Setting up insurance premiums in 1s 8.3 zup. Reflection of contributions and accruals to individuals who are not employees

ATTENTION: a similar article on 1C ZUP 3.1 (3.0) -

Good day to all, you are again on the pages of my blog. In this article, we will continue to consider the basic functionality of the 1C Salary and Personnel Management software product and touch on the topic calculation and payment of insurance premiums... Let's get acquainted with the list of documents by which insurance premiums are calculated in 1c zup, as well as what documents and how to correctly reflect the fact of payment of insurance premiums in 1c. Three articles have already been posted in this series of publications. For a list of all articles, see below:

Calculation of insurance premiums in 1s

✅

✅

✅

In previous articles, we hired and calculated the salaries of three employees, and also paid the salaries. Calculation and payment of wages are those operations that the calculator performs in 1c on a monthly basis. Another monthly operation in 1c of a calculator's accountant is the calculation of insurance premiums. This is done after calculating the monthly salary. In 1s zup, a specialized document "Calculation of insurance premiums" is used to calculate insurance premiums. The data calculated and saved in this document will subsequently be used for the automatic generation of regulated reporting 4-FSS, RSV and individual information of SZV.

Access to the journal of documents "Calculation of insurance premiums" can be obtained on the "Taxes" tab of the program desktop in the left column of links at the top: "Journal of calculating insurance premiums to the Pension Fund, MHIF and FSS". As I said, it is advisable to enter this document on a monthly basis after the calculation and payment of wages to employees. The document is filled in and calculated automatically based on the results of accrued wages and the rates of insurance premiums specified in. There is no need to manually edit these rates in the parameters. If you are regular, the rates will be in accordance with the law.

The only parameter that must be independently specified in the "Settings of accounting parameters" before calculating insurance premiums is the "Rate of contributions to the FSS NS and PZ".

In previous articles, we calculated and paid salaries for January 2014. Let's create a new document "Calculation of insurance premiums". We will also indicate January 2014 in the “Accrual month” field in the document and press the “Fill in and calculate” button. This will fill in the data on the following tabs:

- Contributions - the amount of insurance premiums of the FSS, MHIF, PFR for MPI individually for each employee;

- Basic charges and additional charges - the base from which the contributions were calculated;

In our case, the first three tabs were filled, see the figures:

✅ Seminar "Life hacks on 1C ZUP 3.1"

Analysis of 15 life hacks for accounting in 1s ZUP 3.1:

✅ CHECK LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step by step instructions for beginners:

Payment of insurance premiums. Entering information in 1s

With the help of the document "Calculation of insurance premiums", we calculated how much our organization should transfer to the social, health insurance and pension funds. This information is present in the corresponding regulated reporting, and in order for the fields reflecting this data in the reporting to be filled in automatically, it is necessary to enter information into the program about when and how much was paid. For this, the document "Calculations of insurance premiums" is used.

This document also assumes monthly data entry. A separate document is entered for payment to the Pension Fund of the Russian Federation, separately for payment to the FSS and separately to the MHIF.

Consider the first version of the document "Payment to the FIU":

- In the “Payment / accrual” field, select “Payment to the FIU”;

- Document date ("from:" field) - payment for January 2014 will be at the beginning of February, so I will enter the date 02/10/2014. The date of the document is important from the point of view of tracking the organization's debt to funds. In our case, with the document "Calculation of insurance premiums" with the date of 01/31/2014, we calculated how much we should pay for January 2014 - 21,340 rubles. And now in the document "Calculations of insurance premiums" dated 02/10/2014, this still unpaid debt will be highlighted in red.

- Payment type - current installment payments;

- The payment date is 02/10/2014, it is necessary to automatically fill in the corresponding field in the regulated reporting;

- Contributions to GPT "Amount" - this field can be filled in automatically by clicking on the button "Fill in balances", which is located below. Or you can independently contribute the amount that was transferred to the fund, if it differs from the balance. We will fill in automatically;

- The insurance part of the pension and the funded part of the pension "Sum" - the fields were used before the change in legislation. Left in connection with the need to reflect this data in old documents. In our example, we will leave it blank.

Click OK, the document is recorded and posted.

