More advantageous to invest everything. Contribution or investment account: much more profitable to invest

Reasonable investment is the key to the high-protected future. By placing free money in promising investment projects, you get the opportunity to significantly increase well-being. What instruments are potentially profitable and what profitability they can bring a novice investor in detail in detail in today's article.

You can invest free money in these projects:

Sources of receipt of investments

The question where to take free cash is set by those people who are already thinking about their future. As you know, no extra money is. Therefore, if it is purposefully not taken to accumulate capital measures, then there will be nothing to invest. So where to take free money to invest?

Consider 3 reliable options:

- Postpone 10-20% of salary . This option is always running. It is important to determine what amount you can withdraw without consequences. If you find it difficult to scatter money and the temptation to spend them great, you can start. True options are not so much and they are not so profitable relatively with investments in 100,000 or more. But you can consider investing small money as a temporary line that will lead you to a big goal.

- Lend money from relatives . Not the best idea, but there is a place to be. Moreover, parents can give the initial capital for a good deed free.

- Additional income . As sources of dopework, you can consider overtime part-time jobs at the main place of work or short-term options with small payment. Of course, it will have to work anymore. But for the sake of obtaining passive income in the future it is worth an effort.

Top 17 ways to invest free money

So, you have a small capital and you want him to work. Below is a list of 17 working methods where you can invest free money. You can only adapt them to yourself and, depending on the ratio of income and the degree of risk.

1. Bank deposit

Attach free money to the bank makes sense when it is necessary to sort an inviolable stock just in case. In addition to urgent contributions, interest on contributions are completely penny. Therefore, it is not worth counting on good dividends even with a large amount. To the one who still decided to place the savings on the bank account for the amount of more than 1400,000 rubles must be divided into it and put in various banks . To in case of default The state reimbursed the investments in full.

2. Securities

Shares one of the most attractive, but also the most risky options. As practice shows, the disposal of securities is better to entrust experienced professionals, although they cannot guarantee income. The peculiarity of the method is that the upper ceiling of profit, as well as the loss does not exist. In each case, all individually. Of course, you can predict a major trend based on past experience, but it does not always work.

Read our review About how to avoid mistakes that make 90% of beginner depositors, and.

3. Real Estate

A fairly popular method to attach free money. After all, to invest means getting the opportunity to quickly income and cover them payments for the mortgage. However, it is necessary to take into account that if the apartment for some reason does not give up, the money must be made from your pocket. In the case when the housing is purchased on its own capital, you will receive a stable profit with minimal risks. It is most profitable to rent an apartment for offices and other commercial premises.

4. Binary options

With their help, each investor has the opportunity to make money on the shares of popular companies, banks and corporations. The options for options are built as: either you get maximum profits, or in case of failure, completely lose it. Risks are high, but profit can reach 70%.

Earnings on the options depends on whether you guess or not, it will grow or fall the price per shares within a certain period. You can buy them at different times, starting from 1 minute and ending with months.

Optional investment is carried out through a broker and requires knowledge of the basics fundamental and technical analysis.

5. Microfinance organizations

7. Business

One of the most controversial investment options. On the one hand, with the right choice of a niche, he can bring the greatest profit to his owner. On the other hand, you cannot hope for long-term income, without constant contributions to the development of the project. An alternative solution is a franchise, but here you will come across the strict limitations of the franchisor.

Read a separate publicationAnd you will learn what other pitfalls will wait for you in.

8. Dragmetals

13. Own site

Website creation One of the most popular ways to invest savings and there are a number of reasons:

- small initial investments;

- efficiency of creation;

- you can immediately start earning;

- passive income in perspective.

With all the merits it is worth considering that competition in this area is huge.

And before the project, it is necessary to understand all possible ways to monetize and promotion. Ideally, an investor should deal with these questions on his own, then the income will be maximum.

