How to create a 6 ndfl report in 1c. Forgot to correct the planned payout date

Throughout 2016, accountants have been wondering why the 6-NDFL form was invented. Everyone is accustomed to the fact that the 2-NDFL form was the main and only form of report reflecting the accounting of personal income tax. But 2-NDFL is a history of the relationship between a tax agent and a taxpayer, and the tax authorities also needed a tool to track their own relationships with agents. And it is necessary - done. And voila! - you already, swearing, fill out a new form.

So, Form 2-NDFL, with an emphasis on the correctness of the calculation and the timeliness of withholding tax by a tax agent, was supplemented by Form 6-NDFL. Correctly calculated and timely withheld tax must be transferred to the budgetary system of the Russian Federation within the time period established by Article 123 of the Tax Code of the Russian Federation. Responsibility is established for failure to withhold or non-transfer of tax amounts (letter from Mifin No. 03-02-07 / 1/8500 of 03/19/2013). Moreover, the penalty is imposed not only for non-transfer, but also for late transfer of tax.

The presence of penalties implies some kind of relationship between the Federal Tax Service Inspectorate and organizations-tax agents. When the 6-NDFL report (reflecting these relations) for the 4th quarter is submitted and the results of all four reports for the year converge with the 2-NDFL annual report, the number of questions for accountants will decrease.

In the meantime, without waiting for 2017 and the delivery of 6-NDFL for the 4th quarter, 1C experts will consider several specific situations and tell you how to reflect them in the program "1C: Salary and Human Resource Management 8" version 3.1.1 (for ease of perception, examples are completed as if there were no other calculations in the program).

The fixed advance payment exceeds the amount of personal income tax calculated from the salary of a foreign employee employed in a Russian organization. How should 6-NDFL be filled in in this case?

In accordance with clause 6 of article 227.1 of the Tax Code of the Russian Federation, the amount of personal income tax is reduced by the amount of fixed advance payments. If the monthly fixed payment exceeds the amount of personal income tax calculated from the income of a foreign worker, then the tax is not transferred to the budget. This opinion was formulated by the Federal Tax Service in a letter No. BS-4-11 / [email protected] dated 05/17/2016. But in accordance with the recommendations in the letter of the Federal Tax Service No. GD-4-11 / 14507 dated 08/09/16, when generating the 6-NDFL report, in the case when no amount is subject to transfer, it is necessary to reflect the tax on a general basis, and indicate the zero amount of the transferred personal income tax ...

In the 6-NDFL form, this situation is reflected in section 1 (amounts of calculated income, tax and fixed advance payment) and in section 2 (date and amount of actual receipt of income). The fields “Date withholding tax”, “Term for transferring tax” are filled in with dates in accordance with the law, and “Amount of tax withheld” are filled in with zero.

Example 1... Visa-free foreigner Privalov A.I. submitted a notice to reduce the tax on advance payments in the amount of 12,600 rubles (Fig. 1). When calculating the salary for July, he was accrued income - Salary payment in the amount of 46,155 rubles and personal income tax was calculated at a rate of 13% - 6,000 rubles.

Fig. 1 Advance payment for personal income tax

The advance payment of 12,600 rubles exceeded the amount of the calculated personal income tax of 6,000 rubles and the tax is not subject to transfer.

Section 1 of the report for 9 months (Fig. 2) reflects:

in line 20 "Amount of calculated income" - 46 155

on line 40 "The amount of calculated tax" - 6,000

on line 50 "The amount of a fixed advance payment" - 6,000

Fig. 2 sections 1 and 2

Section 2 of the report for 9 months (Fig. 2) reflects:

On line 110 "Date withholding tax" - 08/03/2016 in accordance with the rules of Art. 226 of the Tax Code of the Russian Federation, withholding personal income tax from wages should be on the day of payment of wages for the second half of the month;

On line 120 "Term for transferring tax" - no later than one day from the date of tax withholding on 04.08.2016 (clause 6 of article 226 of the Tax Code of the Russian Federation);

When calculating the salary for August, the employee Privalov A.I. income was accrued - Salary payment in the amount of 60,000 rubles and personal income tax was calculated at a rate of 13% - 7,800 rubles. In the example, the 6-NDFL report is generated before the actual payment of income to the employee and the transfer of tax.

The remainder of the advance tax payment after 6,000 rubles of personal income tax calculated in July have been credited is 6,600 rubles (12,600 - 6,000). 1,200 rubles (7,800 - 6,600) should be transferred to the budget.

According to the results of two months, section 1 of the report for 9 months (Fig. 3) reflects:

on line 20 "Amount of calculated income" - 106 155 (46 155 +60 000)

on line 50 "The amount of a fixed advance payment" - 12 600

on line 80 “The amount of tax not withheld by the tax agent” - 1,200.

Fig. 3 Sections 1 and 2

Since no income was actually received, the wages and taxes calculated in August are not reflected in section 2 of the 9-month report.

Section 2, however, contains information only about the income of July (Fig. 3).

On line 100 "Date of actual receipt of income" - 07/31/2016;

On line 110 "Date withholding tax" - 08/03/2016;

On line 120 "Term for the transfer of tax" - 04.08.2016;

On line 130 "Amount of income actually received" - 46 155;

On line 140 "The amount of tax withheld" - 0.

Income, calculated in August in the form of Salary Payment in the amount of 60,000 rubles, was paid on September 5th. The tax is now considered withheld after income is paid. Therefore, in section 1 of the report for 9 months (Fig. 4), the tax amount from line 80 "goes" to line 70.

Line 70 indicates the "Amount of tax withheld" - 1,200,

and on line 80 “The amount of tax not withheld by the withholding agent” is reset to zero.