Consider the second option "Payment to the Social Insurance Fund":

- "Payment / accrual" - payment to the FSS;

- The field “Amount” in the section “Insurance in case of temporary disability and in connection with maternity” and in the section “Insurance against industrial accidents and occupational diseases” - fill in using the button “Fill in balances”. Please note that the filled in amounts correspond to those that were accrued in the document "Calculation of insurance premiums". These fields can also be filled in manually.

And finally, the third case is the reflection of the payment to the MHIF. Everything is similar to the previous two cases, except that it is necessary to select the category “Payment to the MHIF” in the “Payment / accrual” field.

✅ Seminar "Life hacks on 1C ZUP 3.1"

Analysis of 15 life hacks for accounting in 1s ZUP 3.1:

✅ CHECK LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step by step instructions for beginners:

Thus, the 1C Salary and Personnel Management program involves the monthly entry of one document "Calculation of insurance premiums" and three documents "Calculations of insurance premiums" for each of the payment directions.

That's all. In the next article I will tell you how effective.

To be the first to know about new publications, subscribe to my blog updates:

The technical capabilities of the 1C program allow the calculation and accrual of insurance premiums paid by the company from employees' earnings, and most of these processes are automated, which reduces the risk of errors and reduces the burden on the accountant. In this case, you must first set the appropriate settings.

Contribution accounting settings

In the settings of the accounting policy, it is required to reflect the taxation system used at the enterprise. They are specified in the same way as the settings used for "wages". To do this, you need to go to the section "Salary and personnel" - "Reference books and settings" - "Payroll settings".

If necessary, the user has the ability to access the basic reference information through the "Contributions: Tariffs and Revenues" tab. All reference data are filled in during the development of the program version, but if necessary, it is possible to manually correct them.

Setting up contributions is carried out through the subsection "Main", where the form opens, to set the parameters for calculating the salary. In this case, the user is interested in the "Taxes and Payments with Payroll" tab. Here you must specify the following data:

- The type of tariff used and the duration of its validity. In this case, the tariff is determined in accordance with the selected taxation scheme.

- Indicators for calculating additional contributions are established. Here are indicated the positions of employees with harmful or other factors that provide for a modified rate of deductions for insurance of a citizen.

- Contributions from NS and PZ. In this paragraph, it is necessary to indicate the amount of the deduction rate established for the enterprise in the FSS authorities.

Contributions to 1C accruals

For each of the employees of the enterprise, the amount of accrual required to determine the amount of his earnings is established. Separate charges are used for sick leave and leave. Any of them can be viewed through the directory of accruals available in the section "Salary and personnel" - "References and settings" - "Accruals".

For the form of accrual, the "Type of income" variable is used, which sets the requirements for taxing the amount with contributions. "Payment by salary" already exists in the directory, and is subject to full social security contributions. Sick leave payments are accrued under the category “State benefits of compulsory social insurance, paid at the expense of the FSS.

In cases where new charges are reflected, they need to choose the right type of income.

Insurance premium cost items

Cost items are necessary in order for the contributions made to be correctly reflected in accounting. The articles "Insurance premiums" and "Contributions to the FSS from the NS and PZ" are set by default. It should be borne in mind when choosing an option that there is a clear relationship between contributions and accrual costs.

You can select the required option of articles through the section "Salary and personnel" - "References and settings" - "Cost items for insurance premiums".

If there is a need to use other articles, the user has the ability to manually add them to the reference book.

Calculation of insurance premiums

The procedures for calculating insurance premiums in 1C are fully automated and linked to the "Payroll" document, carrying out parallel calculations. You can track them through the section "Salary and personnel" - "Salary" - "All accruals".

After the operation is completed, the system enters the amount of deductions for each employee, which can be seen on the "Contributions" tab. Calculations by the system are carried out on the basis of the type of income and the established tariff.

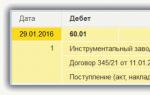

After the document is posted, the system will generate transactions, not only related to payroll, but also reflecting the accrued social insurance contributions. The transfer of transactions is carried out to the debit of the accounts for which the salary is reflected, and to the credit of subaccount 69 "Calculations for social insurance and security".

Analytical reports on insurance premiums

The main report here is the report "Taxes and contributions (briefly)", which reflects information on the charges of each employee of the enterprise and in total as a whole.