14. Social networks

The topic of earnings in publics in social networks does not lose its relevance. On the Internet, the discussion is actively underway whether it is possible to earn more money on your group or the train has already left. Answer uniquely to this question is difficult. In any case, those who started a couple of years ago, have explicit advantage. In general, it all depends on the organizational abilities of the investor and experience in promoting projects.

In any case, doing social networks yourself, you will not need a lot of money. With a successful circumstance, you will receive a good income from the sale of advertising, with unsuccessful experience, nothing will prevent a loss-making group.

15. Education

At the initial career stage it is very important to invest in gaining knowledge. New skills make it possible to establish yourself as a competent specialist and earn more money for a comfortable life in perspective.

16. Structural products

A stable way to invest accumulation, which has gained popularity in the ripping of the crisis and uses it so far. The essence is in the division of capital and investment of the main share of investment (80%) in bonds and balance (20%) into futures and options. Such a combination allows the investor with success to get up to 40% yield, with failure - to remain with its means.

Pay attention to the comparative table below (click on the picture to enlarge it):

Based on it, it can be concluded that structural products have the highest yield at relatively small investments.

Profit may be higher if it comes to, but it is important to carefully track news and analytics.

17. PAMM-account

Investing in the PAMM-account is a transmission of free money to a temporary order in order to increase them as a result of trade activities on Forex. The feature of such investments is that deposits are protected From possible fraud on the part of the account holder. When losing losses are distributed between all account participants, including the manager, which is an additional motivation of successful trading.

Conclusion

As you see decent options, where you can invest free money - a lot. The entry threshold in the listed alternatives is available, so you can try all the tools and determine suitable practically without cash losses. We, in turn, wish you not to be afraid to try a new one, because only this is what experiences are gaining and investment intuition develops.

How to reduce risks

How to reduce labor intensity

How much money to invest

Actual types of low risk investments

What to pay attention to when choosing where to invest

To understand whether to invest in one or another source of income, it is necessary first to define the criteria for which it will be determined by it or not.

If you restrict ourselves to three simple criteria, we would like to highlight the following:

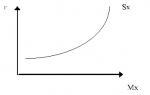

Yield

The yield is undoubtedly one of the defining factors when choosing where to invest money to earn. It is measured most often in percent percent per sum of the invested capital and determines how much capital will increase in a year, that is, how much will the investor work. If we want the money to work, and not just save them, then at a minimum, the level of yield should be higher than the level of annual inflation. At the moment, bank deposits in Moscow cannot boast of this, since the average rate on them is about 8.5% is lower than the level of average annual inflation, which over the past three years before 2017 is 9.9%. Therefore, to invest in a high percentage and earn money on it, you need to use other features that we will look at further.

Risks

The risk level is also the main criterion when choosing where to invest in interest. Risks are the likelihood of events in which the investor can lose their profit or even its investments. If, when considering ready-made investment proposals, the amount of profitability is most often determined immediately, then the quantitative risk assessment is almost always unknown. This is due to the fact that to predict the likelihood of certain negative consequences is most often very difficult. Yes, and not all consequences can be defined. Therefore, when choosing, where to put money for interest, it is best to delve yourself, and on what the project actually earns how this process has long been established and there can be a situation in which something will not go wrong. If you do not have sufficient experience in these processes, it is better to attract the experts to this, who understand this and understand. It also needs to be understood that most often than the higher yield, the higher the risks. If you are a novice investor, then at the initial stage it is better to invest money under a small percentage, and as experience gained experience in more favorable offers for a high percentage.

Labor intensity

If in a pure investment, when I put money and do nothing more, it is enough, in our opinion, an understanding of the levels of profitability and risks, then, for example, when investing in your own business, an additional factor appears, as laboriousness - this is the amount of working time spent, multiplied by experience and expert performers. In other words, how much time you or your team will spend on business development, and in any number of knowledge and skills you possess. The development of its own project can have the highest yield: hundreds or even thousands of percent per annum, but at the same time the necessary labor-intensiveness of the process is strongly increasing, especially if you independently participate in business processes. The risks at the same time have the opposite dependence on the experience and expense of the team, that is, the more experience and knowledge - the less risks.