Lines 20, 40, 50 have not changed:

on line 20 "Amount of calculated income" -106 155 (46 155 + 60 000)

in line 40 "The amount of calculated tax" - 13 800 (6 000 + 7 800)

on line 50 “The amount of a fixed advance payment” - 12 600.

Fig. 4 Sections 1 and 2

The money was transferred to the employee on September 5, therefore, personal income tax was withheld. Therefore, in section 2 of the report for 9 months, a block is added containing information about the August salary (Fig. 4).

The second block of section 2 displays:

On line 110 "Date withholding tax" - 09/05/2016 (in accordance with the rules of article 226 of the Tax Code of the Russian Federation, personal income tax should be withheld from wages on the day of payment of wages for the second half of the month);

On line 120 "Term for transferring tax" - 09/06/2016 (according to clause 6 of article 226 of the Tax Code of the Russian Federation, tax agents are required to transfer personal income tax withheld from wages no later than the day following the day the income is paid to the taxpayer);

On line 130 "Amount of income actually received" - 60,000;

On line 140 "The amount of tax withheld" - 1,200.

Please note that the actual tax transfer date is not displayed in the report.

When checking the report, the IFTS compares the value of line 120 "Term of tax transfer" with the data from the calculation card with the tax agent's budget. In case of disputable situations and the need to attach a payment confirmation, the value of field 107 "Tax period" in payment orders for personal income tax may be significant. The legislation does not give a clear answer to the question of what to indicate - a month or an exact date. In order to avoid misunderstandings, you can indicate the month, as the FTS experts advise in the article "How to fill out line 107 in personal income tax payments in 2016?" (letter of the Federal Tax Service dated 01.09.2016 No. BS-3-11 / [email protected]).

In the program "1C: Salary and Personnel Management 8" rev. 3 there are reports Checking Section 2 of 6-NDFL and Control of the timing of payment of personal income tax, which are designed to help the user not to be mistaken with the date of tax transfer.

The employee receives his salary in cash at the cash desk. After his dismissal, he did not appear for the final payment. Thus, the employee did not actually receive income, the calculated personal income tax was not withheld and was transferred. How should 6-NDFL be filled in in this case?

Example 2... Employee Gorbunkov S.S. was dismissed on 12.07.16. Upon dismissal, the final calculation was made - the salary due to him and compensation for unused vacation in the amount of 35,544.60 rubles was accrued. and at a rate of 13% tax was calculated 4,621 rubles. But the payment was not made, the tax was not withheld or transferred.

Section 1 of the report for 9 months (Fig. 5) reflects:

in line 20 "Amount of calculated income" - 35 544.60

on line 40 "The amount of calculated tax" - 4 621

and on line 80 “The amount of tax not withheld by the withholding agent” - 4 621.

Fig. 5 Sections 1 and 2

Section 2 contains information on the income of July (Fig. 5).

On line 100 "Date of actual receipt of income" - 07/12/2016;

On line 130 “Amount of income actually received” - 35,544.60;

On line 140 "The amount of tax withheld" - 0.

An employee is entitled to deductions for children in excess of the calculated personal income tax. How should 6-NDFL be filled in in this case?

A similar situation is considered by the Federal Tax Service in a letter dated 05.08.2016 No. GD-4-11 / 14373. But in a letter dated 09.08.2016 No. GD-4-11 / 14507, the department clarifies that in the case of payment of income when the tax was not subject to withholding, since it was calculated equal to 0, the situation is interpreted as withholding and transferring a zero amount of tax (similar to example 1 ).

Example 3... Employee Rostova N.I. a standard tax deduction in double the amount for a disabled child under 18 years old is allowed, if the second parent refuses the deduction - 24,000 rubles. The employee's earnings in July amounted to 20,000 rubles.

The deduction is greater than the income received, but is applied in an amount not exceeding the income. Section 1 of the report for 9 months (Fig. 6) reflects:

in line 20 "Amount of calculated income" - 20,000

on line 30 "The amount of tax deductions" - 20,000

on line 40 "The amount of calculated tax" - 0

Fig. 6 Sections 1 and 2

At the same time, section 2 contains information on the income of July (Fig. 6).

On line 100 "Date of actual receipt of income" - 07/31/2016

On line 110 "Date withholding tax" - 08/05/2016 (in accordance with the rules of article 226 of the Tax Code of the Russian Federation, personal income tax should be withheld from wages on the day of payment of wages for the second half of the month);

On line 120 "Term for transferring tax" - 08.08.2016 (no later than one day from the date of withholding tax, taking into account weekends of the year, in accordance with clause 6 of article 226 of the Tax Code of the Russian Federation);

On line 130 "Amount of income actually received" - 20,000;

On line 140 "The amount of tax withheld" - 0.

The former employee of the organization received income in kind. At the same time, he did not receive any cash payments in the current year. How should 6-NDFL be filled in in this case?

A similar situation was considered by the Federal Tax Service of the Russian Federation in its letter No. BS-4-11 / 13984 dated 01.08.2016.

Example 4... Former employee M.M. Kamnoedov the organization paid for the tickets for the trip to the sanatorium in the amount of 5,000 rubles, thus he had a natural income. It is impossible to withhold the calculated personal income tax of 650 rubles, since no monetary remuneration is paid to the former employee.

In the program 1C: Salary and personnel management 8 "edition 3, the income of a former employee in kind is registered (Fig. 7)

Fig. 7 Income in kind

Section 1 of the report for 9 months (Fig. 8) reflects:

in line 20 "Amount of calculated income" - 5,000

on line 40 "The amount of calculated tax" - 650

on line 80 "The amount of tax not withheld by the tax agent" - 650

Fig. 8 Sections 1 and 2

At the same time, section 2 contains information about the income of August (Fig. 8).

