VTB24 Bank sells the debts of many of its clients. Bank offered to buy out its debt VTB sold debt

We began to receive letters from readers to the editorial office asking if banks can sell debts to collectors in 2017? Immediately, we note that yes, they can. But with a number of amendments and changes, which we decided to understand and comment on.

ATTENTION!!!

For residents MOSCOW available FREE consultations in office provided by professional lawyers on the basis of Federal Law No. 324 "On free legal aid in the Russian Federation ".

Don't wait - make an appointment or ask a question online.

The article will touch on many points, we will try to analyze in detail whether banks can transfer debts according to the old schemes, or they will have to reckon with legislation and innovations that have affected the entire collection as a whole.

Federal Law # 230 severely restricts the work of not only agencies, but also bank collection. From now on, the collector should not put pressure on the borrower and demand to repay the debt. The bailiffs will monitor this process and accept complaints on the fact of illegal debt collection.

The editors of our site can judge the effectiveness of the law in reducing the number of letters from debtors, where they complain of constant threats and intimidation. The number of such requests has decreased by three times.

But the bailiffs and collectors have not yet fully established interaction, therefore, contrary to the instructions, not twice a week, but ten times a day. What violates the Federal Law. Most likely, this will end soon when agencies and banks receive serious fines and statements from citizens to the prosecutor's office.

Bank to collectors on the basis of Article 382 of the Civil Code of the Russian Federation. The borrower himself signs the agreement that he agrees to such conditions. But this is a compulsory measure, without a signature, money will not be given.

There are two types of contracts under which the assignment of rights of claim occurs:

- Assignment agreement (Article 389.1 of the Civil Code of the Russian Federation). Debt is sold to collectors forever.

- Agency agreement (Article 1005 of the Civil Code of the Russian Federation). The contract is transferred to third parties for a time. Usually the period does not exceed three months.

Important! All debts are transferred to collection without a judicial act. The borrower himself permits such actions by signing the clauses of the loan agreement.

There is an important circumstance that obliges banks to get rid of problem contracts in this way. This is an order of the Central Bank that restricts the issuance of additional funds to a financial institution if they have a certain number of loans on their balance sheets.

For example, the bank received 100 thousand rubles from the Central Bank and issued 10 loans of 10 thousand rubles each. If borrowers pay, then the next month the bank again receives 100 thousand rubles.

If payments under one agreement are terminated, then the bank receives 90 thousand rubles. So until the contract is canceled or written off.

You can write off it in the following ways:

- sell to collectors;

- collect the debt yourself;

- on the fact of fraud.

Only in these cases will the Bank of Russia continue to further finance the credit institution.

If the bank has given a debt to the collectors, what should the debtor do in this case? We would like to draw your attention to the fact that everyone solves this problem on their own, but the choice here is small.

- Pay the debt in full.

- Agree on partial payments.

- Ignore foreclosure.

- Try to resolve the issue in court.

Collectors will insist on a one-time and full repayment of the debt. But if there is no money, try to negotiate.

- inventory and seizure of property;

- a ban on traveling abroad;

- prohibition on registration actions with movable and immovable property;

- problems at work.

Important! Only through negotiations can the desired result be achieved. It is beneficial for the collectors that the debtor pays at least something, rather than just disappears.

Yes, collectors can repay the debt to the bank, but only on condition that it is transferred to them on the basis of an agency agreement. In other cases, this is unacceptable.

Problematic contracts are bought in portfolios of several thousand and cannot be returned. These are unspoiled goods, like in a store, and financial transactions.

In addition, if the creditor gave the debt to the collectors on the basis of an assignment, then the borrower owes nothing more to the bank. His account is closed and the delay is debited. You will have to pay for the details of the agency.

Frequently asked questions from our readers about what collectors can or cannot

Sue the debtor

If the debt is redeemed, then the collectors have the right to sue the debtor. Moreover, with the changes in legislation, this becomes the only way to make a profit.

Russia began to adopt the Western experience of collection, where everything is decided in the manner of legislation.

Call relatives

Collection is based on calls, so the collectors find out the necessary information. Of course, they can talk with relatives or colleagues, but on a regular basis. In Federal Law 230, the time intervals are clearly indicated - no more than twice a week. Unfortunately, this is not being implemented at the moment.

Come to work

Personal contacts with the debtor are as possible as calls. Agencies send their employees to the address of the borrower's place of work. Thus, the person's ability to pay is ascertained.

