How to make a declaration for profit in 1C. Accounting info

Profit tax for paying to the budget is calculated on the basis of chapter 25 of the Tax Code of the Russian Federation:

Profit Tax \u003d Taxable Profit × Profit Tax Bet.

Tax base for calculation profit tax 1c is defined as a difference between income and flow, which may differ from those taken in the bu. In this case, there are differences between profit, and therefore the calculated profit tax on the BU and well.

The arising differences between accounting and tax profit (loss) may be two types: permanent (pr) and temporary (VD and NVR). In accounting, the differences are not reflected, but the amount of tax calculated from these differences.

Accounting for income tax calculations is carried out using the following balance sheet accounts:

- 09 "Deferred tax assets";

- 77 "Deferred tax liabilities";

- 68.04 "Profit Tax";

- 68.04.1 "Calculations with the budget";

- 68.04.2 "Calculation of income tax;

- 99 "Profit and losses",

- 99.02.1 "Conditional consumption for income tax";

- 99.02.2 "Conditional income on income tax";

- 99.02.3 "Constant tax obligation";

- 99.02.4 "recalculate deferred tax liabilities and assets"

Profit Tax Program: 1C: Accounting 3.0

Select the organization in the program 1C: Accounting 3.0, and proceed to setting up accounting policies:

Install a tick - Used PBU 18/0.2, if there is no such.

Let's go to the information register Profit tax rateand set values. It should be remembered that for different subjects of the Russian Federation rates may differ.

Before watching relevant income tax reports, it is necessary to fulfill the regulatory operation - Closing of the month. After that, you can go to the reports.

For internal analysis, there is a report - Analysis of the state of income taxwhere you can always choose the section of interest.

There is also a report Certificate of Profit Tax Calculationin which it is convenient to analyze the data obtained.

Report intended for tax - Profit tax declaration.This report can be accessed through 1C reporting.

Profit Tax in Program: 1C: UPP 1.3

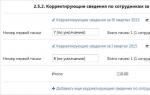

In the program 1C: OPP 1.3 There is a document - Calculation of income tax

This document performs regulatory tax accounting operations to obtain information on income tax. Document is introduced after the fulfillment of all accounting and tax accounting operations. For each organization your separate document.

After that, you can use the reports specified in the previous section (for the configuration of Accounting 3.0)

Profit tax in the program: 1C: ERP.. Enterprise Management 2.0

In the program 1C: ERP Enterprise Management 2.0 To form a profit tax, there is a document - Regulatory operation.To form a profit tax, you need to create a specified document with a type of operation -Cearning income tax.

Document Regulatory operation will form the following postings:

After which you can go to the item Regulated reporting and form a profit tax declaration on the necessary organization.

Thank you!

Let's talk again about tax accounting, or rather about the calculation of income tax in accounting. All organizations (with the exception of budgetary, insurance and small businesses) are obliged to apply in account the Accounting Regulation 18/02 "Calculation of income tax".

But in practice, the majority of accountants are "afraid" to apply this PBU and are trying to bring accounting data with tax accounting data to then not deal with the differences. In fact, everything is not so difficult if competently approach the study of this issue. Accounting for PBU 18/02 is especially simple if it is conducted in the program "1C: Accounting 8".

In order for the program to automatically calculate the amount of income tax in accordance with the standards of PBU 18/02, it is necessary in accounting policies to establish the flag "Applied PBU 18/02" Calculation of income tax "" and fill out the register of information "income tax rates" .

Further, when conducting documents, indicating the article costs or articles of other income and expenses not taken for income tax purposes, wiring will be created by type of accounting "PR".

And when conducting documents in which the amounts of income (costs) in accounting and tax accounting are different, due to the various ways of recognition of income (expenses), wiring with the type of accounting of "BP" will be formed in the amount of these differences.

When carrying out the document "Closing of the month" with the reflected flag "Calculations for income tax (PBU 18/02)" will be formed on the difference in posting on education (repayment) of deferred tax assets and liabilities, as well as permanent tax liabilities (assets).

And here it begins the most interesting ... How to check whether the program has calculated the difference? Let's start.

First stage You need to check all income and expenses. For each account in the program, the equality of bu \u003d NO + PR + BP is observed. To verify, it suffices to form two reports, for example, a turnover of the Salda Statement for Accounting and a Werette - the Salda Statement for Tax Accounting without specifying the type of accounting. Or you can use report "Analysis of the state of tax accounting", In which income and expenses are grouped according to classification features in the context of the types of accounting bu, well, pr, BP and compliance with the equality of boo \u003d NO + PR + BP, in case of no compliance, the report displays errors and documents that they are formed. Both of all found the following errors:

- In the document "Operation introduced by manually" did not fill in the Tax Accounting tab

- In which document did not install the Flag "Reflect in Tax Account"

- In the document, the "Manual adjustment" flag was corrected by the amount in accounting, and forgotten in tax accounting.

