to evaluate in detail the main functions used in practice by each user.

- Accounting for the documentation of one or several organizations;

- Inventory control;

- Accounting for contracts;

- Accounting for commissions;

- Accounting for transactions;

- Asset accounting;

- VAT accounting;

- Payroll preparation;

- Formation of reporting.

The extensive list shows how useful the tutorial version is. With its help, a person quickly becomes a real specialist. Yes, he will need an accounting education, but it can become secondary.

The main part of the actions for the user is performed by the software, which means that he does not have to delve into individual details. So it's time to take a closer look at a few individual actions.

Accounting and tax accounting in the 1C Accounting 8 program is maintained in accordance with the current legislation of the Russian Federation.

The structure of "1C Accounting 8" includes a chart of accounts of accounting, corresponding to the Order of the Ministry of Finance of the Russian Federation "On approval of the chart of accounts for financial and economic activities of organizations and instructions for its use."

The composition of the accounts, the organization of analytical, currency, quantitative accounting on the accounts comply with the requirements of the legislation of the Russian Federation on accounting and data reflection in the reporting. If necessary, users have the opportunity to independently create additional sub-accounts and sections of analytical accounting.

Accounting "from the document" and typical operations

The main method of reflecting business transactions in accounting is to enter configuration documents similar to primary documents. Direct user input of individual transactions is allowed.

You can also use collective entry of transactions. This tool is called “typical operations” and it is not difficult to configure it.

Accounting for multiple organizations

The program "1C Accounting 8" makes it possible to use a common information base for accounting and tax accounting of several organizations - legal entities, as well as individual entrepreneurs. This is very convenient, especially if the economic activities of these enterprises are closely related to each other.

Users can use general lists of goods, contractors, employees, warehouses (storage locations), etc., and generate accounting and tax reporting separately for each organization.

Accounting for documents of several organizations

One of the most advanced steps is collaborating with multiple organizations. Such services are offered by accountants who prefer to work remotely.

They do not depend on a single organization, in which they are assisted by Accounting 8.3. Its versatility allows different databases to be pushed to the server at the same time in order to gain access to enterprise documentation.

Interestingly, version 8.3 is not new in this matter. With the advent of 1C: Enterprise, many managers have forgotten about the permanent staff of specialists. It is easier for them to work remotely with a single professional who can easily handle paperwork in a huge factory. Of course, this is much more profitable, and the conduct of business is not disturbed by anything.

Accounting for commodity and material values (goods and materials)

Accounting for goods, materials and finished products is implemented in accordance with PBU 5/01 "Accounting for inventories" and guidelines for its application.

The following methods of assessing inventories at their disposal are supported:

- at the average cost,

- at the cost of the first in the time of purchase of inventories (FIFO method).

To support the methods of assessing FIFO, batch accounting is maintained on the inventories' accounts. Different assessment methods can be applied independently for each organization. In the accounting and tax accounting of an organization, the methods of assessing inventories are the same.

Inventory control

In warehouses, quantitative or quantitative-total accounting can be carried out. In the first case, the assessment of goods and materials for the purposes of accounting and tax accounting does not depend on the warehouse from which they were received. Warehouse accounting can be disabled if not needed.

In the program "1C Accounting 8" inventory data is registered, which is automatically verified with accounting data. Based on the inventory, the identification of surpluses and the write-off of shortages are reflected.

In addition, you need to highlight warehouse accounting. Even the training version includes a lot of useful operations in this concept. Among them are accounting of incoming products, calculation of balances, volumes sold and other actions. At such a banal level, of course, it is impossible to describe in detail the true beauty of ready-made databases, but still an example turns out to be useful.

A whole group of people have always been involved in inventory control. They had to count the units of goods according to documents, and then add up the balances in order to calculate the profit.

Now the data appears in front of the user with just one click of the mouse, which allows you to reduce the time wasted, reducing them to zero. Because of this, installing even the tutorial version allows you to immediately prepare for convenience.

Accounting for trade operations

The program automates the accounting of transactions for the receipt and sale of goods and services. When goods are sold, invoices are issued for payment, invoices and invoices are drawn up. All wholesale transactions are accounted for in the context of contracts with buyers and suppliers. For imported goods, data on the country of origin and the CCD number are taken into account.