Calculate interest and penalties

Yes, collectors can charge fines or oblige the debtor to pay legal fees. But most often they are written off so that a person is more willing to pay the main debt. In any case, it is beneficial to both parties.

Find out a new place of work

The collection is mainly carried out by former police officers, prosecutors, and the FSSP. It is not difficult for them to find out the new place of work of any person. Therefore, yes, they can find out the new place of work of the problem borrower and contact his management.

Any bank tries not to accumulate debts on its balance sheet. Let's take Alfa Bank and VTB as an example. They also sell their borrowers' contracts to get more money from the Central Bank.

If you disagree with this, then you can go to court, but because of the contract that you personally signed, you will not be able to win it.

Therefore, as soon as you feel that you cannot make monthly payments, contact your bank with a written one. If they refuse, feel free to go to court and terminate the loan agreement.

At the moment, there are many similar examples in judicial practice.

Outcome

As you can see, banks can sell debt to collectors in 2017 without serious restrictions. The only difference will be the agency's approach to collection. Everything becomes civilized and controlled by the state. In fact, it took this business for itself, putting bailiffs in charge. But this benefits primarily us - the debtors.

If you have any questions on the topic of this article or if you need expert advice, leave your comments or contact the lawyer on duty in the form of a pop-up window. We will definitely answer and help.

Hi friends. We continue yesterday's topic of repurchasing credit debts, which you can familiarize yourself with in the previous article. By the way, I now display the publication dates of articles. I decided that it would be more convenient, otherwise all these "yesterday-today-tomorrow" began to confuse me.

Yesterday, but no, not like that. 03/09/2016 I told you a general trend that is now gaining popularity. If you, I will tell you in a nutshell: gradually both banks and collection agencies come to the conclusion that it is ineffective to collect overdue loans from debtors, and then hammer the bailiffs. Debtors have learned how to properly "drain" or hide property, to understate their already low salaries, in general, by hook or by crook to avoid the execution of decisions.

In such a situation, getting your money back to the bank is already quite problematic. Yes, there is a procedure for writing off the debt, but why waste a loan for nothing, when you can earn at least some money on it? And then the credit community decided that overdue debts can be sold without trial and investigation, as they say somewhere in a distant, distant galaxy.

The collectors came to the same conclusion: spend money on all these mobile brigades, on printing evil leaflets, on gasoline and transport, in order to catch the debtor and call to account. Again, the restriction or complete prohibition of collection activities as an institution is not far off. In this light, the collectors also decided not to "bother" with the collection of delays, and came up with an excellent scheme - to buy out debts from the bank, and then sell them to the debtors themselves.

That's what the previous article was about. And today I will dwell in more detail on the procedure for repurchasing a debt from a bank. And tomorrow we will talk about financial relations with collectors.

Why do they buy out debts?

Yes, that is exactly what it sounds like - to buy out the debt from the bank. Not to repay the debt, not to pay off the debt, but to buy it back. And there is a fundamental difference in this. In most cases, debtors are not able to pay off the loan debt in one payment, hence delays, litigation and, as a result, enforcement proceedings.

The average debtor can repay his loan for years by withholding part of his salary, other income, or by selling (compulsory or voluntary) his property. And all this time arrests, restrictions and unpleasant consequences of the enforcement of the decision will hang over the debtor. And, of course, neither the bank nor the bailiff service will lag behind him until he pays off the debt in full, in the amount that is spelled out in the decision.

And another thing is when it comes to debt redemption. The debtor gets the opportunity to "kill three birds with one stone" at once:

- close the debt;

- to execute the court decision;

- save a significant amount of money.

Moreover, here the key is exactly saving... The fact is that the bank is not selling debt at face value, but at a large discount. Trading begins with 50% of the debt, and in the end, if you approach this issue thoughtfully and reasonably, you can buy out the debt from the bank for 10% of the total amount. How to do this? We read on.

How to buy out a debt from a bank under an assignment agreement

I can talk about two really working situations. In principle, they differ from each other only by the initiator, otherwise the stories are similar.

1. The bank itself offers the borrower (but more often the guarantor) to redeem its debt through a third party. The circuit works like this. The bank makes an offer to the debtor, which is difficult to refuse - to pay only 50% of the total amount to pay off the debt and forget about the loan like a nightmare.