The report "Analysis of contributions to funds" involves the formation of analytical tables for each of the types of contributions. They indicate not only the accruals made, but also the facts of exceeding the limit amounts, indicating the accruals to which contributions are not applied.

When you go to the "Salary reports" document, you can get into the "Insurance premiums accounting card". It is also available for formation and through the "Payroll" document.

The Tax Code of the Russian Federation from January 1, 2017 was supplemented by a new chapter No. 34 "Insurance premiums". It established not only the objects and payers of taxation, but also the amount of insurance premiums. In the 1C program, you can check the rates for your company at this address: in the "References" menu item, select "Salary settings", in it "Classifiers", and then - "Insurance premiums".

A window will open with the following tabs:

- Insurance premiums, income discounts;

- The maximum amount of the base of insurance premiums;

- Types of income from insurance premiums;

You need the last tab. In it you will find a list of tariff types and using the search you can find a tariff for your organization.

By double-clicking on the cell of the rate size, a context window will appear with the fields of the set rates, which can be edited.

Here you can choose the type and size of the tariff, as well as the period of its relevance. These rates include: health insurance, social security and pension insurance. Today they have the following tariffs: 5.1%, 2.9% and 22%. If it turns out that the program has other parameters, you can easily change them to the current ones.

This setting of insurance premiums in 1C is used most often, but there are other options. You can use the following address: "Administration / Accounting parameters / Salary settings" and there you can find the required item "Insurance premiums".

Setting up a contribution to the Social Insurance Fund

Each organization must submit information to confirm its type of economic activity. It is necessary to provide the following documents to the territorial department of the FSS:

- Certificate of confirmation of economic activity;

- Statement;

- A copy of the note to the balance sheet.

An example application can be downloaded from the FSS website.

The rate of contribution from accidents (HC) and occupational diseases is provided in the form of a certificate and is established on the basis of the submitted documents.

When the certificate is received, the accountant must enter the data into the program. To do this, go to the "Administration" menu, select the "Accounting parameters" menu item, and select "Salary settings" there.

A window will open, at the bottom of which there is another tab "Tax and reporting settings", which must also be opened. In the list on the left, select the line "Insurance premiums" and edit the norms of insurance premiums from the National Assembly at work.

Also, if there is such a need in the "Additional premiums" column, you can select a list of positions that are subject to the individual sizes of insurance premiums. If there is no required position in the list of positions, then you can also add it to the program yourself.

Since this year, there have been no significant changes in the calculation of insurance premiums paid by individual entrepreneurs for themselves. Only the size of the minimum wage (minimum wage) has changed and the amount of contributions has increased accordingly. Consider how you can calculate the insurance premiums of an individual entrepreneur in 1C Accounting 8 ed. 3.0.

All self-employed entrepreneurs without workers must pay contributions to the Pension Fund and the Mandatory Health Insurance Fund.

Since 2014, contributions to the Pension Fund are not divided into insurance and funded parts, they are paid in one amount according to the details of contributions to the insurance part.

In addition, entrepreneurs pay contributions on the basis of their income, in excess of the amount of 300,000 rubles. Contributions are calculated based on the product of the minimum wage, which is established at the beginning of the year, as well as the rate of contributions to the Pension Fund, multiplied by twelve:

Minimum wage x Tariff x 12

In 2015, the minimum wage is 5,965 rubles. And the amount of contributions is 18,610.80 rubles. in the Pension Fund of the Russian Federation and 3650, 58 rubles in the MHIF.

If the amount of income of an individual entrepreneur is more than 300,000 rubles, contributions are calculated based on the product of the minimum wage established at the beginning of the year and the rate of contributions multiplied by 12, plus one percent of the amount of income that exceeds 300,000 rubles for the billing period:

Minimum wage x Tariff x 12 + (Income - 300,000) x 1%

At the same time, the amount of contributions cannot exceed the amount of eight times the minimum wage multiplied by the rate of contributions to the Pension Fund and increased by 12 times.