On line 100 "Date of actual receipt of income" - 08/22/2016;

On line 110 “Date withholding tax” - an empty field;

On line 120 "Term of tax transfer" - an empty field;

On line 130 “Amount of income actually received” - 5,000;

On line 140 "The amount of tax withheld" - 0.

The employee has been accrued wages and bonuses. They were paid at the same time, personal income tax was transferred on the same day. How should 6-NDFL be filled in in this case?

There is an opinion that the bonus is non-salary income. The date of actual receipt of the salary is the last day of the month (clause 2 of article 223 of the Tax Code of the Russian Federation), and for other income, for example, in the form of a bonus, the day of issue (clause 1 of article 223 of the Tax Code of the Russian Federation).

The Federal Tax Service of the Russian Federation in its letter No. BS-4-11 / [email protected] of 06/08/2016 says that, considering the premium as non-wage income, in the 6-NDFL report it should be indicated in a block separate from the salary, since the values in line 100 "date of actual receipt of income" differ.

If the user of the "1C: Salary and Human Resources Management 8" rev. 3 program intends to allocate the bonus as another income, then in terms of the types of calculation of the Accruals for the bonus, you need to change the income code from the default "2000" to "4800".

Example 5... Employee Nevstruev Ya.P. accrued wages of 30,000 rubles and a bonus of 3,000 rubles, paid together with the salary for the second half of the month. How should 6-NDFL be filled in in this case?

Section 1 of the report for 9 months (Fig. 9) reflects:

in line 20 "Amount of calculated income" - 33,000

on line 40 "The amount of calculated tax" - 4250

on line 70 "Amount of tax withheld" - 4250

Fig. 9 Sections 1 and 2

Section 2 contains two separate blocks on salaries and bonuses (Fig. 9).

In the salary block:

On line 100 "Date of actual receipt of income" - 08/31/2016;

On line 110 "Date withholding tax" - 09/05/2016;

On line 130 “Amount of income actually received” - 30,000;

On line 140 "The amount of tax withheld" - 3,900.

In the block about the prize:

The date of the actual receipt of income on line 100 coincides with the "Date withholding tax" on line 110 - 09/05/2016;

On line 120 "Term for the transfer of tax" - 09/06/2016;

On line 130 “Amount of income actually received” - 3,000;

On line 140 "The amount of tax withheld" - 390.

Surely, accountants will still have a lot of questions about the new 6-NDFL form, which will be explained by the specialists of the Federal Tax Service of the Russian Federation. Corresponding changes will be made to the 1C: Salary and Human Resources 8 program. Therefore, we recommend that you follow the updates and implement them regularly.

We remind you: the 6-NDFL report for 9 months must be submitted no later than October 31, 2016.

UPDATED: 01.2019

Hello dear subscribers. Today, on the pages of my blog, I would like to dwell on the question accounting 6-NDFL... I note right away that this article will consider a not very complex example, which, however, will make it possible to understand how the data accounting process works for filling out a 6-NDFL certificate in 1C ZUP 3.1(a similar article for 1C ZUP 2.5 ).

And in order to stay aware of all the changes in the accounting of personal income tax in 1C (and not only personal income tax), I strongly recommend subscribing to the help system for 1C:.

Well, in this article I will try to outline the main points of accounting for 6-NDFL. The example will cover only 1 quarter, but the considered principle of personal income tax accounting applies to any other quarter. In this article, I will review one employee who is paid December salary in January to demonstrate how to fill out section 1 and 2 of form 6 personal income tax.

There will also be inter-settlement accruals: sick leave, which is paid with salary, and leave, paid in the inter-settlement period. We will also show the rollover payment for March, which is paid in April, in order to demonstrate here the difference between filling out the first and second sections 6-NDFL.

✅

✅

Memo on recording personal income tax and filling out 6-personal income tax in 1s ZUP 8.3 you can get it .

CONTENT video:

00:00 - general description of the topic;

00:40 – EXAMPLE 1: accounting in 6-NDFL December salary paid in January;

- 00:40 - accounting of income and calculated personal income tax in 1C ZUP 8.3 (description of registers);

- 03:48 - filling out section 1 of 6-NDFL (according to the example);

- 04:03 - accounting for personal income tax withheld in 1C ZUP 8.3 (description of registers);

- 06:55 - determination of the date of receipt of income (theory, memo);

- 08:27 - determination of the retention date (theory, memo);

- 08:55 - determination of the deadline for the transfer (theory, memo);

- 09:55 - filling out section 2 of 6-NDFL (according to the example);

- 11:30 - filling in section 1 of 6-NDFL (theory, memo);

- 12:51 - filling in section 2 of 6-NDFL (theory, memo);

- 13:30 - the peculiarity of filling in line 070 6-NDFL;

15:23 – EXAMPLE 2: accounting in 6-NDFL sick leave paid with salary;

- 15:47 - the importance of the payment date for charges, the date of receipt of which is taken into account by the payment date;

- 19:11 - mechanism for specifying the date of receipt of income

- 21:17 - reflection of the example in 6-NDFL;

23:00 – EXAMPLE 3: payment of vacation pay in the 1st quarter, the transfer period of which "leaves" in the 2nd quarter

- 24:45 - demonstration of the "gap" between the data of section 1 and section 2 of 6-NDFL;

The basics of the mechanism for filling out a 6-NDFL report in 1C ZUP 3.1 (8.3) - a simple example

Accounting for income and calculated personal income tax

Now let's move from theory to practice. Since this publication will consider the basics of personal income tax accounting for filling out 6-personal income tax, for ease of perception, only 1 employee has been added to the information base - Kononov B.S., who is charged the salary for December.