The cession agreement, the very agreement through which the bank sells all the delay to collectors, will help to crank this event. However, the bank cannot sell the line to the debtor himself, such a transaction will not be understood either by the bank's head office, or by the tax authorities or the Central Bank. Why on earth does the bank forgive half of the debt to the debtor? Unclear. After all, if the debtor has half, then there will be the rest to pay off the entire amount.

Therefore, the bank offers a ransom to the debtor, but the contract of assignment of the right of claim (cession) is drawn up between the bank and a third party. The borrower must bring his friend or relative to the bank, preferably with a different surname, and the bank will issue an assignment agreement to him.

Which banks offer to buy out debt

Most often, VTB 24 and Sberbank are the first to make such proposals. These are one of the largest banks in Russia, and therefore they have more than enough delays, which is what they are doing. This does not mean that other banks do not sell loans. On the contrary, they sell, but not so massively and more and more at the initiative of the debtors themselves.

2. The borrower or the guarantor themselves go to the bank with a proposal to redeem their debt... Here you have the cards in hand. If you want to close a loan - find a trusted person, and on his behalf write a statement to the bank: “ I, such and such, want to redeem the debt of such and such a borrower for so much money».

Send the letter to the office where the loan is issued, as well as a copy of the letter to the bank's head office. As for the ransom amount, you can offer the bank any number that suits you. By default, the bank will hold 50%, but you can improvise. Below I will tell you how the ransom amount changes depending on the stage of collection, so that you understand what you can really count on.

After the bank reviews your application, it can:

- either refuse,

- or agree on your terms,

- or offer your own version of cooperation.

When you agree on all the key conditions, you can proceed to the deal. The form of the assignment agreement is standard, I will not cite it in the article. However, I will say about one peculiarity.

The amount of claims and the amount of the redemption may differ in either direction. Let's say you have a debt of 100,000 rubles. The bank prescribes in the agreement the transfer of rights of claim in the amount of 100,000 rubles, but it sells this right of claim for at least 50,000, at least 10,000, at least 1 ruble. And no one will be interested in how much the new creditor received this right of claim.

This form of agreement allows the debtor to close the loan for any agreed amount.

What is important, if the bank has already collected the debt in court, received a writ of execution and sent it to the bailiff service, then before signing the assignment agreement, the bank must revoke the writ of execution, and the bailiff, accordingly, must complete the enforcement proceedings.

After signing the contract and paying the amount, the new creditor will receive from the bank all the loan documentation, the court decision and the writ of execution (if they already exist). And from that moment on, the borrower's debt to the bank will be repaid, but the right to claim it will pass under the assignment agreement to your authorized representative.

How to protect yourself from a new lender

I understand everything, friendship, trust, family ties are all good. But believe me, everything changes when it comes to money. After all, it is enough for a new creditor to go to court and establish procedural succession on the basis of an assignment agreement. After which he will be able to submit a writ of execution to the bailiff service and you will pay the debt already in his favor.

Therefore, in order to finally resolve the issue with the creditors, you must enter into a cancellation agreement with your new creditor. It's not difficult, I think you can do it yourself or find a sample on the Internet. The essence of the compensation is that you "pay" the creditor a certain amount of money, thereby repaying your obligation, and the creditor gives you all the loan documentation, decision, writ of execution, and so on. It is clear that money will be transferred only on paper, but who will prove it, if you do not have witnesses, but there will be a correctly drawn up receipt.

It will not be superfluous to spread straws in this matter, so do not neglect and do not leave behind tails that someone can beat.

At what stage of delay is it most profitable to buy back the debt

The amount of the redemption depends on the stage of your delay. Therefore, a smart debtor will take this issue seriously. I will describe the main stages, and you are already planning your actions.

Delay 2 - 6 months... The bank will accept the deal only on condition of a 50% discount. This is understandable, there has not yet been a litigation, the bailiffs have not yet worked.

The bank received a decision on debt collection... Here you can already bargain a little, but I would not count on less than 40% of the debt. The bank will still rely on bailiffs.

Enforcement proceedings... Here you can already improvise. I hint: if you do not have property on which the bailiff can foreclose, but there is an official source of income from which the bailiff can withhold, the ransom amount can be up to 30% of the debt. If you have neither property nor income, you can safely count on 10%. Remember, yesterday I told you for what% the banks sell debtors to collectors? That's the same.