And to accrual deferred tax assets and obligations, the place of difference is taken into account. Those, if the difference originated with different methods of depreciation, then temporary differences formed in the account 02 "OS depreciation" will be analyzed to accrue the deferred tax obligation, if in the method of write-off species. clothes - on account 10.11 "Spec. Clothing in operation ", etc. If the differences are formed correctly, then the sum of differences in accounts 02, 10, and others should be equal to temporary differences in account 99 "Profit and losses".

Most often found the following errors:

1. Again "Handles" (all problems from manual adjustments!), I.e. Manual adjustments on the credit account 10.11 corrected the type of accounting, for example, BP, and the debit of account 20, 25,26,23 was left well, accordingly, deferred tax assets or liabilities will be accrued, and at the expense of 99 temporary differences will not "reach".

2. Similarly, the document "Operation introduced by manually" - tax accounting does not require a dual record principle, reflected a temporary difference on the credit of account 02, and the corresponding account did not indicate.

They are easier with constant differences, they arise at cost accounts and are charged on them, for example, on account 91, 20.26. It practically does not occur here.

Third stages. We check the current income tax: for this, the amount on account 99 for tax accounting is multiplied by the income tax rate and receive the current tax on tax accounting data. The amount of accounting on account 99 is multiplied by the income tax rate, add the amount of temporary differences in account 99, multiplied by the income tax rate, and add constant differences in account 99, multiplied by the income tax rate, and must reach the amount of tax For profit according to tax accounting. And all this can be verified using one report "Analysis of the status of tax accounting"

!

Deferred assets and liabilities are formed in the program in the context of groups of assets and obligations: fixed assets, finished products, materials, work in progress, etc., and the formation of differences on the object can be viewed in the report "Help-Calculation of permanent and temporary differences". In this report, wiring on the formation of deferred tax assets and obligations, as well as permanent tax liabilities and assets, are expanded, and in form 2 "profit and loss statement" fall rolled, please take into account when reporting reconciliation.

Go to the list of direct spending:

Here the "methods for determining direct costs of production in well" are determined.

Mandatory to fill in accounting organizations that produce products and provide services. Initially, the default setting is, but then it is desirable to configure in the extended mode under the activities of the organization.

Filling is carried out according to the principle: the data reflected in this register is considered direct expenses, and all other indirects.

Entering data is required. If not fill out, some fields in the declaration are empty.

Filling the reference book "Nomenclature groups of sales of products, services" is needed to reflect income detail.

The reflection of income from implementation will be precisely the selected nomenclature groups.

Correct data entry is based on:

The absence of operations entered manually.

Proper income and expense analytics.

Manual filling of amounts can lead to errors in analytics. Based on what errors occur in the calculations and, accordingly, in the declaration.

Consider the document "Report of production for shift". Here on the "Products" and "Materials" tabs should indicate the same nomenclature groups, and the cost of the cost should be reflected in the "Methods for determining direct production costs."

The last paragraph of preparation for the correct formation of the Declaration is the closure of the month:

For control it is possible to conduct preliminary closures of periods. It is important that all regulatory operations are performed unmistakably. After the formation of the report "Closing of the month" is desirable to check the balances on account 68.04.2 (calculation of income tax) - should be zero:

Let us turn to the formation of the declaration. Located in the magazine regulatory reports "":

We choose the report "Declaration of Profit Tax" and press the "Fill" key.

It is necessary to check the reflected data. You can start immediately from the 02 application list 2, as all costs are indicated.

Check can be made in two ways:

Through the "Decryption" key.

Through registers well.

To check through the decryption on the left in the structure, select the desired string and press the same key in the upper menu of the document.

To check through the registers, we switch to the "Reports" menu tab, "tax accounting registers" and select paragraph 1.04 "Direct costs for the sale of goods, services".

Tax registers are presented to a tax agent when verifying to confirm the correctness of accounting.

All other partitions can be checked in the same way.

Before sending a report to the tax authority before sending a report to the tax authority, press the "Check" key and select from the drop-down list "Check the control ratios". Make sure that all data is reflected correctly, send a declaration.

This review is devoted to the procedure for calculating the income tax and filling out the relevant Declaration in 1C 8.3, the configuration "1C: enterprise accounting". It is assumed that the reader is already familiar with the principles of PBU 18/02. It is impossible to cover the entire head of the Tax Code of the Russian Federation in one article, we will focus on the main points and consider the actions algorithm for the calculation of income tax by applying the 1C program.