An employee's salary is 50,000 rubles. As we can see, personal income tax was calculated in the amount of 6,500 rubles. We carry out the document.

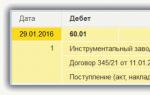

I brought the register into the form of the document (it is in this register that the fact of CALCULATION and WITHDRAWAL of personal income tax is recorded). This register is added to the document form via Main menu - View - Customize form navigation bar. In fact, it is according to the data from this register that sections 1 and 2 of 6-NDFL are formed, therefore, in the publication it will be considered in some detail.

When posting a document Calculation of salaries and contributions in this register there is an "incoming" entry (pictogram with a green plus sign) for the amount of calculated personal income tax.

The most important parameter in this entry is Date of receipt of income, since it is the date of receipt of income that determines which quarter this calculated personal income tax will be attributed (information about the calculated personal income tax is shown in section 1 of 6-personal income tax in line 040).

For salary (accruals with income code 2000), the Date of receipt of income will be the last day of the month, i.e. in this case it is 31.12, the amount of personal income tax calculated is 6500 rubles.

Another important register, in which, at the time of calculating income, data for filling 6-NDFL in 1s ZUP 8.3, is the register Accounting for income for calculating personal income tax... It also records information for filling out section 1 of 6-NDFL, but for line 020 "Amount of accrued income". In this case, the value of the date of receipt of the income is also used to determine the quarter to which these incomes relate.

Payment of salaries and withholding of personal income tax

Create a "Statement ...", click the "Fill" button. The amount that the organization must pay to the employee and the amount of personal income tax that the organization must withhold from the employee and transfer to the budget will appear. When filling in personal income tax, the program analyzes the register "Calculations of taxpayers with the budget for personal income tax", and takes the positive remainder for this register, i.e. that which is calculated but not yet withheld.

Let's see the movements that this document will form in the register Calculations of taxpayers with a budget for personal income tax... Let me remind you that to add a register to the form, you need to go to the Main menu - View - Configure the form navigation panel - Calculations of taxpayers with a personal income tax budget.

We will see movements in this register with a minus sign - "expenditure" movement. This means that personal income tax was withheld. Such "expense" movements are taken into account by the program when filling out Section 2 of 6-NDFL in 1s ZUP 8.3.

Consider what data from this movement is important when filling out 6-NDFL:

- Column Date of receipt of income- for the example under consideration, it remained unchanged on December 31 (it was inherited from the incoming movement and did not change, since income with the 2000 code was accrued and paid) - this will be line 100 "Date of actual receipt of income" second section 6-NDFL.

- Column Period- it is equal to the date of the document "Statement ...", in this case 10.01 is 110 line "Date withholding tax"... Thus, the salary for December was paid to the employee in January and personal income tax was withheld in January. Therefore, it is very important to correctly fill in the payment date in the Statement ... document so that line 110 6-NDFL is correctly filled in.

- Deadline for payment- this is 120 line 6-NDFL "Term for transferring tax" - for all income, except vacation and sick leave, this value is determined as the next day after withholding personal income tax (ie, for this example, it is 11.01). In fact, this value also depends on the date of the statement, since the date of withholding personal income tax = the date of payment. This period is very important, since it is by this date that the fact of withholding this personal income tax will be shown in the 6-NDFL report for which quarter. You can read more about this here:

Filling 6-NDFL in 1s zup: 1 section 6-NDFL

The most important thing when filling out 6-NDFL is to understand that data in sections 1 and 2 falls according to a different principle and it is not necessary to compare the data between the 1st and the 2nd in this regard.

Section 1 6-NDFL lines 020 to 050 are filled in cumulative total from the beginning of the year to date of receipt of income, i.e. for example, the report for the 4th quarter (annual report) will only include information that has the date of receipt of income from 01.01 to 31.12 of the year for which the report is generated. And if we talk about the report for the 1st quarter, then the data with the date of receipt of income for the period from 01.01 to 31.03.

In the example under consideration, the employee was credited only for one month - for December. This income and personal income tax calculated from it have the date of receipt of income 31.12. Therefore, it will be shown in the report for the 4th quarter (for the year).

This information will no longer be included in section 1 of the report for the 1st quarter of the next year (for clarity, I have not accrued anything to the employee in January and subsequent months).

In addition to lines 020 - 050, the first section still has lines 070 - 090... They are NOT filled in by the date of receipt of income.

Line 070 "Amount of tax withheld" is filled in according to the actual date of tax withholding... The data is selected from the expenditure movements of the register "Calculations of taxpayers with a budget for personal income tax" according to the data in the Period column (this is the withholding date equal to the date of the statement, which is registered with this withholding).

In the example under consideration, the December salary tax was withheld when salaries were paid on January 11, i.e. in the first quarter of next year. Therefore, line 070 in the report for the 4th quarter is not filled in, it will be filled in the report for the 1st quarter.

I also want to draw your attention to 080 line "The amount of tax not withheld by the tax agent"... It is filled in if, on the date of filling out the report (it is determined by the date specified in the requisite Date of signature on the title page of the report) there is a calculated, but unretained personal income tax.

In the example under consideration, for the 4th quarter report, I indicated the signature date of December 31, and by this date the December salary payment statement has not really been entered yet (it was entered with the date 10.01), therefore, the amount of unretained personal income tax in line 080 was filled in.