For retail, both real-time reflection of retail sales and reflection of sales based on inventory results are supported. Retail goods can be accounted for at purchase or sales prices. For retail sales, payment by bank loans and the use of payment cards are supported.

In "1C Accounting 8" the use of several types of prices is supported, for example: wholesale, small-scale, retail, purchasing, etc. This simplifies the reflection of receipts and sales transactions.

Accounting for commission trading

The accounting of commission trade has been automated both in relation to goods taken on the commission (from the consignor) and transferred for further sale (to the commission agent). Supports the reflection of transactions for the transfer of goods for subcommission.

When generating a report to the consignor or registering a commission agent's report, you can immediately make a calculation and reflect the deduction of the commission.

Accounting for agency agreements

In the 1C Accounting 8 program, accounting of agency services is implemented by the agent (providing services on its own behalf, but at the expense of the principal) and from the principal's side (providing services through the agent).

Accounting for monetary transactions

Accounting for the movement of cash and non-cash funds and foreign exchange transactions has been implemented. Supports the input and printing of payment orders, credit and debit cash orders.

Operations for settlements with suppliers, buyers and accountable persons (including transferring funds to bank cards of employees or corporate bank cards), depositing cash to a current account and receiving cash on a check, purchase and sale of foreign currency have been automated.

When reflecting transactions, the payment amounts are automatically divided into advance and payment. On the basis of incoming and outgoing cash orders, a cash book of the established form is formed.

Implemented data exchange with programs of the "Bank Client" type.

Accounting for settlements with counterparties

Settlements with counterparties in the configuration are always carried out accurate to the settlement document. When drawing up documents for receipt and sale, you can use both general prices for all contractors, and individual prices for a specific contract.

Accounting for fixed assets and intangible assets

Accounting for fixed assets and intangible assets is carried out in accordance with PBU 6/01 “Accounting for fixed assets” and PBU 14/2007 “Accounting for intangible assets”.

All basic accounting operations are automated: receipt, acceptance for accounting, depreciation, modernization, transfer, write-off, inventory. It is possible to distribute the amounts of accrued depreciation for the month between several accounts or objects of analytical accounting. For fixed assets that are used seasonally, it is possible to use depreciation schedules.

Accounting for main and auxiliary production

During the month, the accounting of the manufactured finished products is carried out at the planned cost, and at the end of the month the actual cost of the products and services rendered is calculated.

Accounting for indirect costs

The program has the ability to account for various costs that are not directly related to the release of products, the provision of works, services - indirect costs. At the end of the month, indirect costs are automatically written off.

Direct costing is supported for general business expenses. This method assumes that general expenses are written off in the month in which they are incurred and charged in full to expenses in the current period. If the organization does not use the direct costing method, then general business expenses are allocated between the value of the manufactured product and the work in progress.

When writing off indirect costs, it is possible to use various methods of distribution by nomenclature groups of products (services). For indirect costs, the following distribution bases are possible:

- output volume,

- planned cost,

- salary,

- material costs,

- revenue,

- direct costs,

- separate items of direct costs.

VAT accounting

Accounting for value added tax is implemented in accordance with the norms of Ch. 21 of the Tax Code of the Russian Federation. Purchase and sales books in 1C Accounting 8 are filled in automatically.

Automated calculation of the cost of products and services produced by the main and auxiliary production, accounting for the processing of customer-supplied raw materials, accounting for workwear, special equipment, inventory and household accessories.

The amount of VAT on indirect costs in accordance with Art. 170 of the Tax Code of the Russian Federation can be divided into sales operations subject to VAT and exempt from VAT.

To control the order of performing routine operations, the program has a "VAT Assistant".

Indeed, the full version of the Accounting 8.3 program allows you to forget about additional tax calculations. For this, there is a special setting that automatically sets the necessary data, coping with the work instead of a specialist.

In the training version, you can freely familiarize yourself with such a function, so that you can then regularly apply it in practice. Even professionals never resort to additional resources and paperwork. It is enough for them to use a ready-made database of their own, in which the main checkboxes for daily work are marked.

Payroll accounting, personnel and personified accounting

In "1C Accounting 8" records the movement of personnel, including accounting for employees at the main place of work and part-time jobs, while internal part-time jobs are supported optionally, that is, support can be disabled if this is not accepted at the enterprise. The formation of unified forms in accordance with labor legislation is ensured.

