Personal income tax

What income tax do individuals need to pay? Personal income tax (NDFL) is a tax on income paid...

The first meeting of the expert group “Reducing inequality and combating poverty” was recently held, dedicated to the preparation of proposals...

In the Tax Code of the Russian Federation, individuals whose income is subject to taxation are divided for ease of calculation...

If you submit 2-NDFL certificates to your Federal Tax Service on paper, then you must attach to them the Register of information on the income of individuals...

Do you know what benefits are available for property taxes (transport tax, land tax and personal property tax)...

» » Property of entrepreneurial activity Property of entrepreneurial activity Return back to To carry out...

On February 16, 2017, the Presidium of the Supreme Court of the Russian Federation approved a review of the practice of courts considering cases related to the use of certain...

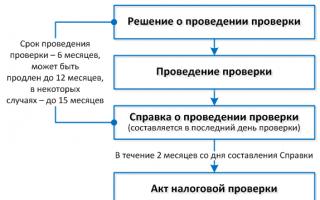

We continue the series of articles devoted to the control work of tax authorities. In the sixth part A.A. Kulikov, managing partner of LLC...

How to restore the TIN if lost? This question interests everyone who has lost a document. TIN is a unique combination of numbers....

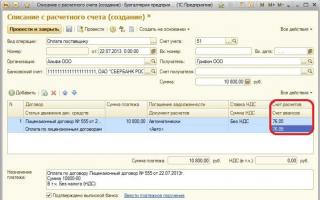

Almost every organization in the course of its activities is faced with the acquisition and use of computer programs. How...

An interest-free loan is a common phenomenon among business entities. Until recently, the attitude of tax authorities towards...

The car tax is called the luxury tax. This is a property tax that must be paid by all citizens...

Variants of tax accounting methods appeared in the Tax Code of the Russian Federation gradually. The very concept of “accounting policy for tax purposes” was introduced...