Refusal of lending. Why did banks stop issuing consumer loans? Why did Sberbank stop issuing credits for training? False information or fake documents

A source: RIA News"

How it works?

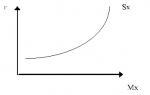

According to the new requirements of the Central Bank of Russia, the higher the total cost of the loan and PDN of the Client, the more funds the bank must freeze in its accounts as a reserve. And this is a direct way to reducing the indicator of its own capital, problems with the Central Bank and the deprivation of a license.

Obviously, banks with ladded borrowers will be easier not to get involved at all.

They tried not to do this before, but now the rule is common to all market players. Changes entered into force on October 1. And the current order will continue until October 2020 only for car loans and loans worth up to 50 thousand rubles.

Why do you need it?

Minister of Economic Development Maxim Oreshkin has repeatedly stated that the situation in consumer lending becomes dangerous.

Already 15% of borrowers spend more than 70% of their income on debt payments.

And the new rules for issuing loans, as requested by the head of the Bank of Russia Elvira Nabiullina, slow down the growth rate of the consumer money from the current 20% to 10-15% per year.

A source: RIA News"

How to find out your PDN?

You can calculate your debt load yourself. To do this, it is necessary to add a payment on the alleged loan to the amount of monthly payments. And the resulting digit is divided into the average monthly income per year and multiply to a hundred.

For example, Peter Peter has a monthly income of 30 thousand rubles and a valid car loan, for which he gives 15 thousand each month. And he wants to take another loan for a new iPhone 11, with a monthly payment of 5 thousand. But for the beginning, he must learn his debt burden. Fold payments on current loans with the payment of the alleged loan, the amount is divided into income and multiply to a hundred: (15,000 + 5000) / 30000 × 100 \u003d 66.7%. That is, the debt load of Peter with a new loan will already be 66.7%. And this is a bad indicator, since the level is considered to be risky above 50%.

And if I am a guarantor?

When calculating the debt burden, loans will be taken into account in which a person made a guarantor if there are overdue for such loans for more than 30 days. If the loan with the guarantion is paid without overdue, it will not affect the debt burden.

In 2014, for the first time in several years, the incomes of the population declined and became negative. Against the background of the crisis, there is an outflow of deposits from banks and an increase in loans, especially mortgage. The devaluation of the ruble forces Russians in attempts to save savings, invest in real estate.

At the same time, banks have ceased to issue loans with minimal first installment, tightened requirements for borrowers and raised interest rates after a shock increase in the key rate of the Central Bank in December 2014.

In the article, we analyze the situation that has developed on the country's credit market, and consider the reasons that influenced the change in the provision of loans.

The reasons

The robust demand for borrowed funds in 2014, in combination with the fall in the solvency of the population, led to an increase in the risks of the banking system, which forced credit organizations to significantly tighten the requirements for borrowers and increase the initial contribution of mortgage products. At the moment, large organizations are primarily paying attention to competent risk management, and not the growth rates or market share.

For example, they have tormented such as the Russian standard, home loan, oriental express, the level of overdue debt is many times higher than the average market. This is explained by the high proportion of unsecured loans. The actions of the Central Bank of the Russian Federation for the cooling of the market and the debt of the population on loans led to the growth of "bad cases" against the background of a slowdown in lending.

The Russian standard of retail loans in May 2014 amounted to 17.4% (46.3 billion rubles), in Eastern Express, the loss in four months of 2014 reached 1.8 billion.

Roshy Home Credit Bank in the retail loan portfolio amounted to 16.3% on May 1, 2014 (45.2 billion rubles) with huge sales of "bad" debts. In four months of 2014, the organization received a loss in the RAS in the amount of 19.4 million rubles. Starting from the second half of 2013, the credit portfolio decreases in the home loan and cost reduction.

The Russian economy is confidently rolled into recession, and problems will increase in a geometric proportion. Given the negative experience, most financial organizations revise their own proposals, tighten the requirements for borrowers and try to work in those segments of the market, which differ in the minimum risk level.

Prospects for mortgage programs in 2015

The rapid increase in mortgage demand is explained by investment purposes, while there is an increase in the volume of loans issued using maternal capital.

Most mortgage loans this year were drawn up without confirmation of income and employment. The risks in such a situation were covered with a high initial contribution, which in some banks reaches 40% -50% of real estate value.

Mortgage remains the only product for which the lover of the population is low, so experts believe that next year it will become the main driver driver.

Are you terrible sanctions?

The sanctions influenced 50% of bank assets, however, an indirect influence having a long-term effect is much more dangerous. Loss of investor confidence and capital outflows against the background of the lack of growth in the economy can cause irreparable harm to the financial sector.