But it is assumed that line 080 is only filled in if if personal income tax arises that the organization cannot withhold(for example, an employee was fired and after that it turned out that personal income tax was not withheld from any income). In this case, at the end of the year, before the submission of the main 2-NDFL report for such employees, a 2-NDFL report will be generated with the form "On the impossibility of withholding personal income tax" and the amount shown in this report must coincide with line 080 of the 6-NDFL annual report.

If it is assumed that Personal income tax will be withheld(as in the example under consideration, where it is withheld upon payment of 10.01), then in line 080 information on such personal income tax should not fall... To do this, on the title page, it is enough to indicate the date of signature more than the date of the statement on which such personal income tax is withheld (for our example, any date from 10.01).

To make the principle of filling out section 1 of 6-NDFL more understandable, I have prepared a special plate, where it is clearly visible from which register and from which column of this register the data is taken for each of the cells of the 1st section of 6-NDFL, as well as which column is selected date data for the corresponding cells. Small memo for filling out Section 1 of 6-NDFL, which will allow you to quickly remember what and how is filled in the report. The full version can be obtained.

In this plate, the basic data (information about income calculated and withheld personal income tax), which are the most important and which will be of interest to most users of 1C ZUP, are highlighted in bold type. The rest of the data may appear in 6-ndfl, depending on whether the corresponding situation is reflected in the accounting of a particular organization or not.

Filling 6-NDFL in 1s zup: 2 section 6-NDFL

Now let's talk about filling in section 2 6-NDFL. Information for filling out the second section is selected from the expenditure movements of the register "Calculations of taxpayers with the budget for personal income tax". I would like to draw your attention to the fact that NOT by the date of retention, namely by the deadline for the transfer of personal income tax. This is very important to understand, because sometimes, when checking the completion of section 2, it may seem that one of the payments (one of the personal income tax deductions of the current quarter) is lost, but it could simply “skip away” into the next quarter exactly at the deadline for the transfer of personal income tax. The logic of filling out section 2 of 6-NDFL is considered in detail, I also recommend looking at an analysis of one of the users' questions about this in the publication: So, let's return to the example in question. The payment and deduction of personal income tax occurs on January 10, and the deadline for the transfer of personal income tax from income with a 2000 code is the next day, i.e. January 11 is Q1, so this retention will go to the second section of the Q1 report, not to the annual report.

And in the report for the 4th quarter (for the year) 2, the section for the example under consideration will not be filled at all, since there were no deductions with a transfer date in the 4th quarter. Thus, it turns out that in our example of accrual and payment for December, the data fell into section 1 of the 6-NDFL report for the 4th quarter ( by date of receipt of income), as well as in section 2 of the report for the 1st quarter ( by the date of transfer of personal income tax This is the main difference in filling out the first and second sections of 6 personal income tax.

For a more convenient perception of the principle of filling out section 2 of 6-NDFL, I also prepared a visual reminder plate, which represents from which register and which columns of this register in 1s 8.3 zup information is selected to fill in the corresponding cells of the 2nd section.

Full version reminders for recording personal income tax and filling out 6-personal income tax in 1s zup 8.3 you can get it .

Reflection of personal income tax from sick leave paid with a salary in 6-personal income tax

Determination and clarification of the date of receipt of income in 1s ZUP 8.3

✅

✅ CHECK-LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step by step instructions for beginners:

Let's consider our example further. Employee Kononov B.S. fell ill in January. We make out for him Sick leave(Salary - Sick leave certificates). In the example under consideration, it was assumed that sick leave would be paid to the employee along with the salary on 08.02, this date was indicated in the requisite Payment date.

It should be noted right away that date of receipt of income, on which the income itself and personal income tax from sick leave are registered, is determined not by the last day of the month of accrual (as was the case in the example above with income code 2000), but by date of payment... This date of payment must be indicated immediately in the document "Sick leave" and it is this date that will determine date of receipt of income, on which the calculated personal income tax and income will be registered in registers 1s zup 8.3.

Personal income tax was calculated from the salary (income with the code 2000) on the date of receipt of income equal to the last day of the month of accrual on 31.01.

When paying salaries through the January statement, both the salary for the hours worked and the sick leave will be paid, respectively, personal income tax will be withheld both from the salary and from the sick leave.

However, the payment did not take place on 08.02, as it was initially assumed when the document "Sick leave" was introduced, but on 11.02. Therefore, when registering withholding personal income tax in the document "Vedomosti ..." the date of receipt of income is being clarified for sick leave and personal income tax from this sick leave.

This can be seen in the statement itself in the decoding of the cell in the column "Personal income tax to be transferred".

Or directly in the movements made by the "Statement ..." document in the registers "Accounting for income for calculating personal income tax" and "Calculations of taxpayers with the budget for personal income tax".

These screenshots show that the program transfers the calculated personal income tax and the income itself from the date of receipt of income 08.02, which was originally recorded during the "sick leave", to the date of receipt of income 11.02. Detail this principle clarification of the date of receipt of income in the statement reviewed in the publication

Reflection of sick leave in 6-NDFL

Let's start with the second section of 6-NDFL. As I wrote above, the data for the second section of 6-NDFL are selected by the deadline for the transfer of personal income tax... In our example, the sick leave is paid along with the salary for January, and in the statement of February 11, not only personal income tax is withheld from salaries, but also personal income tax from sick leave. The term for transferring personal income tax is different for them:

- from personal income tax from the salary the next day after the deduction, i.e. 12.02;

- from personal income tax from sick leave no later than the end of the month, i.e. 02.28;

Deadline for transferring personal income tax the program determines automatically when registering the fact of withholding personal income tax in expenditure movements according to the register "Calculations of taxpayers with the budget for personal income tax" of the document "Statement ...", which is paid the January salary and sick leave.

