Usn

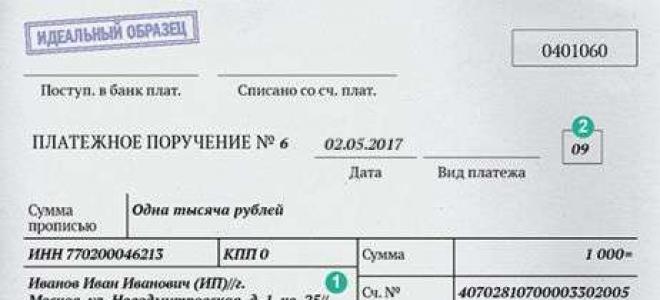

Companies pay advance payments under the simplified tax system three times a year based on the results of each quarter. BCC depends on the object - “income” or “income minus...

Based on the provisions of the Tax Code of the Russian Federation, business entities recognized as tax payers under the simplified system (STS) are exempt from...

Tax on the simplified tax system is paid quarterly, and the declaration is submitted once at the end of the year - this is the most important thing that entrepreneurs need to remember...

The single tax in “simplified taxation” is inextricably linked with the concept of “advance payment under the simplified tax system.” In order to pay the state one by one...

– this is half the battle when starting your company. Taxes, the mechanisms for their calculation and payment - this is a task, incompetence in solving it...

Payment of advance payments Yulia Gusarova Advance payments on the simplified taxation system are paid based on the results of three, six and...

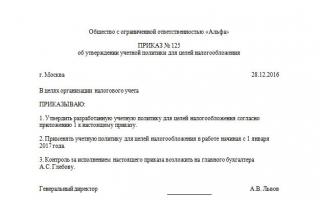

Some simplifiers, by virtue of the law, simply cannot do their work without a special internal document - the accounting policy on the simplified tax system...

Simplified people report their income received and expenses incurred to the tax office by filling out a special form...

Website. Easter - when will it be in 2020: Easter, also called the Holy Resurrection of Christ, is the most important event...

Small enterprises in their activities, in most cases, use a simplified taxation regime, which establishes...

Some entrepreneurs who do not use hired labor are wondering: what kind of reporting does an individual entrepreneur submit without employees? In our...

In most cases, a mortgage can be called a “lifeline,” but joy is never cloudless. It happens that when all the steps...

KUDIR is a document of activity, but to conduct it competently it is important to take into account certain subtleties of the process. Let's consider...