Where to invest in 2020 in order not to lose - Moscow expert advice

When there is an understanding which factors are determining when choosing, where to invest money, so that they work, you can already consider and evaluate specific investments than now we will do.

All options will be somehow related to mortgage loans.

We believe that such investments, on objective reasons, are the least risky, but they have a high yield.

At the same time, everyone can find an acceptable type of type, based on possible labor costs and the availability of expense.

To begin with, we will tell you more about what loans are secured and why the risks are minimal. Loans secured are loans that give financial companies (MFIs, PDAs, auto bardes, leasing companies) or private lenders secured by real estate and cars. All this activity is legal and regulated by the relevant laws of the Russian Federation. Rates on such loans are much higher than that of bank loans, and averaging from 40% to 100% per annum. Borrowers are most often entrepreneurs - the level of profitability of their business allows to cover high interest, and they have no opportunity to pass long and thorough bank checks. The second category of borrowers is people with a corrupted credit history, the road to the banks for which is closed. Or people who are not able to confirm their informal income.

All loans are issued or secured by real estate, or on the security of cars. At the same time, the maximum loan amount most often does not exceed 50% of the market value of the collateral object, and the loan period is usually not more than one year. If the borrower cannot pay a loan, then the object of pledge is sold at a market value, which allows you to cover the amount of the principal debt, and the amount of accrued interest. If the difference remains - it is transmitted to the borrower.

It is the presence of collaterals that provides a minimum risk level for an investor, financial companies and this activity as a whole.

In 2020, experts noted, activities with mortgage loans became particularly popular and in demand from borrowers, and decent players appeared in the market of non-bank lending, allowing ordinary individuals without any labor costs to invest in this sphere and not only not to lose But also to make money well on this, having received your percentage with a guarantee provided by the presence of collateral.

Now, when we figured out how it works, and why the risks are minimal, we turn to the consideration of specific species of investments, their profitability and complexity. Total three options:

- Favorable treasures from 14% to 22% per annum

- Investment easily under 24% per annum

- Investing-pro up to 100% per annum

Let us dwell on each of the options, and you can find out in detail about each one by going on the relevant link where you can also leave an application for participation in the relevant program.

Favorable savings

This type will suit those who do not want or cannot be given time to invest. Here everything is simple: invested money and received income after the expiration or monthly payments depending on the type of savings. No labor costs on the part of the investor, but also the yield is not the highest, but 2.5 times higher than deposits in banks - from 14% to 22% per annum. Favorable savings are suitable for those who want to invest, for example, 100,000 rubles, since the minimum amount is 1000 rubles. Companies Savings:

This type for those who want to immerse themselves in investing in loans secured and receive a higher yield from investments than in conventional deposits. Here, directly the investor himself issues loans secured on his own behalf, but all other business processes are such as the search for borrowers, underwriting (risk assessment and checking of the borrower), assessment of the deposit, drawing up contracts, receiving payments and other, carry out qualified specialists. Investor labor costs are consideration and selection of investment proposals and the presence on the conclusion of the contract. Yield 24% per annum. It is suitable in the presence of investments from 300,000 rubles, optimally invest 500,000 rubles and more.

The most profitable, but also the most time-consuming type of investment of money. This method is suitable for those who are well versed in loans on bail. In contrast to the previous method, all business processes, except for the search for borrowers, must be made independently. Yield up to 100% per annum. A good option where to invest 10,000,000 rubles and after a year and a half earn a million rubles from above.

Where it is profitable to invest in interest - comparing options

- Risks

- Payments

- Labor intensity

- Amount of investment

Where to invest money to bring income?

This is the main question of business people in Russia. Especially acute began to rise within the framework of the economic crisis. Unstable economic situation in the country makes thinking.

