You have acquired any products for a company or firm, then made the formation of primary cost, determined the period during ...

Accelerated depreciation makes it possible good tax optimization. But if not all conditions are fulfilled, the company will accuse ...

Accounting for fixed assets in accounting and tax accounting in 2017 has undergone amendment. About the main provisions of the Resolution ...

According to the main document on the fixed assets of PBU 6/01 (paragraph 15), the Organizations can be revalued by the fixed assets ....

Sale or Exchange of an apartment, as in general, and other real estate transactions are one of those causing the greatest number of questions ....

The banking industry does not stand still, constantly demonstrating customers new tariff proposals, technical and software ...

In recent days, the currency market demonstrated a dizzying dynamics, and many worked for a reflex "run to the exchanger". For someone...

When solving the issue of conducting an exit audit on the organization, the IFSS explores various factors. The main of them is ...

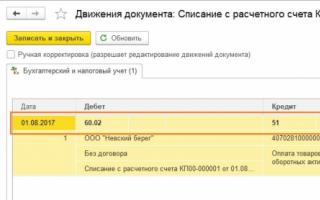

What rules of reflection of operations on the received advances should be remembered by companies? We will understand in the current information in 2020. Theores ...

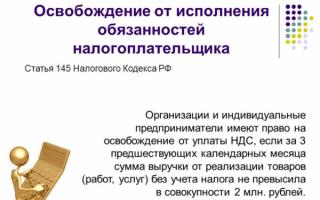

"one. Organizations and individual entrepreneurs have the right to exemption from the execution of the duties of the taxpayer associated with ...

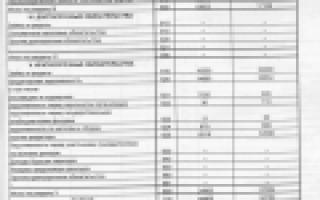

In this article, which was among others, was posted on the disk of ITS, the Methodists of the company "1C" talk about how in the editorial board 4.2 ...

About how you can compare tax systems in order to legitimately reduce payments to the budget when doing business, read in the article ...

Features of VAT payment in the implementation of agricultural products purchased from the population

If the firm sells agricultural products purchased from the population, VAT must pay as if it requires 4 of article 154 ...