Since both of these dates refer to the first quarter, it is clear that the data on these deductions will fall into the 2nd section of the report for the 1st quarter.

However, they will be presented as two separate line groups.

Now with regard to Section 1 of Section 6NDFL.

Column 20 of this section includes income from salaries and sick leave for January. In column 40 Amount of calculated and in column 70 Amount of tax withheld - the tax was received only for January.

Reflection in 1C ZUP 8.3 of withheld personal income tax from vacation pay paid off-set

Accounting for calculated and withheld personal income tax from vacation pay

✅ Seminar "Life hacks on 1C ZUP 3.1"

Analysis of 15 life hacks for accounting in 1s ZUP 3.1:

✅ CHECK-LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step by step instructions for beginners:

Moving on. In February, employee B.S. Kononov. went on vacation. Payment of vacation pay is carried out 3 days before its start, therefore, in the "Vacation" document, in the "Payment" field, we will indicate "In the inter-settlement period", and since the employee's vacation begins on February 15, we set the payment date to 12.02.

It should be noted here that for income with the code 2012, which exactly corresponds to the Vacation, the date of receipt of income is determined by the date of payment(as well as for sick leave). However, even if the actual date of payment (the date of the "Statement ..." document) differs from the one specified in the Leave document, then in the Statement ... the date of receipt of income will be clarified, as it was in the example with the sick leave.

We pay vacation pay. The payment took place on the day that was planned - 12.02.

However, if you look at the movements in the register Calculations of taxpayers with a budget for personal income tax, which is done by the Vedomosti document ..., then we will see that the program nevertheless tried to clarify the date of receipt of income, but in the end received the same date. This is normal program behavior.

Filling 6-NDFL on vacation

Now we re-fill the form 6 personal income tax for the 1st quarter and see what has changed. A group of lines has appeared that corresponds to the fact of withholding personal income tax from vacation pay. The deadline for transferring personal income tax from this vacation is February 28, so this information was included in the report for the 1st quarter.

For vacation pay, as well as for sick leave, lines 100,110,120 filled in the same way, i.e. date of actual receipt of income and date of tax withholding - this is the date of payment (date of the statement), and the term for the transfer of tax is also no later than the last day of the month.

These vacation pay were also included in Section 6-NDFL report for the 1st quarter, since the date of receipt of income (12.02) also refers to the first quarter.

If we decipher the "Amount of Accrued Income" field, we will see that along with other incomes, this includes vacation for February. This also applies to personal income tax from vacation, it also got into the first section.

Reflection of salaries in 6-NDFL paid in the next quarter

The next step is to calculate and pay the salary for FEBRUARY. There is no difficulty in this. Date of receipt of income for February salary 28.02 ( last day of month), therefore, it will fall into the first section of 6-NDFL in the 1st quarter.

The salary is paid for February 08.03, therefore, personal income tax will be recorded as withheld precisely on 08.03 with a transfer date of 11.03 ( taking into account the weekend since 09.03 and 10.03 are days off). Thus, in the second section of 6-NDFL, the fact of retention will be shown in the report for the 1st quarter.

Of greater interest is personal income tax from the salary for March, since here, as in the case of the December salary, there will be the gap between completing the first and second sections of 6-NDFL.

By the date of receipt of income (31.03), the calculated personal income tax will refer to the 1st quarter.

And according to the deadline for transferring personal income tax to the second quarter: salaries are paid on April 10, therefore the transfer date on April 11 is already the second quarter.

Thus, the group of lines corresponding to the withholding of personal income tax from the salary for March will fall into the second section of the 6-personal income tax report for the 2nd quarter.

As for section 1, it is filled in by date of receipt of income, therefore, we will see data on income and personal income tax calculated from salaries for February and March in section 1 of the report for 1st quarter.

The report will show all income for the 1st quarter under the code 2000, which must go into 6-NDFL. The total amount must agree with the decoding from 6-NDFL (code 2000).

Summing up, I want to highlight some points that you should pay attention to when forming and (or) checking 6 personal income tax, and indeed when working in 1s ZUP 3.1. When checking 6-NDFL, you must:

- Indicate the date of the document "Statement ...", which corresponds to the actual date of payment:

- so that when filling out a document in the field "Personal income tax for transfer" the entire calculated, but still unrestrained personal income tax was loaded to the retention;

- so that the date of withholding and the deadline for transferring personal income tax are correctly indicated in the register of Taxpayers' settlements with the budget for personal income tax.

- Try to fill in as accurately as possible "Payment date" in the documents in which this is provided (Vacation, Sick leave, etc.);

- It is necessary to take into account the difference between the rules for filling out the 1st and 2nd sections and not try to compare them;

- Consider deadlines real transfers of personal income tax in the budget and the terms that you show in section 2 of 6-NDFL.

In fact, there are much more recommendations and features of data accounting for the correct filling of 6-NDFL in 1C ZUP, and most of them are understood on quarterly support broadcasts for the preparation of reporting. Therefore, I highly recommend subscribing to the 1C help system: Free access for 14 days (upon first registration) to stay up to date with all the changes and innovations.

The year 2016 was marked by such a bright event for accountants and their accompanying 1C specialists, as the introduction of a new form of quarterly reporting 6-NDFL.

Probably, users of 1C 8.2 (ZUP 2.5) got the most problems. At first, they were strongly advised to uncheck the box "When calculating personal income tax, take the calculated tax to account as withheld", then practice showed how much more convenient it was to leave this tick.