Instability in the financial market pushed citizens to think where can I invest money in RussiaDue to the increased risks and the lack of understanding of what is happening.

Invest dangerously stored meaningless

Precious metals (on the example of gold)

Bonds and stocks remain only securities»A temporary influence. Gold is the most stable currency among precious metals. For several centuries, this precious metal only continues to increase growth rates.

State banks maintain the value of this direction by the goldenwriter. Investor invested accumulation in goldHe sleeps calmly, knowing that the price for it will only increase.

Some features are inherent in precious metals, we assume a person decided to invest in gold, went to the banking establishment for the purchase of a gold ingot, except for the value of the goods, an 18% tax imposed on the state of the state. When selling the ingot, there is no taxation, but the percentage of overpays will not return.

Investment in precious metals on the household level

Russians consider jewelry of gold and silver - an investment. In part, this is the case, but the work of the Wizard (Jeweler) is included in the price. The second negative point is sales. When trying to sell a jeweler lombards take it at a price of scrap, significantly different from the cost of goods.

The acquisition of precious metals is a very advantageous direction of investment, one should take into account the minimum yield threshold - 3 years. Middle income from gold + 20% per annum.

Securities (bonds, stocks)

Make a share of capital in bonds can afford people are not inclined to risks. Bond is a business emission, the tool is designed to receive a fixed income, after a certain period of time expires.

Big earnings on bonds should not be expected to be called their favorable investment - the language does not turn, but as cash making mechanism, It is worth considering.

Shares

One of the most profitable forms, where you can now put rubles, protrude Shares" Along with high yield, it is associated with increased risks, depending on external influences.

Promotion - share valuable paper that gives the Statute " co-owner of the company»Allows you to count on part of the organization's profit. The connection is simple, the company develops and flourishes, the package of securities is growing in price, the co-owner receives part of the profit, if the firm suffers losses, the owner also losses.

Work is conducted through brokers. More suggestions, allows you to independently choose shares, work out strategies, predict the behavior of indicators. Low threshold for entry, high probability rapid development, constantly attracts new faces in this industry.

TOP 7 Where is not worth investing

Main in investment - acquisition of financial literacy. Keep current projects under control, predict behavior on the market, catch the subtleties of the medium - these are the main components of the competent capital investor.

Financial Pillow An integral part of the Investor

Term " financial pillow"- 6-month finance reserve, for painless accommodation, without changes in the previous state of life. This condition should be respected without taking into account other sources of income.

- Want to know what you can save money now to afford more? If so, follow this link.

Engage investment activities Without a certain cash supply - unreasonable. The only exception is to contribute to the banking institution, which in most part acts as a tool for saving current savings.

In case of delay in translation, freezing of the project, risks associated with full or partial loss of allocated funds, the airbag must be. This is not advice, it is a postulate!

Alexey 32 years old Krasnodar

Time goes, and money is depreciated. I began to search where to invest. At first opened the bill and began to trade on Forex. It came to the conclusion that this is not mine.

And here I did not lose. You look at what my course is now! For a cryptic future, it is already in stores.

Some still do not know where it is profitable to invest money And how to make a profit from investments!

What you need to know about investments?

Where best to invest money?

What should be aware of where it is profitable to invest?

Investing money is always a risk.

Even the most reliable banks can go bankrupt, and get their tools back may be difficult.

It is not possible to avoid this 100%, but you can choose the most reliable place and make sure that even in the case of the collapse of the organization, you will get back what was invested.

What you need to consider a person, the first time inserting money:

Do not invest all savings in one place.

The attachment must necessarily documented.

This is a mandatory measure that will allow you to get your money back in unforeseen circumstances.

Pay attention to the deadlines.

If you wish to get your funds earlier than the deadline specified in the Treaty, you can lose the accumulated percentage.

Consult with friends and relatives, find out where it is profitable to invest money.