Insurance premiums for individual entrepreneurs in 1C Accounting 8 ed. 3.0

Insurance premiums for individual entrepreneurs in the program 1C Accounting 8 edition 3.0 are reflected as follows. First, it is necessary to indicate in the accounting policy that the contributions are paid by an individual entrepreneur. By default, these are contributions to the FIU and the MHIF. If an individual entrepreneur pays voluntarily contributions to the Social Insurance Fund, this must also be reflected in the accounting policy by checking the appropriate box.

To calculate the amount of contributions in the program there is a special assistant "Payment of fixed premiums". It is located on the "Accounting, taxes and reporting" tab in the "Individual entrepreneur insurance premiums" section.

Here, contributions to the Pension Fund of the Russian Federation, the MHIF, as well as the contribution to the Pension Fund of the Russian Federation from the amount of income, in excess of 300,000 rubles are calculated separately.

You can also choose the method of payment of contributions: from a bank account or in cash on receipt.

ATTENTION: a similar article on 1C ZUP 2.5 -

Hello dear visitors of the site. In the last publication, we examined in some detail the issue of personal income tax accounting in the 1C ZUP program, edition 3, and today we will talk about insurance premiums. I will tell you where and in what documents they are calculated, how to pay insurance premiums to funds. We will also see how the paid insurance premiums will be reflected in the regulated reports of the RSV-1 PFR and 4-FSS. Consider all the settings available in the 1C ZUP 3.1 (3.0) program that affect the calculation of contributions.

✅

✅

I want to note right away that I will analyze today's material on the basis of the information base that we have formed as a result of previous publications, where I talked about and. Therefore, I recommend that you familiarize yourself with the previous articles.

So let's talk about premium settings first. First, we need to correctly configure the accounting policy in the program for calculating insurance premiums in the information about the organization. To do this, go to the Settings section - the Organization details reference book, our Alpha organization will open and on the Accounting policy and other settings tab, click the Accounting policy link. Now, in the window that opens, you need to select the type of insurance premium rate. By default, the program has a tariff applied under the "main system of taxation, except for agricultural producers." This type of tariff can be changed by choosing from the appropriate list. In our example, we will apply exactly this tariff - Organizations using OSN, except for agricultural producers... Here you should indicate The rate of contributions to the FSS NS and PZ(Social Insurance Fund for Accidents and Occupational Diseases). Next, set a group of checkboxes:

- There are employees with early retirement rights, check the box if the organization has such employees, i.e. work in harmful and difficult working conditions.

- The results of a special assessment of working conditions are applied, check the box if the organization has carried out a special. assessment of working conditions. In the staff unit of the employee, also establish information about these working conditions.

In more detail, I considered setting up working conditions and calculating additional rates for such employees in a separate article.

On the right side of the "Accounting Policy" window, there is another group of settings:

- There are pharmacists

- There are flight crew members

- There are miners (miners)

If the organization has such categories of professions, then when you check the box, special rates are applied when calculating insurance premiums for employees hired for these positions. For example, if the organization is in the UTII taxation mode and is engaged in pharmaceutical activities (the checkbox is checked in the settings There are pharmacists), then she is entitled to a reduced tariff for certain positions. In the positions of this organization (Settings - Positions directory), it becomes possible to select the checkbox that this position is pharmaceutical. The situation is similar with checkboxes. There are flight crew members and There are miners (miners). If they are installed, then in the Positions it becomes possible to indicate that this is a Flight Crew Position or a Miner's position.

If we check the box There are crew members of sea vessels, then already in the subdivision (section Settings - the Subdivision reference book) it will be possible to select the checkbox, which means that this subdivision Corresponds to a vessel from the Russian Register of Ships... Accordingly, for all employees admitted to this unit, insurance premiums will be calculated at special rates that are spelled out in the relevant federal laws.

So, at the level of the accounting policy of the organization, it is important to correctly indicate the type of tariff of the organization and the rate of contributions to the FSS NS and PZ. Also set the necessary checkboxes for calculating additional contributions and contributions at special rates. It should be noted that the type of tariff in the organization and the rate of contributions of the FSS NS and PZ may change and the program provides for storing the history of all these changes (link Fare type change history and link Changelog ...).