Summarize. Today, a debtor - an individual may well redeem his debt from a bank on very favorable terms. In my opinion, this can be used, especially if such proposals are received from the bank. However, before you run to the bank with a proposal, I recommend reading the following article, which will talk about buying out debts from a collection agency. Who knows, maybe the offer of collectors will be more profitable. The new article will be released 03/11/2016.

Due to the large number of requests for the service: "Debt redemption", I decided to first write and then put up for sale a book of the same name, which will answer all your questions and help to redeem my debt from the bank on my own.

Stay tuned for updates and subscribe to my mailing list - you will find the subscription right under the article.

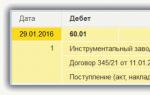

In November, this story began when VTB24 Bank offered me to buy back my debt on a loan for 10%. I was given a term until the end of November, then until the end of December, and now in February, the story with the repurchase of the debt on the loan under the assignment has been continued.

How I bought a loan debt

I already managed to talk about this live in Periscope and now it's time to write a short article on the website and shoot a video for the anti-credit channel on YouTube.

About how this story began, you can watch my video about how VTB24 offered me to buy out my debt and how I talked in the VTB24 office with an employee working with problem loans. It describes in detail the terms of the cession that the bank offered me and I took the project, the cession agreement (assignment of rights to claim the debt on the loan), which I posted on the site.

In short, my debt on VTB24 loans is 2 million as an individual - it includes consumer loans, business loans issued to me as a business owner and, of course, magic credit cards that VTB24 snatched me when issuing another loan and which , of course, I accepted with gratitude. By the way, I also have loans issued to a legal entity and even with a pledge, for which I am the guarantor and there the amount is another 23 million rubles, but so far VTB officials cannot do anything with these loans and cannot even take the collateralized property (and there mortgage) for 2 years. About this, I have a video about my tricks with banks, where there are the amounts that I owed to different banks and what they did to me for it. But I didn’t receive any intelligible proposals on these loans.

When there was a delay in VTB24 loans, even at the pre-trial stage, I received an offer from the bank to redeem my debts for 50% after about 3 months of delay, then almost another six months passed and the bankers offered me a figure of 30%, but unfortunately, or fortunately, I could not then buy back these loan debts. Well, in November, I received an exclusive offer to buy out the loan debt already for 10%.

I received the final offer at the stage of enforcement proceedings. That is, the bank filed a lawsuit, naturally won the lawsuit and naturally received a writ of execution and, of course, took it to the bailiff. But it just so happened that I have nothing and I am a beggar and the bailiff did not manage to collect anything from me. Well, if you regularly watch my channel and have already completed the Course of the Young Fighter Defaulter of Loans and received a hundred-ruble consultation on Skype after completing the Course, then you, too, have already prepared to communicate with the bailiffs and have nothing to take from you either. In this case, you have a lot of chances to receive a similar offer to buy out your debt on a loan not only from VTB24, but also from other banks. Go for it!

I must say that this is a rather profitable offer for a bank, because there is nothing to take from me and they have a rather meager choice - either sell to me and get 10% or sell to collectors for 0.75-1.5%. Of course, it is more interesting for them to sell the debt on a loan to me than to receive a penny from the collectors or to write off the debt as a financial result - that is, to recognize a loss.

Well, the deadline for me was set at the end of November - I did not buy the debt. Then it was extended until the end of December - but I still did not draw up the assignment agreement. I already thought everything was a final comedy, but the story was continued.

Throughout January, I received calls from unfamiliar numbers, and given that I had a lot of work with video and a lot of consultations after the New Year, my phone was in the “do not disturb” mode and I did not call these numbers back. But one day I got a message on WatsApp. As you can see, the offer has been extended until February 20 and may even be extended further, given the previous extensions. I did not refuse and did not say that I was not interested in buying back the debt (I will explain further why it is not interesting). I continued the dialogue, but not for myself, but in order to collect information and tell you. Perhaps it will be useful to someone. I want to see what will happen next - either they will extend the offer, or my debt will be sold to collectors or the debt on my loan will be written off by the bank - that is, they will forgive me, because it is unprofitable to keep such debts on the balance sheet.

As you can see, I even protested to the banker that I was not in Russia and that my debts on loans and the status of not traveling abroad did not prevent me from going abroad. He was probably very surprised. Well, I had fun. But not the point. So, I want to answer the frequently asked questions that come to me from subscribers.

Did I buy back the debt on the VTB24 loan?