Automated:

- calculation of salaries for employees of the enterprise on a salary with the ability to specify the method of reflection in the accounting separately for each type of calculation;

- conducting mutual settlements with employees up to the payment of wages and the transfer of wages to the card accounts of employees;

- deposition;

- calculation of taxes and contributions regulated by legislation, the taxable base of which is the wages of employees of organizations;

- generation of relevant reports (on personal income tax, unified social tax, contributions to the PFR), including the preparation of reports for the PFR personalized accounting system.

To simplify the work with documents on personnel and payroll accounting, the "Payroll Assistant" has been implemented.

The program "1C Accounting 8" supports different taxation systems:

- general taxation system (income tax for organizations in accordance with Chapter 25 of the Tax Code of the Russian Federation);

- simplified taxation system (Chapter 26.2 of the Tax Code of the Russian Federation);

- taxation system in the form of UTII (Chapter 26.3 of the Tax Code of the Russian Federation);

- Personal income tax for individual entrepreneurs (in accordance with Chapter 23 of the Tax Code of the Russian Federation).

Payroll preparation

With the help of the training version, you can also get acquainted with the quick calculation of the salaries of all employees. Enterprise 8.3 is based on the aggregation of several separate products, so the result can always be the full amount of data in the output. Now the accountant will only have to display a ready-made report, which will indicate the amounts paid.

Interestingly, the shell works with several types of salaries at once. It is prepared for interest, salary and even ratios applied decades ago.

This allows you to familiarize yourself with common principles during training, and then freely get a job in an organization of any size.

Tax accounting for income tax

Tax accounting for income tax is kept on the same accounts as accounting. This simplifies the comparison of accounting and tax accounting data and the fulfillment of the requirements of PBU 18/02 "Accounting for Income Tax Calculations".

Tax registers and income tax returns are automatically generated according to tax accounting data.

Simplified taxation system

The accounting of economic activities of organizations and individual entrepreneurs using a simplified taxation system has been automated.

Tax accounting for the simplified tax system is maintained in accordance with Ch. 26.2 of the Tax Code of the Russian Federation. The following taxation objects are supported:

- income,

- income reduced by the amount of expenses.

The income and expense book is generated automatically.

Accounting for activities subject to unified imputed income tax

Regardless of whether the organization applies the simplified tax system or the general taxation system, some of its activities may be subject to a single imputed income tax (UTII).

In "1C Accounting 8" provides for the separation of accounting for income and expenses associated with activities taxable and non-taxable UTII. Expenses that cannot be attributed to a specific type of activity at the time they are committed can be distributed automatically at the end of the period.

Accounting for income and expenses of individual entrepreneurs - personal income tax payers

Accounting for income and expenses of individual entrepreneurs applying the general taxation system is maintained in accordance with the Procedure for recording income, expenses, and business transactions for individual entrepreneurs, approved by order of the Ministry of Finance of the Russian Federation of 13.08.2002 No. 86n / BG-3-04 / 430, chapters 23 and 25 of the Tax Code of the Russian Federation.

The book of income and expenses and business transactions is automatically generated according to the form approved by the order of the Ministry of Finance of the Russian Federation of 13.08.2002 No. 86n / BG-3-04 / 430, and the personal income tax return.

Final operations of the month

Routine operations performed at the end of the month have been automated, including currency revaluation, write-off of deferred expenses, determination of financial results, and others.

Standard accounting reports

The program "1C Accounting 8" provides the user with a set of standard reports that allow you to analyze the balances, turnovers on accounting accounts in various aspects.

When generating reports, the user has the ability to customize the grouping, selection and sorting of information displayed in the report, based on the specifics of the organization's activities and the functions performed by the user.

Regulated reporting

The structure of "1C Accounting 8" includes all the necessary forms of accounting and tax reporting, reports, as well as reports for statistics bodies and government funds.

It is possible to upload accounting and tax reports to a file for submission in electronic form. Also, the "1C Accounting 8" program supports the technology of applying a two-dimensional barcode on the sheets of tax declarations.

In order to provide the PFR with data on the calculated insurance experience and paid insurance premiums, a personified account of employees is maintained. Corresponding reporting can also be recorded on magnetic media.

Reporting

Reporting is perhaps one of the most important functions of the software. Because of this, during training, these activities are given the most time. Accordingly, the educational version makes it easy to get acquainted with all the main nuances, so that you can then apply them in practice during work.