10 ideas, where better to invest money

By investing money, you should consider several options and choose the best, suitable for you.The best ideas where you can invest money:

Suitable as an additional way to preserve and increase funds.

Few know what mutual investment funds is and fear to invest their funds in them, but in vain.

Income from mutual effects is medium, but stable.

During the year - two can be obtained about 40% of the original amount.

The property.

Implementation in real estate is the best option.

The price of real estate can grow and fall, but they always rise in the end, and the sale of an apartment at such a moment brings big profit.

You can also leave an office.

Your own business is great ways to invest, save and multiply money.

In order not to lose funds, you need to make a clear, the most detailed plan, weigh all the pros and cons choose the case that you have to do.

Shares and securities.

For a long period of time - about 5 years, invested money grows many times, but in order not to lose funds, it is necessary to have some experience in trade in securities, and have at least minimal financial knowledge.

In order not to turn around, you should choose a manager who will do everything you need.

Metals: gold, silver.

To purchase ingots and coins, you need to contact the Sberbank of Russia.

You can also purchase securities provided by gold, visiting stock exchanges.

Attachments are highly efficient, however, it should be borne in mind that when selling gold ingots subsequently, it will have to pay a tax of 13%.

Own site.

Attachments in the creation of the site are not too high and justify themselves entirely.

One, well-promoted site can bring up to 40,000 rubles each month, depending on the number of advertising placed.

Venture fund.

Venture funds today are considered a worthy alternative to other financial instruments.

Attachments justify themselves, but it is necessary to wait for several years.

Own development.

A person who wants to increase his capital and earn big money, should never forget about its own development.

Investments in this case are carried out in education, appearance, knowledge of the world - travel, seminars and trainings.

A multilateral educated person will always find its place in the world.

Art.

By purchasing and selling art objects: paintings, the first publications of books, antiques, you can make a lot of money.

But for this you need to understand the values \u200b\u200bof things, be able to separate the grains from the whores, or resort to the services of a specialist.

Deciding whether much better invest money, It is necessary to calculate all the options for the possible development of events.

In order not to lose all your investments at once, in the event of a negative development of events, it is recommended to invest in several different directions.

The question of where to invest more profitable money is bothering, as a rule, those who are not familiar, or a badly familiar with the principles of increasing profits and methods of investment of funds.Tips wishing to invest their money:

- It is necessary to think about the preservation and increase in funds necessary in those periods when everything is in order with finances, and the payment of a large debt is not hanging on the nose. Sometimes makes it makes incorrect actions.

- For six months, the amount should be accumulated, which will be postponed to the bank for interest. And more the amount, the greater the ultimate you can remove from the account.

- Always strive for financial freedom. Do not reassure yourself that today everything is fine, and nothing else is needed.

- If you have children, think about their future right now. On the name of the child, you can open a cumulative account, and put money before the onset of the age of majority.

- Once in three or four months, create a new source of additional income.

- The most effective investment methods remain the same from year to year. This property, investments in precious metals, and stock markets.

- Gold is most extremely in the ingots than in the form of numbers on the brokerage account. It is all possible to invest in gold indices in stock markets.

- Use the stock market as a means of investing and multiplying capital follows only if you are confident in your financial knowledge and abilities.

- It is best to think about ensuring your future aged 20-30 years. However, due to inexperience, it should be resorted to the help of specialists in order not to lose investments.

Investments without loss: Where to invest money?

Observing the basic rules compiled by investment specialists, a multiple increase in capital and reducing risk can be achieved.

The main rules of investment:

Reinvestment.

The money received by investment should not be spent immediately.

They need to invest in other projects, leaving for the necessary spending some percentage of profits.

Do not invest the latter.

If you put everything in the wallet, you can stay at all without livelihood.

The main rule of successful investment is to act with the mind, and the investment of all recent means is a crazy deed.

Care at the conclusion of transactions.

Read all documents, demand the compilation of the contract and consult with experts.

Investing money "in different baskets".