Declaration for income tax in 1C reflects income and expenses taken to calculate the tax base for income tax. In detail, the order of its completion is set forth in the order of the MMB-7-3 FNS / [Email Protected] from 10/19/2016

The tax period for all companies is the calendar year, the deadline for the annual declaration is March 28. If the last day of the declaration of declaration falls on the day off, it is transferred to the nearest working day after it.

Under the reporting periods and advance payments, there are nuances:

Organizations with minor turns pass over the year reporting on the basis of:

- 1 block until April 28;

- Half of the year until July 28;

- 9 months before October 28.

At the same time, payments on accrued profits are paid, which are considered advance, because Fully the tax amount will be formed only by the end of the year. Sometimes there are situations where the amount paid during the year of advance payments exceeds the tax accrued in the year, then the organization forms a tax overpayment.

If the organization has a revenue for the last 4 quarters, the revenue on average for the quarter is equal to or exceeds 15 million rubles,they pay monthly up to the 28th of the advance payments for income tax formed by the settlement path (an example of the calculation will be later). The term of the reporting is similar to the above paragraph. If, after the quarter, the amount of advance payments will be less than the amount of the accrued tax, the delta will need to pay extra.

Not always the order when during each month you need to pay an advance payment for income tax, beneficial to the organization. There are situations where there are no profit, but paying advances have to pay. In this case, the organization can go to the procedure for calculating the actually received profits: according to the results of each month it will be necessary to give reporting to the tax authorities.

To go to this mode, apply the appropriate application before the calendar year start, then until the end of the tax period will be changed.

Profit tax in 1C 8.3. Step-by-step instruction

- Fill out account settings.

- Fill out reference books related to tax registers. Special attention to pay expenses directory.

- When entering documents, correctly indicate the parameters that can affect the calculation of the income tax: accounts and subaccounts according to the account plan, types of income or expenses, nomenclature groups, etc. If documents contain special settings for tax accounting, they should pay special attention and, if necessary, fill. When entering a document, analyze wiring and pay attention to the display of data in well.

- After entering all documents for a month, it is necessary to form regulatory documents Closing the month, check the results. If the results in 1C did not coincide with the expected, it means somewhere in the settings or entered documents made an error.

- CT Sch.68.04.1 per month should be formed the right amount of income tax. If we achieved such a situation in 1C, you can go into regulatory reports and form a declaration.

- We form and check the declaration. Sometimes I do not like the distribution of direct and indirect costs. This can be edited by the appropriate settings. If all positions in the declaration correspond to our expectation, unload it and send it to the Tax Inspectorate.

- Next, you should pay tax and reflect the payment in 1C. On the account 68.04.1, a real balance should be displayed, reflecting the tax on the tax income tax in terms of settlements with tax inspectorate and budgets.

Consider an example of calculating the tax for the quarter. The first two months of the example show options for constant and temporary differences, in the third month we will add the operation of the purchase and sale of goods.

How to charge income tax in 1c

We implement the considered theoretical steps in practice. Watch accounting policy settings. The parameter must be set that we apply the Eighteenth PBU.

While wiring in the bu and well coincide. But, since the type of costs indicates the normalized advertising costs, then, when performing a regulatory operation to close the month, the expenses will be debited to expenses not exceeding 1% of revenue.

It contains not accepted costs that form constant differences.

Show wiring on revenue. Every month during the quarter it will be services.

We look at the SMD in January. Pay attention to the difference in well and boo according to our example. SCH.26 in well left unclosed advertising costs. In January, you can write off only 1 thousand rubles. But if next month there is a revenue, it will be possible to write off an additional amount. On account 99.02.1, the amount of conditional income tax flow. Temporary differences influenced the wiring. 09 and 77. The constant difference was reflected in the account 99.02.3, the difference in advertising was added there. On the account 68.04.1. The total amount to the payment of income tax.

Consider the account of the account 68.04.2, which reflects the accrual of income tax. This is a rare case when considering the report is more logical from the end of the document. Then the amounts formed from the influence of permanent and temporary differences are added to the conditional consumption for income tax. The total amount of tax is transferred to the account of calculations with a budget with division into federal and regional payments.

For the second month, operations to write off the depreciation in BU for overalls are added to already familiar rev. Additionally charged the cost of advertising, as a result of which the amount of sch. 99.02.3 decreases.

Create a profit declaration. Fill the title page, the adjustment number must be zero. When filled with updated declarations, the adjustment number will be increased. By the "Fill" button, we form the sections of the declaration.

Consider those of them that have data. Section 1 reflects the amount to pay in the context of budgets. It is necessary to check the correctness of the filling of the CBC, then specify it in the payment when paying tax.

Appendix 02 - Decryption of expenses. On many lines of declaration, you can see more detailed details. To do this, select a cell and click the "Decod" button.