Learning 1C in practice is a simple and useful step for a person. The limited version allows you to check the instructions, as well as work them out to automatism.

After that, the user freely switches to a full-fledged software shell in order to perform all the necessary actions. As a result, practiced actions will allow you to replace an entire department with a useful database.

At all times, the accounting department of any organization required the hiring of several specialists. Moreover, the pile of papers still never understood, as it took too much time. Now there is software that can fix all problems instantly. It is well known to all professionals, like all other 1C products.

What's the point of Tutorial 8.3?

If a person wants to learn how to work with a complex shell in practice, he will need educational version 8.3. It has a lot of nuances that allow you to quickly master the basic skills of working with databases in order to move on to more serious development. Moreover, the finished project guarantees a minimum amount of time, which positively differs from any courses.

It should be noted that Accounting 8.3 is a separate version of the Enterprise. It is prepared to work with several major databases in your organization, so you should consider its capabilities in detail. It is in them that the essence of accessible training is hidden, which occurs exclusively in practice with the help of complete instructions.

http://1c-md.com/stati/1s-buxgalteriya-8-3-uchebnaya.html

In this article, we will analyze the procedure for writing off materials in 1C Accounting (using the example of a BP 8.3 configuration), and also give step-by-step instructions for making a write-off. First, we will consider the methodological approach from the point of view of accounting and tax accounting, then the procedure for user actions when writing off materials in 1C 8.3. It should be noted that the general procedure for writing off materials is being considered, without taking into account certain industry nuances. For example, a development, agricultural or industrial enterprise requires additional standard documents or acts to write off materials.

Methodological guidelines

In accounting, the procedure for writing off materials is regulated by PBU 5/01 "Accounting for inventories". According to clause 16 of this PBU, three options for writing off materials are allowed, focused on:

- the cost of each unit;

- average cost;

- the cost of the first purchase of inventories (FIFO method).

In tax accounting, when writing off materials, one should be guided by article 254 of the Tax Code of the Russian Federation, where, under clause 8, options for the assessment method are indicated, focusing on:

- unit cost of inventory;

- average cost;

- the cost of the first acquisitions (FIFO).

The accountant should fix the selected method of writing off materials for accounting and tax accounting in the accounting policy. At the same time, it is logical that in order to simplify accounting in both cases, the same method is chosen. Often, materials are written off at average cost. Write-off at unit cost is appropriate for certain types of industries where each unit of materials is unique, for example, jewelry production.

|

Account debit |

Account credit |

Description of wiring |

|---|---|---|

|

Write-off of materials for the main production |

||

|

Write-off of materials for auxiliary production |

||

|

Write-off of materials for general production costs |

||

|

Write-off of materials for general business expenses |

||

|

Write-off of materials for expenses related to the sale of finished products |

||

|

Disposal of materials upon their free transfer |

||

|

Writing off the cost of materials in the event of damage, theft, etc. |

||

|

Write-off of materials lost due to natural disasters |

Typical transactions for material write-off

Before writing off materials in 1C 8.3, you should install (check) the appropriate accounting policy settings.

Accounting policy settings when writing off materials in 1C 8.3

In the settings, we will find the submenu "Accounting policy", and in it - "Method of assessing the inventories".

Here you should remember about a number of specific features characteristic of the 1C 8.3 configuration.

- Common mode enterprises can choose any assessment method. If you need a unit valuation method, you should choose the FIFO method.

- For enterprises on the STS, such a method as FIFO is considered the most suitable. If the simplification is 15%, then in 1C 8.3 there will be a strict setting for the write-off of materials according to the FIFO method, and the choice of the "Average" assessment method will be unavailable. This is due to the peculiarities of tax accounting under this taxation regime.

- Pay attention to the auxiliary information 1C, which says that only on average, and in no other way, the cost of materials accepted for processing is estimated (account 003).