No, as you see the assignment agreement, I have not drawn up and am not going to draw up, because I do not see the point. Of course, if you have only one VTB24 loan debt, then this deal is very interesting. But in my situation, when I have debts of 18 million, to buy out the debt on a loan of 2 million and leave another 16 million - there is no point, would you agree? In addition, I have already begun training in the bankruptcy procedure of an individual and I started the reality show THE BANKRUPT OF THE BANKRUPT, where I will bankrupt myself and show the pitfalls of this procedure. Releases of the reality show are temporarily frozen, but at the end of February everything will resume and I hope this year I will receive the title of Honored Bankrupt of the Country (abbreviated ZBS).

In short, it makes no sense for me to buy out my debt, I study this information with the aim that it may be useful to other people. By the way, if you think that it can be useful to others - like the video on YouTube and share the article from the site on social networks and this will help this material rise in the search and others will be able to find it more easily. With one click of a button, you will help me help people. I give blessings.

The following very popular questions are:

- What pitfalls does the assignment agreement have and why is this transaction dangerous for the assignee?

- What needs to be done in order to redeem your debt under an assignment agreement?

- How is debt written off after the cession agreement is signed?

- What should be attributed to bailiffs to terminate enforcement proceedings?

I will answer these questions in the following videos, where I will analyze in detail the assignment agreement, tell you what to look for, how not to get into a mess with the debt redemption so that the bankers do not deceive you and how to complete everything after the debt is repurchased so that the bailiffs stop enforcement proceedings. Therefore, subscribe to the channel so as not to miss anything and in the near future links to these videos will be available and you can follow them and see detailed information.

I have already posted the assignment agreement and the application on the site, and you can download and view them. In the description of the video there is a link to an article on the site and there you can find drafts of these documents. They are standard and this form is offered by VTB24 throughout Russia. If you liked the video and article - like it and share with your friends. Be sure to write in the comments if you have received such offers to buy out your debt on a loan from VTB24 or from other banks and maybe you will help other people.

And remember that whatever is done is for the best. And after you have become a loan debtor, you have the opportunity to close the loan on much more favorable terms. Don't hang your nose! It's only begining!

When a bona fide borrower takes out a loan from a bank, he plans to pay it off according to the schedule, as expected. But since almost all types of loans are given, as a rule, for several years, during this time events that do not depend on the client can occur, which lead to insolvency.

This does not mean that the debtor does not want to pay, he has objective reasons that do not allow him to do so. Usually they are associated with the source of income, for example, you can lose your job or get sick, and therefore the person does not receive the salary with which he expected to pay off the loan.

There is an overdue debt, which can drag on for months with varying degrees of success - the debtor periodically deposits small amounts if he manages to intercept them somewhere. In this difficult period, VTB's debt amnesty can help. Customer reviews speak of the great benefits of such a bank service. In particular, it prevents the bankruptcy of borrowers. Clients welcome the nascent civilized relations between debtors and credit institutions, they believe that debt repayment actions raise them to a new level, and increase the financial literacy of the population.

Borrowers VTB 24 - briefly about the bank

Throughout the entire period of the bank's work, its clear position “facing the client” was noted. The activities to improve interaction were constantly carried out, in particular, actions were carried out aimed at solving the client's problems or improving the conditions for using banking products. All this contributed to the strengthening of the bank's reputation, its popularization among the widest strata of the population, and increased customer loyalty. It remains to be hoped that in 2019, the preservation of traditions awaits after us.

Consider how the debt amnesty works for individuals at VTB 24.

Debt amnesty as a way to pay off debts

What happens if arrears continue to accumulate from month to month? Professional expertise and research show why the bank itself is extremely disadvantageous to situations with delayed loan payments:

- First, it increases the share of overdue loans in the organization's loan portfolio, which negatively affects financial performance and goodwill.

- Secondly, the bank loses part of its income if the debtor does not make regular payments.

Therefore, each credit institution has a department for work with overdue debts, which is called upon to resolve issues of non-payments. What's on offer?

- Loan restructuring - reducing the monthly installment or increasing the loan term, drawing up an individual payment schedule,

- Debt amnesty - “forgiveness” of a part of overdue debt. For example, when paying the agreed amount to pay off the principal debt, the debtor is forgiven the already accrued penalties and fines.

Participation in the action VTB 24 "Debt thaw"

At a certain stage, the bank launched the Debt Thaw campaign with the aim of contributing to the situation of stabilization and further improvement of the lending market in Russia. Clients whose arrears were too high due to penalties and fines were allowed not to pay part of the penalties, and some - there were such cases - were completely removed. In general, fines were written off in the amount of about 25-100 percent. Reducing the amount of debt made it easier for the client, made it possible to honestly pay off the delay.

