Assets

You purchased any products for a company or firm, then formed the primary cost, determined the period for...

Accelerated depreciation allows for good tax optimization. But if not all conditions are met, the company will be accused of...

Accounting for fixed assets in accounting and tax accounting has undergone changes in 2017. On the main provisions of the Resolution...

According to the main document on fixed assets PBU 6/01 (clause 15), organizations can optionally revaluate fixed assets....

L.A. Elina, economist-accountant Future expenses: to be or not to be How in 2011 to keep track of costs that were previously reflected in...

BASIC CONCEPTS An agreement on compulsory pension insurance is concluded with a citizen if, for the formation and...

Account 25 means general production expenses and is used to collect information about all expense areas that have...

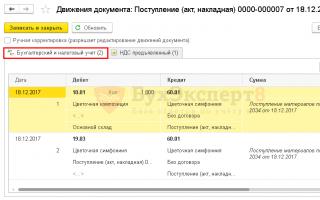

Accountants often make the mistake of writing off fuel and lubricants in 1C 8.3 as an operation entered manually. This is not entirely correct. I'll tell you why. The thing is...

VAT is written off to 91 accounts in a number of situations when, for some reason, it is unlawful to accept input tax as a deduction...

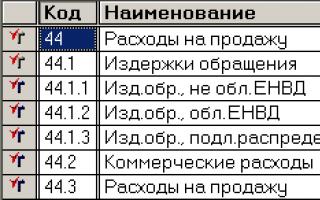

Accounting is an article that summarizes information about costs associated with the sale of goods, provision of services or performance of work. She...

Sales costs are one of the main indicators that an enterprise must take into account to determine the price of a product....

On active account 29 “Service production and facilities”, the corresponding costs are taken into account if on the balance sheet of the enterprise...

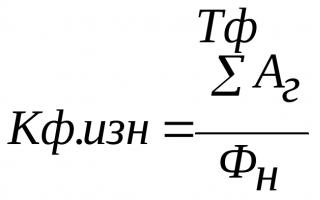

Fixed assets tend to wear out, gradually losing their operational properties. Eventually complete wear and tear sets in, after...