Writing off materials in 1C 8.3

To write off materials in the 1C 8.3 program, you must fill out and post the document "Requirement-waybill". The search for it has some variability, that is, it can be carried out in two ways:

- Warehouse => Requirement-waybill

- Production => Requirement-invoice

Create a new document. In the header of the document, select the Warehouse from which we will write off materials. The "Add" button in the document creates records in its tabular section. For the convenience of the selection, you can use the "Selection" button, which allows you to see the remaining materials in quantitative terms. In addition, pay attention to the interconnected parameters - the "Cost accounts" tab and the checkbox "Cost accounts on the" Materials "tab". If the box is not checked, then all items will be debited to one account, which is set on the "Cost accounts" tab. By default, this is the account that is set in the accounting policy settings (usually 20 or 26). This indicator can be changed manually. If it is necessary to write off materials on different accounts, then set a check mark, the "Accounts" tab will disappear, and on the "Materials" tab it will be possible to set the required transactions.

Below is the screen of the form when you click the "Pick" button. For the convenience of work, to see only those positions for which there are actual balances, make sure that the "Remains Only" button is pressed. We select all the necessary positions, and by clicking the mouse they go to the "Selected positions" section. Then you should press the button "Transfer to document".

All selected items will be displayed in the tabular section of our document for material write-off. Please note that the parameter “Cost accounts on the“ Materials ”tab” is enabled, and from the selected items, “Apple jam” is debited to the 20th account, and “Drinking water” - to the 25th.

In addition, be sure to complete the Cost Division, Item Group, and Line Item sections. The first two become available in documents if the settings are made in the system parameters "Keep track of costs by departments - Use multiple item groups". Even if you keep records in a small organization, where there is no division into nomenclature groups, enter the item "General nomenclature group" in the reference and select it in the documents, otherwise problems may arise when closing the month. In larger enterprises, the correct conduct of this analytics will allow you to quickly receive the necessary cost reports. A cost division can be a workshop, a site, a separate store, and so on, for which you want to collect the cost amount.

The nomenclature group is associated with the types of products. The amount of revenue is reflected by item groups. In this case, for example, if different shops produce the same product, one product group should be indicated. If we want to see separately the amount of proceeds and the amount of costs for different types of products, for example, chocolate candies and caramel, we should set different product groups when the raw materials are released into production. When specifying cost items, be guided by at least the tax code, i.e. you can specify the items "Material costs", "Labor costs", etc. This list can be expanded depending on the needs of the enterprise.

After specifying all the necessary parameters, click the "Post and close" button. Now you can see the postings.

With further accounting, if you need to write out a similar invoice requirement, you can not create the document again, but make a copy using the standard features of the 1C 8.3 program.

Algorithms for calculating the average price

Algorithm for calculating the average price, on the example of the position "Apple jam". Before the write-off, there were two receipts of this material:

80 kg x 1,200 rubles = 96,000 rubles

Total average at the time of write-off is equal to (100,000 + 96,000) / (100 + 80) = 1,088.89 rubles.

We multiply this amount by 120 kg and we get 130 666.67 rubles.

At the time of writing off, we used the so-called moving average.

Then, after the write-off, there was a receipt:

50 kg x 1,100 rubles = 55,000 rubles.

The weighted average monthly average is:

(100,000 + 96,000 + 55,000) / (100 + 80 + 50) = 1,091.30 rubles.

If we multiply it by 120, we get 130,956.52.

The difference 130 956, 52 - 130 666, 67 = 289, 86 will be written off at the close of the month when performing a routine operation Adjustment of the item cost (the difference of 1 kopeck from the calculated one occurred in 1C when rounding).

In this case, the cost of expenses per month will be as follows:

100 kg x 1,000 rubles = 100,000 rubles

20 kg x 1,200 rubles = 24,000 rubles

The grand total is 124,000 rubles.

Important addition

The formation of invoices and their application for write-off requires the fulfillment of an important condition: all materials written off from the warehouse must be consumed for production in the same month, that is, writing off their full value for costs is correct. In fact, this is not always the case. In this case, the transfer of materials from the main warehouse should be reflected as a transfer between warehouses, to a separate subaccount of account 10, or, alternatively, to a separate warehouse on the same subaccount on which it is accounted. With this option, materials should be written off for costs by an act for writing off materials, indicating the actual quantity used.

The version of the act, printed on paper, should be approved in the accounting policy. For this, 1C provides for a document "Production report for a shift", through which, according to manufactured products, you can write off materials manually, or, if standard products are produced, draw up a specification for 1 unit of product in advance. Then, when specifying the amount of finished products, the required amount of material will be calculated automatically. More details about this option will be discussed in the next article, which will also highlight such special cases of write-off of materials, such as accounting for workwear and write-off of customer-supplied raw materials into production.