Debt amnesty at VTB 24 helped to solve the problem of many lending loans. First of all, the protection of the rights of the bank's client was implemented, which had a positive effect on the bank's business reputation. The bank's administration turned out to be right; there was no need to convince the witnesses of the “debt amnesty” action. Every conscientious client wants to fully pay off the annoying delay and breathe freely.

Fines are canceled, but what about the main debt?

Debt amnesty and minimization of the amount of fines were offered to borrowers who had a credit card, as well as for consumer loans and car loans. At the same time, debts overdue for more than two months were considered. Subject to the full repayment of the amount of the loan body, the bank took a retaliatory step in the form of removing from the client the obligation to pay penalties. For example, a client repaid the principal debt in the amount of 169 thousand rubles, after which a fine of 25 thousand rubles was removed from her.

At the same time, loans with different statute of limitations were considered, and, as you know, the statute of limitations for debts is three years. At first, the debt amnesty for VTB 24 was limited in time, but gradually the action became permanent. Debt amnesty for VTB 24 will always be in effect in order to stabilize the process of repayment of problem loans.

Bank motives - what is it for

The question arises: what are the reasons prompting the organization to do this, because you have to receive less money due under the contract?

The reasons are clear:

- firstly, obtaining approval from current and future borrowers;

- secondly, the acquisition of an advantage over other banks, competitors;

- thirdly, the bank's advertising on the banking services market, which characterizes VTB 24 as an organization that meets its customers halfway;

- fourthly, it is the elimination of problem assets and the improvement of statistics.

The debt amnesty at VTB 24 has set an example in the fight against overdue debts to other entities in the banking sector. Financial law and criminal law, the norms of business etiquette only confirm the positive effect of the action for all market participants.

What is the essence of the proposal?

Overdue debt does not appear suddenly, it begins with objective circumstances that prevented the normal repayment on schedule, and accumulates from month to month, only occasionally decreasing with the help of occasional small payments. Sometimes these tiny amounts are only enough to pay fines, and, as is clear from practice, it does not come to paying off interest and principal. So this “snowball” grows without any hope of the borrower's full settlement of debts.

Banks react differently to this situation. Some prefer to transfer debt cases to collectors under an assignment agreement or bring them to court, but realizing that this path leads to a decrease in the bank's profits, some of them, such as VTB 24, began to work under an amnesty to reduce the debt burden in order to completely eliminate debts. By offering a debt amnesty in terms of fines, a financial institution receives a settlement on the principal debt and resolves the issue with the client.

It is important that the bank itself is showing activity: it is beneficial for it to sort out this issue as soon as possible in order to improve the quality indicators of the loan portfolio. Debt amnesty significantly increases the speed of liquidation of problem loans.

How to get a loan amnesty at VTB 24 in 2019?

Being in a situation of increasing debts, the borrower gradually comes to the thought: "What should be done to pay off the debt if I want to get a debt amnesty?" The answer is presented in the table:

| Initiator | Situation | Documentation | Solution options |

| Bank | Large amount of debt with interest, fines and penalties, arrears from several months | Since the proposal comes from the bank, it has already been approved, additional documents are needed only at the discretion of the employees | Debt amnesty:

|

| Client | Loan currency exchange rate has changed | – | Change of currency |

| Loss of job, income, wage cut | Certificate from the labor exchange or salary from the place of work, a photocopy of the work book, certificate of the absence of other housing | Restructuring:

|

|

| The debtor has liquid assets | Title deed | Exchange of part of the debt for property |

Most often, the proposal is put forward by the bank itself, and the debtor gets acquainted with the conditions in order to understand whether it is worth agreeing to a debt amnesty, whether it is feasible to fulfill it. For example, to deposit a large amount, you can sell a property or a car. If you get professional advice from the agency, housing can be sold very quickly.

If you do not receive offers from the bank, you can independently apply there with a request for a debt amnesty. At the same time, the likelihood of approval is greater if at least some payments were made all this time, the client kept in touch with the bank, the financial situation improved (for example, a new job was found). For the bank, this means that the borrower did not shy away from payment obligations, but there were objective reasons.

A request for a debt amnesty must be made in writing, if necessary, get advice from lawyers, read the current reviews of other borrowers, find out what the pitfalls may be.