Also, for the convenience of rectifying the confusing situation in the sequence of documents for accruals and payments of wages, the manufacturers of 1C created an equally confusing document "Chain of personal income tax accounting documents." Attempting to use it adds pain to the tortured heads of accountants. At the time of the last hours of the deadline for submitting the first 6-NDFL declaration, the amount of information on how to work with this document was extremely scanty.

The procedure for filling out the 6 personal income tax form in 1C ZUP

Section 2 of the 6-NDFL form in 1C ZUP requires a clear chronological order of documents. The new requirements increase the level of responsibility for entering each fact of accrual and retention in the program. After each document of accrual / payment / deduction, it is necessary to constantly monitor the movement in the accumulation register “personal income tax settlements with the budget” - each accrual amount must be closed by the withholding amount, and the dates must correspond to the dates specified in article 223, article 226 of the Tax Code of the Russian Federation.

According to Article 223 of the Tax Code of the Russian Federation, the determination of the date of actual receipt of income:

According to Article 226 of the Tax Code of the Russian Federation, the term for transferring personal income tax:

Menu "Actions" -> Go -> Personal income tax calculations with the budget

In ZUP 2.5 there are 2 options for the personal income tax accounting policy. The choice of the option is registered with the checkbox "When calculating personal income tax, accept the calculated tax for accounting as withheld":

- the checkbox is cleared - "normal accounting";

- the checkbox is checked - "simplified accounting".

In the case of "simplified accounting", the accrual document for the personal income tax register is also a document withholding tax. In "normal accounting", the accrual document is only an accrual document, and tax withholding is made as an income payment document. At a certain moment, in order to make it more convenient to enter different payment dates in the same accrual document for different employees, 1C was improved and this feature was added - a "More ..." hyperlink appeared near the salary payment date:

Since 2016, a new form of the regulated report on personal income tax has been introduced - this is 6-NDFL.

The report assumes reflection:

- total amounts paid to individuals;

- the total amounts of personal income tax paid for the period from the income of employees;

- total amounts of deductions, if applicable.

The introduction of the new declaration is based on the state's hopes that:

- increase personal income tax fees;

- bring unscrupulous taxpayers to justice;

- increase control over income.

The declaration form has a title page and two sections:

- the first section contains the totals;

- the second section contains the dates of income (necessarily received actually), dates of withheld tax, dates of transfer of tax and the corresponding amounts.

- First quarter - 04/05/2016

- Half year - 08/01/2016

- 3 quarters - 31.10.2016

- For the whole 2016 - 01.04.2017

The procedure for filling out the 6-NDFL declaration form

When filling out the first section of the form, there should be no questions. Here we indicate generalized indicators such as the tax rate, totals and the number of employees of the company who received income.

Of greater interest is the completion of the second section 6-NDFL.

Get 267 1C video tutorials for free:

Here it will be necessary to fill in all the dates of the actually received income, the amount of income and the amount of personal income tax withheld from a specific income. In addition, it will be necessary to indicate the date of transfer of the withheld personal income tax. Moreover, if different types of income fall on the same date of receipt, but the terms of payment of the tax are different, then they must be distributed along different lines. Now there is a lot of talk about the fact that the declaration is filled with summary data, without analytics for employees, and it is not difficult to fill it out. All of the above suggests otherwise.

You can download a sample form of 6 personal income tax (according to KND 1151099) in Excel format at.

Here is a small sample of filling out 6-NDFL on the second sheet:

I gave the simplest example of four employees, at one interest rate, in three months. Already dazzling in the eyes.

Now let's try to figure out how we now keep records of personal income tax in the 1C: "Salary and personnel management" program. And what are the forecasts for the automation of filling out this declaration.

Accounting for personal income tax and filling out 6-personal income tax in the 1C program 8.3 ZUP 3.0

We will consider version 1C ZUP 3.0, since in 2.5 I think that it will be very difficult to automate filling out this report form, and most likely it will not be implemented. The configuration structure of version 2.5 was laid about ten years ago and simply will not be able to support the necessary analytics.

I will only say that users of version 1C ZUP 2.5 in any case will have to abandon the setting "When calculating personal income tax, take the accrued tax to account as withheld".

In version 1C ZUP 3.0, things are better. At least the withholding tax is formed immediately in the payroll statements:

In addition, in the ZUP 3.0, even the specification of personal income tax is carried out according to the documents on which the tax was withheld.

Moreover, in version 3.0, the personal income tax payment mechanism is very conveniently implemented. Payment can also be made from the payout sheet. To do this, you need to select the link "Payment of salaries and transfer of personal income tax". Then check the box "Tax is listed with the salary" and indicate the document on which the payment was processed:

- 1 Possible errors in calculating personal income tax in the 1C program 8.2 ZUP 2.5

- 2 Possible errors in calculating personal income tax in the 1C program 8.3 ZUP 3.0.

- 3 Possible errors in calculating personal income tax in the 1C program 8.3 Accounting 3.0

- 4 Possible errors in calculating personal income tax

- 5 Possible errors in inter-settlement documents on the example of 1C 8.3 ZUP 3.0

- 6 Possible errors in inter-settlement documents on the example of 1C Accounting 3.0

- 7 Possible errors in inter-settlement documents on the example of 1C 8.2 ZUP 2.5

Possible errors in calculating personal income tax in the program 1C 8.2 ZUP 2.5 Let's consider in the program 1C ZUP 2.5 using the example of the document "Vacation". Accrued vacation pay, which were originally planned to be paid on 01/29/2016. In fact, the payment is made on 01/28/2016. Therefore, we change the date of income payment in the vacation accrual document to 01/28/2016.

Some users of the 1c 8.3 program have problems with personal income tax. And how are you?