Fill in the receipt of goods and services in the program 1C 8.3 Accounting

The receipt of goods and services in the 1C Accounting 8.3 (3.0) program is made by a document of the same name (in the latest versions of the program it is called “Receipt (acts, invoices)”). This article provides consistent instructions for reflecting the purchase of services and goods, and also consider the transactions that the document makes.

How to create a new capitalization

In the interface of the 1C 8.3 program, this document is located on the "Purchases" tab, item "Receipt (acts, invoices)":

After that, we get to the list of documents that have ever been introduced. To create a new receipt, you must click on the “Receipt” button, where a menu for selecting the desired type of operation will appear:

- Goods (invoice) - a document is created only for goods with an accounting account - 41.01

- Services (act) - reflection of services only

- Goods, services, commission - a universal type of transaction that allows you to reflect commission trade and the receipt of returnable packaging

- Materials for processing is a special type of operation for accounting for a tolling scheme, in postings such a receipt will be reflected in off-balance sheet accounts

- Equipment and Construction objects - to reflect the receipt of fixed assets on accounts 08.03 and 08.04

- Leasing services - generates entries for account 76

Let's consider in detail the receipt of goods and services.

Goods receipt in 1C Accounting 8.3

To complete the purchase of goods in the 1C program, you need to enter a document with the "Goods" type. In the header of the document, it is necessary to indicate the organization-recipient of the item, the warehouse for acceptance, the counterparty-seller and his contract:

Below, in the tabular section, information about the items of the item is entered:

What product was purchased, in what quantity, at what price and with what VAT rate (if your company is a VAT payer). Accounting accounts may or may not be present in the tabular section. It depends on the program settings. In postings, the goods are usually credited to account 41.01.

This completes the filling out of the document.

If the supplier has provided an invoice, it must be reflected in the program. This is done by filling in the number and date fields at the bottom of the document:

After clicking on the "Register" button, 1C itself will create a new document "Invoice received". This document makes VAT postings (for example, 68.02 - 19.03) and forms an entry in the purchase book.

Let's see the postings created by 1C using the document "Receipt of goods and services." This can be done by clicking the Debit-credit - debit credit button:

As you can see, the document generated two transactions:

- Debit 41.01 Credit 60.01 - receipt of goods and accrual of debt to the supplier

- Debit 19.03 Credit 60.01 - reflection of the incoming document

In this case, the goods are sold on credit, that is, postpaid. If we had paid for the goods first, the program would have generated an advance payment offset posting (Dt 60.01 - Kt 60.02) for the prepayment amount.

Arrival of services in 1C 8.3

Buying services in the program is not much different from purchasing a product. Filling in the header is absolutely the same, except for the indication of the warehouse. The primary document for reflecting such a transaction is usually the "Act on the provision of services."

The only difference is the instructions in the tabular section of the item with the "service" type. For example, we register the receipt of delivery services:

In the "Accounts" field, you can specify the required analytics. We indicate that we want to distribute expenses to account 26 (General business expenses), with the expense item "Transportation costs". After filling out the document, you can, similarly to the goods, register an invoice.

The key difference in the receipt of services is in the transactions:

For this example, it is advisable to pre-pay the provider for this service.

- Debit 60.01 Credit 60.02 - offset of the advance to the supplier

- Debit 26 Credit 60.01 - accrual of debt to the supplier and an increase in the company's expenses

- Debit 19.04 Credit 60.01 - reflections of input VAT on services

If it is necessary to reflect in one receipt both goods and services (for example, goods with paid delivery), you need to use the document “Receipt (act, invoice)” with the type of operation “Goods, services, commission”.

Based on materials: programmist1s.ru

Group reposting of documents in 1C: Accounting 8.3, revision 3.0

2016-12-07T16: 57: 01 + 00: 00In this lesson, we will learn everything an accountant needs to know about posting documents in 1c, namely:

So let's go!

What is document holding and why is it needed?

By posting the document (by pressing the "Post" button), we force the program to reflect the business transaction, which the document represents, on the corresponding accounts.

Let's take a look at a simple example.

Let us create a new document "Cash receipt", indicating in it the type of operation "Cash receipt at the bank" and the amount of 50,000 rubles:

But is this document considered valid? Of course not. To make sure of this, press the "DtKt" button, which will show us the document transactions:

In response, we will receive a message that the document has not yet been posted and it is too early to look at postings on it.