One project will bring money earlier, another much later.

To always make a profit, you need to calculate the means, and distribute them to different baskets - deep and lower.

There is much better to invest small amounts of money during the crisis,

you will learn from the video:

Where it is profitable to invest money - features of investment in real estate

Real estate operations are most popular to date, rather than investment in mutual funds and funds.Many acquire housing even at the stage of its development at the lowest price, and subsequently resell, getting a good percentage.

However, in this case there are several pitfalls and the risk to run into the unfair developer.

To obtain maximum benefits from investments in real estate, one- and two-bedroom apartments should be purchased, but not three-room, because they are bought worse.

You need to buy apartments in small but developing cities.

Moscow and St. Petersburg better leave for local residents.

Sell \u200b\u200ban apartment in the capital will be very difficult.

To quickly find the buyer, you should make cosmetic repairs in the new building.

There are many answers to the question, where to invest more profitable moneyBut the correct answer everyone chooses for itself, in accordance with the possibilities.

Useful article? Do not miss new!

Enter e-mail and get new articles on mail

Many people do not invest, because they believe that for it you need to have thousands of dollars! It is not true. You can start investing only from 1000 rubles per month. How to become an investor, where to start?

The key to the construction of wealth is the development of good habits. First of all, it is important to learn money every day. If you are investing in a habit now, you will find yourself in a much stronger financial situation in the future.

Where better to invest a novice investor? Here are five ways to start creating a liability with very small money.

Where to start investing a newcomer with a small capital: educate thrift

How to start investing with a small amount of money? Saving money and investment are closely connected. To invest money, you first need to save. It will take much less time than you think, and you can do it with very small steps.

If you have never been over, you can start to postpone only 500 rubles a week. It may not seem very much, but during the year the amount reaches more than 24,000 rubles.

Try putting 500 rubles in an envelope, a box for shoes, a small safe, a porcelain piggy bank. Although it may seem stupid, it is often the necessary first step. We develop in yourself the habit of living for smaller money than you earn, and hide savings in a safe place.

An alternative piggy bank can be an online savings account. It is separated from your current bank card. Money can be removed at any time if you need it, but they are not connected with your debit card. Then, when the wallet is replenished, you can use them for investment in more profitable tools.

Start with small amounts of money, and then increase, then you will get more pleasure from the process. Just think about what you can not go to McDonald's or movie, but instead put this money in the piggy bank. If you are planning investing in Russia, where to start a newcomer?

Replenish your cumulative account

If you have problems with accumulating money and analytics of income and expenses, use the free application "Sberbank Online Expenditure Analysis" and its analogues. In addition, you can configure the automatic replenishment of the piggy bank every month so as not to forget to do it manually.

This is not fantasy, and the beginning is for your future savings. And for people who have never been economical, getting the first experience in saving accumulation.

Open a deposit with interest rate 8-9%

Deposits - the least risky investment option that is suitable for inexperienced investors. Choose the most profitable offers from banks with regard to the amount and date of investment:

- "Special" in the Renaissance loan - 7-8.5% of 30000 rubles for a term of 91, 181, 271 or 367 days;

- "Absolute maximum" in the bank "Absolute" under 8.5% for 367 days;

- Bank opening up to 8%;

- "Seasonal" in VTB24 to 10% for 7 months;

- "Investment contribution" from Rosselkhozbank at 8.15% per annum 180 or 395 days.

- Gazprombank "For the Future" 9%

- Uralsib "Faithful decision", 9%.

- Sovcombank "Record percentage with Halva" 8.8%.

- Promsvyazbank "My Strategy" 9%.

FIF for novice investors with low initial capital

FIF is investment securities that allow you to invest in a portfolio of shares and bonds with one transaction, which makes them ideal for beginner investors.

Among the most reliable management companies that have received the highest level on the Expert Ra scale (A ++) include:

- Sberbank Asset Management;

- Alpha capital;

- Gazprombank- Asset management;

- Capital;

- Ingosstrakh - Investments;

- Portfolio investment region;

- Transfingrupp.

