Reporting

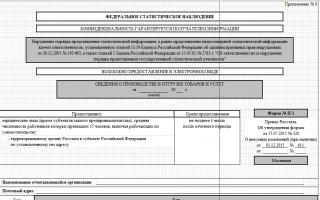

Each organization, regardless of whether it operates under the general taxation system (GTS) or the simplified taxation system (STS), is required to submit...

Not valid Edition dated December 26, 2000 Name of document DECISION of the State Statistics Committee of the Russian Federation dated December 26, 2000 N 130 “ON APPROVAL OF INSTRUCTIONS...

The first quarter of the new year is the traditional time when all business entities must submit a set of reports for the past calendar...

Some entrepreneurs who do not use hired labor are wondering: what kind of reporting does an individual entrepreneur submit without employees? In our...

Perhaps the most pressing question regarding account 03 “Profitable investments in material assets” for this year is whether to include it or not to include it in...

When the global financial system reached intercontinental proportions, and financial interaction between businesses from different countries became...

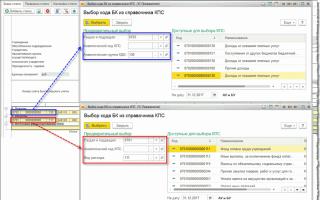

When conducting financial and economic activities, not all operations are carried out by accountants strictly as regulated by the rules...

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION ORDER ON APPROVAL OF METHODOLOGICAL INSTRUCTIONS In pursuance of the Reform Program...

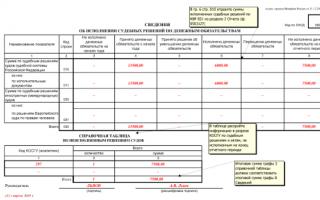

Instructions for filling out the sectoral state statistical observation form No. 2-gr (quarterly) “Information on the implementation...

When preparing financial statements, an organization must ensure that the information provided is complete...

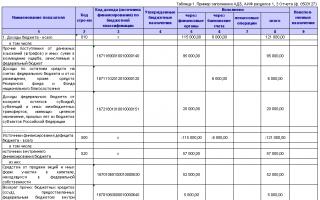

Often, the explanations to the financial statements provide more information about the true financial condition of the enterprise than the statements themselves....

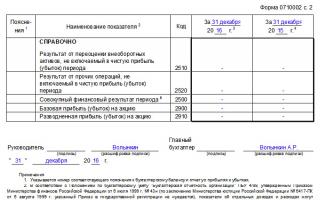

From March 1, 2016, when preparing budget reporting, the Cash Flow Statement (form according to OKUD 0503123 is filled out taking into account...

The tax period for excise taxes is a specific time period, at the end of which the taxpayer is obliged to determine the tax base...