VAT

Tax Code of the Russian Federation). You must submit your VAT return electronically, regardless of the number of employees. Only in exceptional cases is it possible...

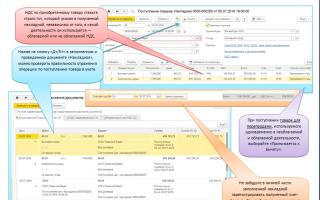

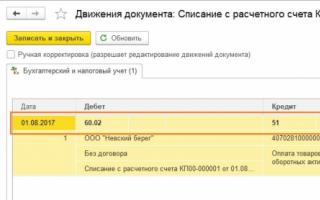

Let's assume that an accountant needs to set up and maintain separate VAT accounting in 1C in the company RetailPro LLC, registered...

"1. Organizations and individual entrepreneurs have the right to be exempt from fulfilling taxpayer obligations related to...

In this article, which, among others, was posted on the ITS disk, 1C company methodologists talk about how in edition 4.2...

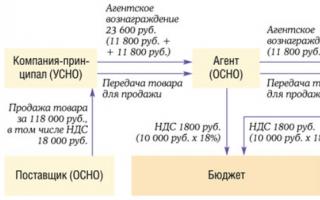

To learn how you can compare taxation systems in order to legally reduce payments to the budget when doing business, read the article...

If a company sells agricultural products purchased from the public, VAT must be paid as required by paragraph 4 of Article 154...

Value added tax is one of the largest sources of filling the state budget. Companies overpaid for this...

Today we are talking about VAT - this is the most difficult tax to understand and optimize. To be or not to be a VAT payer? How clever...

Value added tax (VAT) is a federal tax that all organizations and individual entrepreneurs using...

Value added tax is the largest government tax, providing the budget with about 40% of revenue. Almost all transactions...

Many citizens involved in the sale of goods/services have to face a similar question. In particular, the problem is relevant for...

In the Russian Federation, value added tax is one of the main sources of filling the state budget. By...

Entities operating under the OSNO tax regime are required to pay VAT on almost any type of transaction. The law contains several...