According to investors' experts, the least risky investment for newcomers is to purchase mutations in PIPs specializing in bonds:

- "Sberbank - Ilya Muromets bond fund";

- "Bond Foundation" from the Criminal Code;

- VTB - Treasury Foundation.

You can buy Pai today in the amount of 1000 rubles on the Sberbank Asset Management website.

How to invest in bonds for beginners?

Few minor investors start their investment journey with securities of the Russian Federation, but you can. Investments in securities for beginners - reasonable investment. You never get rich with these securities, but this is a great place to park your money. In addition, you will receive the first investment experience while you are not ready to go to invest with higher risk and higher yield. You give money to the duty to the state and get a fixed profit percentage. Risks are minimal for you, since the state guarantees return on investment. For the first investments, the amount of 30 thousand rubles will be required.

It is easiest to buy bonds of a federal loan through the Sberbank branches with the Sberbank Prime Minister's service area. The fixed bet is 8.48% per annum.

Sign up for early investment courses

Free learning courses on investment and assets management most often offer specialists from brokerage companies for their potential or existing customers. For example, video seminars for beginner investors on a regular basis conducts a broker "Finam".

How to start investing in stock? Non-starting investors should be aimed at investing in securities for the long-term perspective.

A contract for brokerage services can be concluded not only from specialized companies ("Finam", BCS), but also in virtually any nearest branch of the bank (Sberbank, Rosselkhozbank, VTB24, etc.).

Instructions for beginners:

- To faster to delve into all the subtleties of the Stock Exchange and making transactions with shares, read professional literature (it will be discussed below);

- Choose only a proven brokerage company that has a high level of reliability and takes small commission for their services;

- Soberly assess your capabilities, never invest all your savings into stock, leave a financial airbag in the form of deposits by the amount that you have enough for half a year old;

- Sign up for investment courses that conduct practical all brokerage companies for their customers to teach them to use the software for trade in shares;

- Invested in stocks, aim for long-term and choose those companies that have long been working on the market and have high stability. In this regard, the Strategy "Blue Chips" will suit newcomers best.

- Diversification. Do not forget to reduce the risk of your investment portfolio through diversification. Never invest our savings only in the promotion of one company. The optimal solution is the choice of 10-15 companies, then your risks will be minimal. In case of falling prices for stocks, you lose no more than 7-10% of your portfolio, which is much better than to lose half or all of your capital.

- Focus on achieving a plank in 50% yield. It is this result that experienced investors consider not bad. After reaching this threshold, you can safely withdraw your savings.

Top Investing Books for Beginners: Top 7

I propose a selection of the best books on investing for beginners, of which you can learn a lot of important principles and useful advice:

There are many ways to start investing with small money, as many online platforms and platforms based on applications simplify work. All you need to do is take the first step. As soon as you do it, with time it will become easier, and your future will smile.

Real estate investment, where to start?

Investments in the purchase of real estate remain the most reliable at all times. Especially in the period of recession in the economy.

I offer the following strategies for novice investors:

- Purchase of housing at the stage of unfinished construction (when buying an apartment at the layout of the foundations, you will be able to earn up to 40% in the future, resold the finished object);

- Rental business. If you are aimed at long-term investment, then buying an apartment for you to lease it. It is most profitable to rent housing for rent, equip the hostel or make a redevelopment in the apartment, dividing it into 2 parts to hand over the rooms separately.

- Bankruptcy auctions. At the auction, sometimes you can find housing for 10% of its real market value. It gives you the opportunity to resale to get up to 90% of profit.

- Mortgage. This option will allow you to invest in real estate, who has no money for the purchase of housing. An apartment, which is pledged by the Bank, you have the right to dispose of your own discretion, including renting it. It is possible to cover mortgage payments due to the profit received until the bank is fully repaid.