The status of the insured person and information about disability in the 1C ZUP 3.1 (3.0) program

We talked about all the settings of insurance premiums at the level of the organization's accounting policy. Next, let's see what other information needs to be set in the program for the correct calculation of employee insurance premiums. To do this, go to the Personnel section - the Employees directory and open, for example, A.M. Ivanov's card. Follow the link Insurance and here we will also see a number of important settings for calculating insurance premiums.

First of all, it is necessary to establish the status of the insured person. In our information base, which was formed based on the results of previous articles from the current series of publications (), all employees are Citizens of the Russian Federation, but the program has the ability to keep records of foreign employees as well. Moreover, the set of statuses for foreign citizens is quite large. If you have such employees in your organization, then you should correctly define and correctly set their status.

You can see this on the screenshot below.

So, after we establish the status of the insured person, it is required to indicate from which month this information is valid. The program tracks the history of changes in information about the insurance status of employees, we can see this at a special link, which is called History of changes in information about insurance status.

The next group of settings for employee insurance is Information about disability. If the employee is disabled, then check the box Have a certificate of disability, indicate the date of issue, the term of this certificate and the month from which it is valid. For such an employee, when calculating contributions to the FSS NS and PZ, the tariff will be 60% of the tariff set for the entire organization. Those. if in general for the entire organization we have set the rate of contributions to the FSS NS and PP at 0.2% (see above), then for an employee with a disability this rate will be 0.12%. The program also maintains a history of changes in information about disability.

Calculation of insurance premiums in the documents "Calculation of salaries and contributions" and "Dismissal" in the program 1C ZUP 3.0 (3.1)

✅ Seminar "Life hacks on 1C ZUP 3.1"

Analysis of 15 life hacks for accounting in 1s ZUP 3.1:

✅ CHECK LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step by step instructions for beginners:

Insurance premiums in the 1C ZUP 3.0 (3.1) program are calculated directly in the document and this is a difference from the ZUP 2.5 program, since contributions are charged there as a separate document (in more detail about differences between ZUP 3 and ZUP 2.5 you can read c). Here, insurance premiums are calculated in the same document in which the final payment for employees for the month was made.

However, there is also a document called “Dismissal”, which is not just a personnel document (as it was in ZUP 2.5), but a personnel-calculation document. In it, along with information about the dismissal, the final settlement for the employee also takes place, i.e. compensation for basic and additional vacations is calculated, salary is calculated from the beginning of the month to the date of dismissal, and personal income tax is withheld and insurance premiums... Separately, I would like to draw your attention to the fact that it calculates insurance premiums.

You can register the document "Dismissal" in two journals, or in a journal Appointments, transfers, dismissals from the Personnel section, or in the magazine All charges from the Salary section. So, for clarity, on November 16, 2016, we will dismiss the employee A.M. Ivanov. and let's see what calculation happens in the “Dismissal” document. In the tab Accruals and deductions we see that the salary payment for the period worked by the employee from 01.11 has been calculated. until 16.11 and vacation compensation, as well as calculated insurance premiums (the Contributions tab). There will not be repeated accrual of salary payments and the calculation of insurance premiums for this employee in the document "Calculation of salaries and contributions" for November.

Since, according to the terms of our further examples, employee Ivanov A.M. will not be dismissed, we will not carry out the document “Dismissal”.

So, let's calculate the document "Calculation of salaries and contributions" for October. Let's open the Contributions tab. In our example, premiums were calculated for three employees who were hired in October. We can see a more detailed calculation of insurance premiums for each employee by clicking on the link "For more details, see the Insurance Premiums Accounting Card." Select employee Ivanov and click on this link.

A card will open for individual accounting of the amounts of accrued payments and other remuneration and the amounts of accrued insurance premiums for 2016 by employee A.M. Ivanov, broken down by month.

In order to check whether the insurance premiums for the employee have been calculated correctly, let us open for clarity the rates of insurance premiums in force in this period. To do this, in the "Taxes and Contributions" section, open the directory Types of insurance premium rates. For our organization, as you remember, the tariff type has been selected - Organizations applying the OCH, except for agricultural producers, select this tariff and double-click on it. In the window that opens, follow the link Insurance premium rates, and now all rates for this type of rate for different periods will open. Now the rates of 2015 are in effect, and we will just check the calculation for them.

