Taxes

The banking industry does not stand still, constantly demonstrating to customers new tariff offers, technical and software innovations....

In recent days, the currency market has shown dizzying dynamics, and many have had the “run to the exchanger” reflex. For someone...

The object is personal property: structural buildings (apartment, house, garage, outbuilding, etc.), movable property...

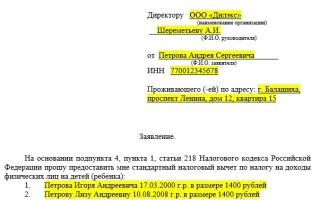

The legislation regulates certain types of income of citizens, which are deducted from the total amount for taxation. Tax deductions...

In addition to the main production, many companies also have auxiliary production. In accounting, the debit of account 23 “Auxiliary...

Account 94 “Shortages and losses from damage to valuables” is intended to summarize information on the amounts of shortages and losses from damage to material and...

When deciding whether to conduct an on-site inspection of an organization, the Federal Tax Service examines various factors. The main one is...

When deciding whether to conduct an on-site inspection of an organization, the Federal Tax Service examines various factors. The main one is...

Single income tax payers are exempt from many taxes by the state. So, they do not pay VAT, personal income tax, transport...

The so-called Concept of the planning system for on-site tax audits was approved by order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/333. She...

Accelerated depreciation allows for good tax optimization. But if not all conditions are met, the company will be accused of...

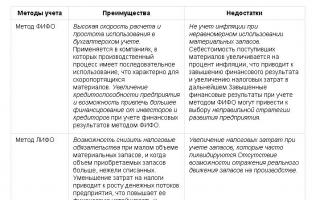

FIFO method calculation example Greetings, dear readers. Sometimes I fear for the future of our country, taking into account the workers in some...

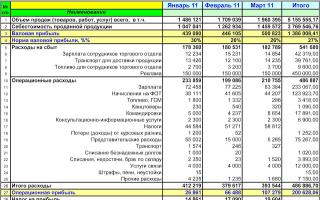

Form No. 2 for OKUD - annual profit and loss report. One of the most important documents in mandatory accounting reporting. The...