For example, it looks like decoding direct expenses.

After filling in the declaration, it can be checked, unloaded in electronic form to the external carrier or send to the tax inspectorate directly from the program.

Consider in more detail the calculation of advance payments. The amount of the calculated tax for the quarter is 83640. If the company operates in payment of only quarterly advance payments, it should pay this amount until April 28 and calmly work the entire second quarter, without worrying about payments and reporting on profits.

But if an enterprise falls under the criteria for paying monthly settlement advance payments (let such a period came on April 1), then 1/3 of this amount, 27880, it will have to pay every month during the second quarter up to April 28, May 28 and June 28th. Then, after completing the quarter, it is considered to calculate the tax amount over half and compare with the advance payments already paid. If less actually accrued, the difference to pay extra until July 28.

Advances for the third quarter are considered to be (the tax amount per half) minus (the amount of tax for the first quarter) and then it takes 1/3 of this value for monthly payments.

Advances for the fourth quarter are considered similarly (the amount of tax for 9 months) minus (the amount of tax over the half year) and further divided by 3. The resulting amount should be mentioned in the fourth quarter. And the same amount will be paid in each month of the first quarter of next year.

As noted above, if an enterprise considers it inappropriate to pay monthly advance payments, it can move to the payment mode on actually received profits, pre-warning the tax authorities about it.

On this, we have completed the consideration of the main points related to the calculation of the income tax and the formation of the relevant Declaration in 1C 8.3.

Calculation of income tax in 1C is fully automated. You can allocate two stages in this process:

- formation of postings on tax accounting in on-line mode, that is, simultaneously with accounting wiring when conducting primary documents;

- performance of the final settlement at the end of the month during a special regulatory operation.

Consider a small example in which we analyze the formation of the tax base and fulfill the tax calculation.

Suppose the enterprise Pioneer LLC is engaged in the production and sale of products. For the manufacturing process you need to purchase materials, equipment, pay salary to employees. The difference between income from the sale of products and incurred costs will be the base for calculating income tax.

Let's see which wiring was formed during this document (Fig. 3). The figure allocates two groups of wiring - accounting and tax. In the tax wiring group, there are three lines at once - for the amount of tax accounting (well) and for the amounts of permanent and temporary differences (PR and BP).

In our embodiment, the difference is not formed, so the lines are empty. But in other cases, the difference will be calculated and will take part in the formation of the tax base. In 1C programmed the calculation of all amounts, as well as the control of the main formula:

BU \u003d NO + PR + BP

It is worth paying attention to another important point. The amount of 5400 for tax accounting is displayed only in the column "CT sum.". The fact is that VAT accounting accounts are not included in the list of taxes, so there are one-sided tax wiring.

Since all the nuances of forming amounts for tax accounting are already laid in the calculation algorithms, the user may not worry for the correctness and completeness of the data. It remains only to observe the actions of the program 1C.

Admission and acceptance of the main fund

Let us turn to the next document. In January, the company (Fig. 4).

Of interest is the document for which the machine (Fig. 5).

To reduce tax payments, we use the right to the amortization premium (Fig. 6).

In 1C, the depreciation premium is taken into account on a special account of kV (Fig. 7).

How exactly the application of the depreciation premium will reduce tax, see later.

Get 267 video tutorials for 1C for free:

Reflection of wages in expenses

For now, we take into account another type of costs - labor payment. To do this, form the document "" (Fig. 8).

When conducting, both accounting and tax wiring are also formed (Fig. 9).

Write off materials in production and production

In the wiring we see amounts and accounting, and on tax accounting (Fig.11).

It remains to reflect the release and sales of products.

In Fig.12, wiring formed by the document "" is depicted. The main thing that needs to be remembered is the amount in wiring depends on the planned price set in advance, and does not have a direct connection with actual expenses.

The last document in our chain - "" reflects the sale of all the released products (Fig. 13) and forms our income.

So, all scheduled costs and income are taken into account. You can proceed to the calculation of income tax. This is the second and final stage of calculating the tax in 1C.

Depreciation

Perform closure for three months - January, February and March. In February (Fig.14), that is, next after the adoption of the equipment, operations will be carried out on the accounting of the depreciation premium.

Figure 15 shows depreciation wiring. The depreciation premium "edited" the amount of depreciation by tax accounting, resulting in temporary differences.

Calculation of income tax in 1C

The following drawing (Fig.16) shows a certificate of deferred assets and liabilities in which the calculations on their formation are described in detail.

Amount 1983,33 rub. It is equal to the percentage of income tax (20%) on the amount of temporary differences (9916.66).

The operating statement (Fig. 17) contains data on deferred assets, which are reflected in the account 77.

As a result, income tax is as follows (Fig.18):