The sanctions imposed by the West in relation to Russian financial institutions has already affected many. Sanctions were sberbank, VTB 24, Gazprombank, Rosselkhozbank, Vnesheconombank, Bank Russia. Financial institutions are now limited access to the European and American capital markets.

This led to the fact that Volshconombank, Gazprombank and Rosselkhozbank had already appealed to the government asking for financial assistance. In combination with the December increase in the key rate of the Central Bank, the restriction of access to the means of Western led to an increase in rates in commercial organizations. In the near future, it is worth expecting further growth in loans in all banks of the country.

The action of sanctions over time will be felt more acute and, if Russia's foreign policy does not change, then serious problems with liquidity in banks will arise. In December 2014, rates on deposits of individuals were significantly raised, but the population is in no hurry to trust their savings to financial institutions due to the unstable economic situation in the country.

Russian banks try to find an alternative to cheap western money, but it is impossible. The Asian market will not be able to replace European loans due to the peculiarities of business and limited resources. An increase in demand will only lead to raising rates, and the shareholders of many Asia organizations are European and American banks.

Sanctions affect not only the banking sector, but on the entire economy of the country. The growth rates are reduced, and many companies will not be able to count on financing or paying existing loans, which will lead to loans defaults. While the only exit is the help of the liquidity of the Central Bank, to which several major organizations have applied.

It was decided to reward VTB and Rosselkhozbank, and the Supervisory Board of Sberbank approved the appeal to the Central Bank for financing. Also, for help, another 19 Russian banks appealed. However, only organizations with state participation and largest credit organizations can count on it.

Due to the lack of liquidity, the banks have already begun the struggle for investors, which will continue in 2015. In December 2014, rates on deposits significantly increased. However, at the same time, rates on loans will continue to grow on deposits.

Most banks try to attract borrowers with a positive reputation that can choose, focusing on the amount of rates, but organizations will have to increase interest after increasing the key rate of the Central Bank.

What awaits banks in 2015

The forecast for the development of this sector for 2015 is pessimistic. The increasing impact will have a growing impact of liquidity deficit, a decrease in the level of capitalization and income due to sanctions and internal economic problems. At the same time, the level of ledity of the population and the volume of overdue debt is growing. At the same time, the requirements of the regulator are tougher, and the solvency of the population and business falls.

In this situation, banks must fully revise their strategies and rebuild the principles of work. It is likely that in the near future offers on loans will be reduced, and cash-based cash services and other non-interests to develop.

The Russian economy and the banking sector of the country in 2015 will depend on the situation around Ukraine and relations with the West. Experts hope that the economic interests of the country prevail over the political ambitions of the manual and the situation will not be brought to the critical point.

In the current realities, receiving a bank loan is a complex and time-consuming process, given that many market participants have reduced retail programs and become more demanding on their potential borrowers who want to get money for percentage. But such a policy of banks has a completely logical explanation: in conditions of deterioration of the economic condition in the country, the main task of market players is to maintain their current positions, which can be done by implementing a well-known and weighted strategy to hold the initial borders without losses and bankruptcy.

Peak passed!

Credit BUM 2012 has long approached its logical end and now banks are forced to spend huge resources to fight his catastrophic consequences: for the period of mass lending to citizens, a large amount of non-secured cash loans was issued, and the money was issued without certificate of income, and banks were extremely Superficially treated to assess the solvency of their borrowers. And for a while such a scheme successfully worked: loan portfolios grew constantly, and each bank tried to overtake their competitors, offering the most loyal, but highly discovery conditions for issuing borrowed funds. However, as soon as the economic picture of the country began to deteriorate, the first to pay customers who took cash loans and card loans (this is not counting the currency mortgage, where the situation was at all on the verge of a foul): Many borrowers, feeling the drop in the level of their income, simply They ceased to make payments, which was a reason for bankers to revise their credit policies in order to prevent further growth of problem debt.

High slaughterism is the reason for all troubles and trouble.

Another actual problem for the domestic consumer market is a high tolerance of Russians. During relative stability in the economy, citizens have not seen problems with the design of 2-3 credits, as they were confident in their income and in the proper level of solvency. But when the level of financial condition began to gradually decline, all previously executed loan commitments have become an unbearable burden for the family budget of borrowers, which has become a reason for banks to refuse lending to those who have time to gain loans, even if such a client pays their payments on time, And his material wealth is still high, as in 2012-2013 (from the point of view of bankers, the more consumer has the current obligations, the higher the risk of its social default, and this is an extremely unwanted version of the development of events when it comes to retail lending. ).

To reduce the risk of delay and protect yourself from cooperation with highly laid borrowers, some banks even expanded the list of potential customers, including students and citizens of retirement age. But this practice was not crowned with success in view of the low payment discipline of such clients.