And if there are no entries, then we will never see these received 50,000 rubles in accounting (for example, in the balance sheet).

And in the journal this document will be without a green checkmark:

Now let's pass the document by clicking the "Post" button:

And again, check if the postings have appeared (the "DtKt" button):

Postings appeared and the document is considered to be posted from this moment.

So, carried out means with entries in accounting accounts and / or movements in other accounting registers (in addition to accounting registers in 1c, there are still information registers and accumulation registers, on which information that does not directly fall into the balance sheet is taken into account).

What happens when you click the Save button in a posted document?

Many accountants I know do not fully understand how the "Write" button works when we press it in an already posted document. Is the document reposting, or is it simply saved with new data, but the transactions remain the same?

To make it clearer, let's look at 2 cases.

We work in not the document

When you press the " Write down": The document is saved, but not posted.

When you press the " Spend": The document is saved and then posted (transactions are generated).

We work in already the document

When you press the " Write down

When you press the " Spend": the document is saved and then posted (old transactions are deleted and new ones are formed).

Output

If the document has already been posted, then there is no difference between the "Save" and "Post" buttons. They do the same thing - repost the document.

Is it possible to change a posted document without reposting it?

First, why would you need it? Well, for example, you need to change some insignificant attribute in an already closed period.

If you just change it and click the "Save" button, then the document will be posted again (after all, it was already posted at the time of our intervention), and this can lead to a change in transactions in an already closed period and many other troubles.

This is most often the case. And when the accountant realizes that he accidentally "passed" the document in the last period and now he has problems with the turnover and closing of the month, he is simply horrified

So, is it possible to change a posted document without posting it again?

The answer for users is no, you can't. Most (if not all) of the standard documents in the "troika" are sharpened for the fact that they form transactions again when the document is changed and written, even programmatically!

Answer for programmers: Use the following code when programmatically saving the modified document:

| Doc. Data Exchange Truth; Doc. Write (); |

How to repost all documents for the organization for the period?

When it comes to the current (not yet closed) period, I recommend doing just that - to carry out all the documents at once for the period in the organization.

Often, documents of various types in 1c are interconnected in terms of the formation of transactions and movements in registers.

Moreover, it can be quite difficult to take into account this dependence yourself, therefore only a complete reposting of all documents for a period guarantees that the program will take into account all the nuances of accounting and form the correct postings.

We go to the section "Operations" item "Group reposting of documents":

In the form that opens, indicate the period, organization and decide whether to stop the process at the first error:

Finally, we press the "Run" button and wait for the end of the process.

How to repost not all documents, but only of a certain type?

If we have good reasons to carry out not all documents, but only of a certain type; or we only need to pass documents that have not been approved - then a more powerful and flexible tool will come to our aid.

Open the "All functions" menu ():

In the dialog that opens, open the "Standard" item and select "Posting documents" in it:

Click the "Open" button. The processing for posting documents built into 1c has opened:

Here you can choose:

- period of documents

- specific types of documents (for example, implementation ... and you can search in the list directly by entering from the keyboard)

- to carry out only carried out or only not carried out, or both

- whether to stop conducting at the first error

Select the desired one and press the "Post" button.

There is only one caveat to this treatment. She makes the conduct of the selected documents at once to all organizations in the database and this must be taken into account so as not to accidentally repost what does not need to be re-posted.

In general, excellent processing, but if you also need to do it separately for organizations, then you may want to get acquainted with an even more sophisticated way.

The most sophisticated way to re-conduct in case there are several organizations in the database

Attention! This option is intended for fairly advanced users. If you are using this opportunity for the first time, I strongly recommend that you create a backup copy of the database before that.Let me show you with an example.

Suppose we have a lot of organizations in our database and we want to re-post the already carried out implementation documents for the 1st quarter of 2013 only for the organization of Jupiter LLC.

We will not be able to do this in any of the above ways.

Therefore, we open the "All functions" menu ():

In the window that opens, open the "Processing" item and find there "Group change of details":

We open it.

In the item "Selection of elements for change" we indicate "Implementation (acts, invoices":

We set up the selection conditions so that only the necessary documents remain in the list:

In this case, I indicated that we only need the documents already carried out on the organization of Jupiter for the 1st quarter of 2013.