There are any ways to roll back from the last update and even a few things back. Everything was fine in November, but now I just want to cry stupidly out of powerlessness Added: Jan 19, 2018, 11:27 am Quote: Gennady ObGES on Jan 19, 2018, 05:49 am Just in case, I will clarify - the documents were rewritten (including unproved ones), months re-closed? Well, how can you answer this by the screenshot and the absence of even minimal information Gennady ObGES, please tell me what kind of information to provide? I started everything from scratch, consistently entered and carried out accruals - statements - payments.

Nothing helps. It is a fact that after the updates, the tables of charges have radically changed. I don't understand the technical details, but there is clearly something wrong with the update.

Personal income tax accounting in 1s 8.3 accounting 3.0

Important! To avoid possible errors in personal income tax, track in the 1C 8.3 (8.2) program the correspondence between the date of income in the income register and the date of income in the tax register, otherwise there will be errors in the program when calculating tax. When registering any income in the program, the date of the actual receipt of income is fixed.

For income with a code of 2000, this is the last day of the month of accrual. For other income, this is the planned payment date from the corresponding accrual document.

When the tax is calculated, the program analyzes from what kind of income this tax is charged, and the date of the actual receipt of income is determined, which is recorded in the tax register. Why can there be a difference in the date of receipt of income, which is recorded in the income register and the personal income tax register? Consider below.

Personal income tax calculated is not equal to withheld

Possible errors in inter-settlement documents on the example of 1C 8.3 ZUP 3.0 On the example of the 1C ZUP 3.0 program in the "Vacation" document, the planned payment date is 01/28/2016, but the document date will be set on 01/30/2016, that is, later than the planned payment date. Let's spend it. The record of the Tax Register was formed as of January 30, 2016.

Important

If we pay vacation pay before the date of the document - 01/28/2016 as planned, we fill out the statement, we see that the personal income tax withheld is not filled. As of 28.01.2016 there is no calculated tax. Accordingly, when conducting such a statement, the personal income tax withheld is not registered.

Attention

If everything is fine with the date of the document and it is earlier than the planned payment date: Then when filling out the statement, everything will also be fine, the tax will be determined. When conducting Vedomosti, it was recorded as withholding tax.

The problem with personal income tax

Possible errors in inter-settlement documents on the example of 1C Accounting 3.0 In the 1C Accounting 3.0 program, everything is the same. The date of the document is important. Let's consider the example of the document "Vacation". The planned date of payment is 01/28/2016, and the date of the document is intentionally set later, for example, 01/30/2016. We will post the document. The calculated tax was registered as of January 30, 2016.

After the payment is made, and not in the Vedomosti, namely, the withdrawal of cash payment or debiting from the current account earlier than the date of the vacation document, the withheld tax is not registered, is not determined and is not recorded in the Register. Therefore, the date of the document is important, if we put on 01/28/2016 and re-issue cash, then the record for personal income tax withheld was formed, everything got into the Register and then it will fall into the 6-NDFL form.

Possible personal income tax errors in 1s 8.3 and 8.2 - how to find and fix

Also, there is a payment date and when this date changes, everything changes automatically. The date of receipt of income for personal income tax also changes automatically.

But, just in case, check it out. Possible errors in calculating personal income tax Also, when calculating personal income tax, we should pay attention to the date of tax calculation. This is true for third-version programs. The tax accrual date must be strictly before the tax withholding date.

If at the time of withholding the tax, the tax itself is not charged, then, in fact, there is nothing to withhold. Important! Track in the 1C program: the dates of inter-settlement documents - this is the date of tax accrual, if at the time of payment the tax is not charged, then it will not be withheld. This is especially true for non-salary income, since the date of the document is fixed as the date of tax accrual. Thus, in the third version, the date of the "Vacation" document, the date of the "Sick leave" document and other documents are also important.

But if we change the date in the main form of the document, the date is automatically changed in the form "More about the calculation of personal income tax". It is simpler here, the program ZUP 3.0. itself guarantees to us that these dates will coincide.

The only thing in the current release of the 1C program is an error for the document "Sick leave". If it is paid with a salary, and we change the date of payment, then in this case the date of receipt of income in the form "More about the calculation of personal income tax" itself does not change.

Here you need to recalculate, or change the date in the form "More about the calculation of personal income tax" manually. For all other cases, the date of personal income tax accounting should change automatically at the date of payment. But just in case, check this moment, control the coincidence of dates. Possible errors in calculating personal income tax in the 1C program 8.3 Accounting 3.0 As for the 1C Accounting 3.0 program, there are also two inter-settlement documents "Sick leave" and "Vacation".

One line in personal income tax with a "minus" from 01/29/2016, and the second line with a "plus" from 01/28/2016. Two more groups of lines from 100 to 140 are added to 6-NDFL. In one, everything is reversed, and in the other - everything is charged again. To avoid such a situation, carefully monitor the date of receipt of income, which will be recorded in the Register of income and the date of receipt of income, which will be recorded in the Register of tax.

They must match. Possible errors in calculating personal income tax in the 1C program 8.3 ZUP 3.0. In the 1C ZUP 3.0 program, the date of receipt of income is also taken into account in two registers: the Income Register and the Tax Register.

For example, consider the document "Vacation". The date of payment from the main form of the document goes to the Income Register. And in the Tax Register - the date from the form "More about the calculation of personal income tax".

These two dates must match.

In this article we will consider working with personal income tax in 1C 8.3 Accounting 3.0 - from settings to operations and reporting. Content

- 1 Program setting

- 1.1 Tax data

- 1.2 Salary setup

- 2 Operations of personal income tax accounting in 1C

- 3 Reporting

- 4 Checking the correctness of personal income tax accrual