Banks work with debtors

The main focus of banking activities today is not made on issuing new loans, but to work with problem debt, which has become the cause of the frequent failures of banks in retail customer lending. In the current situation, the issue is in improving the quality of portfolios, for which a full-fledged and large-scale work with debtors who do not want or cannot repay their loans. Therefore, for the lender, today it is much more important to eliminate the existing debt, inviting the restructuring of its obligations to the current client, credit holidays or other benefits to maturity than to attract new borrowers, which is unreasonably and extremely risky.

The end of 2014 was marked by many events, including, unfortunately, very clear signs of an impending economic crisis in the country. Many Russians could feel it on themselves, to no avail trying to arrange the credit on the eve of the upcoming holidays. Most of them were asked about, or simply banks stopped issuing loans.

In fact, both versions have a complete right to exist, since by the end of the year many credit organizations have been announced by the suspension of loans by almost direct text. Unofficial signals came even from large banks, including Rosselkhozbank.

In fact, the complete stop of the credit activity, of course, was not, but the underwriting became tougher, from among the proposals they mostly disappeared the most profitable programs for customers (including partner, with installments), and also significantly reduced the list of available mortgage products.

The reasons for the development of the situation is thus more than enough, but we will highlight the most significant.

Full outflow

As everyone knows, banks need a flow of funds for their activities, which they are in a considerable extent due to loans from foreign partners. Their share takes about 10% of the total bank liabilities.

In connection with imposed sanctions for many banks, foreign loans have become unavailable or operate in limited mode. Under the press fell, which is negatively reflected in the state of the entire banking sector.

Another way to attract funds is the placement of customer money on the deposit, but also there were also serious problems with this: frightened depositors are in a hurry to pick up their savings both in rubles and currency.

In order not to sow additionally panic, banks still do not establish restrictions on removal of funds, but such an outflow also does not contribute to further strengthening.

In an attempt, at least somehow pushing the formed bars, some banks were fascinated by making money on the currency exchange (soil there is now very fertile for this), thereby further reducing the amount of funds available for borrowers.

Loading

The second on the list, but not much to significance, the reason is too high the level of slaughterism of the population. Many borrowers are already far from two to three loans, which is very negatively affecting the quality of their maintenance: the share of overdue debts is growing, noting all the positive results of banks.

The growth of overdue debts becomes one of the main problems of organizations that have made the mainstream retail lending and they simply cease to issue loans.

Very difficult situation now with the mortgage sector. Two huge risks that with a large probability of probability can be realized in the near future, reducing the income of borrowers and the fall in real estate prices are also played against banks.

And given the fact that almost half of mortgage loans was issued with an initial contribution of less than 30%, and even less than 20%, an increase in the amount of overdue debt on housing loans can be very sensible to finance banks.

Against the background of favorable forecasts for improving the quality of credit portfolios, no one gives, so banks are forced to tighten underwriting when considering applications.

Tightening control

Do not make it easier for banks and controlling organizations. The most significant solution of the past year, which many started in a dead end was a sharp increase, after which the issuance of loans in old rates became simply unacceptable.

The overwhelming majority of credit organizations were not prepared for such developments of events, which led many to the temporary suspension of the issuance of funds (until the situation is clarified). And against the background of increasing the key rate, limiting the maximum loan rates even more aggravated the situation. True, the last measure promised to temporarily suspend.

New regulatory standards entered in 2014 make higher demands on capital adequacy and its quality, tighten the requirements for the disclosure of banking information.

All these measures will eventually lead to the centralization of the banking sector, paying it from unfair participants with problems in compliance with legislation. But at the same time, it will not be very effective to work mainly with consumer lending. New conditions will require banks to diversify their programs.

Results of the year

All these events that occurred in a rather short period have already left their mark, and the results could be observed throughout the past year.

The increase in the share of overdue loans led to the fact that near the fifth of the banks worked with a loss. Among them, Home Credit and Finance Bank, in whose practice is the first such case. Even in the midst of the crisis of 2008-2009, the CFF was able to go out in a plus. In 2014, on the results of each quarter, a loss was recorded, which at the end of the third quarter was 4.2 billion rubles compared with 9.4 billion pure profits for the same period of the previous year. As a result - the closure of the most unprofitable offices and reducing staff.

Approximately the same problem also collided the Russian standard bank, with the difference that losses they suffer not only this year. The situation is exacerbated by the lack of growth of the loan portfolio. In total, 30 large banks earnings this year decreased compared with the previous year by 3% -4%.

Another surprise presented us with a bank trust, according to which the Central Bank issued a decision on a sanation at the end of the year. A similar procedure for the bank from the top 30 is a very rare and significant case. One of the major problems of the organization is a low cost of capital adequacy (10.76% with a minimum required by 10%).