Now, let's return to the "Card for individual accounting of the amounts of accrued payments and other remuneration and the amounts of accrued insurance premiums for 2016" for employee A.M. Ivanov. In the column for the month October the payment to the employee for the month and on an accrual basis from the beginning of the year is reflected, as well as the amount not taxed by insurance premiums. In the same column, the base for calculating insurance contributions to funds is calculated, and accordingly, the assessed contributions are shown broken down by funds.

Those. in order to obtain the basis for calculating insurance contributions to funds, it is necessary to deduct this non-taxable amount from the employee's total monthly salary. What we actually see in the card, the base for calculating insurance premiums in the general public insurance, MHIF and FSS was 14,285.71 rubles (16,221.20 - 1,935.49). Let's check if the insurance premiums to the funds for October were calculated correctly according to the established rates.

- Accrued insurance premiums for MPI: 14,285.71 * 22/100 = 3,142.86 rubles.

- Insurance premiums accrued for compulsory medical insurance: 14,285.71 * 5.1 / 100 = 728.57 rubles.

- Insurance premiums accrued to the Social Insurance Fund: 14,285.71 * 2.9 / 100 = 414.29 rubles.

Everything is calculated correctly.

Also in the document Calculation of salaries and contributions on the "Contributions" tab for employee A.M. Ivanov. insurance premiums of the FSS NS and PZ (accidents) were calculated in the amount of 28.57 rubles. Our organization operates The rate of contributions to the FSS NS and PZ - 0.2%, which we have set in the settings of the accounting policy. The calculation was made as follows: 14,285.71 * 0.2 / 100 = 28.57 rubles Payment of insurance premiums to funds from the section Taxes and contributions. This document is not automatically generated in the 1C ZUP 3.0 (3.1) program. Perhaps, in future updates, the transfer of information about paid insurance premiums will be implemented as part of synchronization with the accounting program, but for now we need to fill it in manually. In order to determine how many insurance premiums we have calculated for October, we can use the report Analysis of contributions to funds(section Taxes and contributions - Journal Reports on taxes and contributions).

From the same report, we can copy all the calculated amounts of insurance premiums to specific funds when filling out the document Payment of insurance premiums to funds.

So, from the report, we see that the Pension Fund of the Russian Federation has calculated 20,154.52 rubles for compulsory pension insurance. Let's create a document, select the Type of payment - PFR - at the aggregate tariff from January 1, 2014Analysis of contributions to funds

The fund for compulsory health insurance received 4,672.18 rubles. Let's create a document Payment of insurance premiums to funds, select the Type of payment - FFOMS, payment date 11/10/2016, copy 4,672.18 rubles from the report Analysis of contributions to funds in the Amount field. Let's post the document.

In October, 2,656.74 rubles were allocated to the social insurance fund for insurance against temporary disability. Let's create a document Payment of insurance premiums to funds, select the Type of payment - FSS, insurance against temporary disability, payment date 11/10/2016, copy the amount from the report Analysis of contributions to funds in the Amount field. The date and number of the payment order should also be indicated here, since this information is required in the 4FSS report. Let's post the document.

Also in the social insurance fund for insurance against accidents in October 183.22 rubles were calculated. Let's create a document Payment of insurance premiums to funds, select the Type of payment - FSS, accident insurance, payment date 11/10/2016, copy the amount from the report Analysis of contributions to funds in the Amount field. The date and number of the payment order should also be indicated here, since this information is also required in the 4FSS report. Let's post the document.

Reports that reflect data on the payment of insurance premiums in the ZUP 3.1 (3.0)

Now I will explain a little why the payment of insurance premiums to funds is introduced in the ZUP 3.1 (3.0) program. The fact is that on the basis of information on the payment of contributions to FIU and MHIF report is generated RSV-1, and on the basis of information about the payment of contributions to FSS, report 4-FSS.

For this, a document is entered in the program Payment of insurance premiums to funds... In more detail, I will tell you about all the regulated reports that can be generated in the ZUP 3.1 (3.0) program in the following publications.

So, in today's article we talked about how to set the necessary settings in the program for calculating insurance premiums and about in which documents they are calculated. With the help of which document to pay the accrued insurance premiums to the funds, and how they will be reflected in the reports.

That's all for today. All the best !!) Stay tuned for the following publications.