How to adjust information in the PFR zag. Sending a corrective calculation for insurance premiums (RSV)

First that the program correctly considered taxes and contributions, in July 2016 documents "Accrual of wages" were created with negative sums. These documents completely repeated the required cancellations of the documents, only the date of the document was "07/29/2016" and the amount were with the "minus" sign. The document "Calling Taxes with Fot" for July month issued many wiring with negative sums. Do not worry, it is correct. Next, we close July, August, September and proceed to filling the RSV-1 for the third quarter. Now we know how to do it. Will be easy. Create the source section 6. Data on July and results for the quarter The program will fill in incorrectly, fill in manual. Next, we create an additional section 6 for the first quarter of 2016. And we introduce corrective information on employees. In the field "incl. Dincinquent "amounts will be with a minus. Create Section 6 to adjust the second quarter.

Subject: Corrective RSV-1 on the act of field check

In the current reporting period, it is necessary: \u200b\u200b- formed on the "alien" insurance number with a canceling form of SZV-6-1 (2) (OMN-form), indicating the correct name of that person, whose insurance number was mistakenly used when the transmitted report is delivered; - to form corre -Forma on this employee, indicating all its correct data: Both the experience, and insurance premiums. The ADV-6-2 formation form should be formed in accordance with Claim 1.3. In the lower part of the OTIC, "information about corrective (abolishing) information", in Grafa "Danced ..." and "Doodle ..." The same values \u200b\u200bof the amount of contribution of the OVN-forms will be indicated with a minus sign (-), and according to the corps with a sign plus "+", so the final sums of this part of the inventory will be zero "0" . 5. Adjustment of amounts of insurance premiums 5.1 Corresponds are formed in accordance with section 1.

Prednalog.ru.

How to make RSV-1 adjustment and pass the clarified in the FIU? Based on the decision of the Management Board of the Firm dated January 16, 2014 No. 2P LLC "Romashka" in the 1st quarter of 2017, it is obliged to submit a refined calculation in the form of RSV-1. The title page is fill in this way: in the field "Reporting Period (Code)" - the indicator "0"; in the "Calendar Year" field - the indicator "2016"; in the "Clarification number" field - the sequence number of the refinement (001 (if the changes are made for the first time) , 002 - change again, etc.); in the field "Reason for clarification" - the indicator "2". The amount of detachments in the FIU (2000 rubles) reflect in line 120 of section 1 and in the corresponding lines of section 4 forms of RSV-1.

In section 6.2 of section 6, it must be specified: in the "Calendar Year" field - the figure "2017"; in the field "Reporting Period (Code) - the indicator" 3 "(1 quarter).

Online magazine for accountant

In this case, in the reporting campaign for the current reporting period, it is necessary to form an ISCD for the past period for one of this forgotten employee, with an indication of only experience, without amounts of insurance premiums. Draw this package new next number in order. This package is presented without inventory 6-2 and will be posted to the report (form of RSV-1) for the reporting period, in which they forgot to submit information to this employee. 3.2 When forming a set of ICED - forms for the current reporting period, it is necessary to form and present in a new separate package of corp on this forgotten employee, indicating all the right data: and experience, and insurance premiums. This corporation will replace the ICED form, which It was represented only with experience. In addition, the ADV-6-2 OPEM for the current reporting period should be formed general, in accordance with clause 1.3.

An example of filling out the form of RSV-1 with corrective partition 6

The type of adjustment is set "corrective" (in subsection 6.3 "Type of adjustment of section 6) for reporting periods (until 01.01.2017), in which the amounts of insurance premiums have changed. And in subsection 6.2 "Reporting period" of section 6 forms of RSV-1, the reporting period is indicated (until 01.01.2017), to which the amounts of accrued insurance premiums are applied. An example of filling the refinery of the RSV-1 in Romashka LLC was conducted a viscation, as a result of which the amount of documents in the FIU amounted to 2000 rubles.

This amount is decisive for payments by employee Rudenko P.R., incl.: 1300 rubles - detachments for March 2014; 700 rubles - detachments for June 2015. The decision to bring to the responsibility of Romashka LLC entered into force in February 2017.

UPFR in the city of Izhevsk (interdistrict) of the Udmurt Republic

For each insured face, such a section is separately drawn up, where they are reflected:

- FULL NAME and SNILS of the physical (in subsection 6.1);

- amounts accrued in its benefit and remuneration (in subsection 6.4);

- amounts accrued with its payment fees on the OPS (in subsection 6.5);

- the dates of the beginning and end of the period of work of the physically for the last 3 months of the reporting / settlement period (in subsection 6.8). According to this information, the FIU will determine the experience of the employee (paragraph 37 of the Filling RSV-1).

Subsection 6.6 RSV-1 is filled only if you need to make corrective individual information on this employee (clause 35 of the Filling RSV-1). And subsection 6.7 - if you charged the contributions from the payments to additional tariffs.

RSV-1 PFR - 2016: Filling Sample

And also fill it with the necessary data. Then for 3 and 4 blocks. Part of the work is done. Dried. And continued. Click "Show all sections". And proceed to fill out this form. To begin with, go to section 4.

Info

Here, a separate line must be filled out for each corrected month. Moreover, the sums in graphs 6, 7 and 14 can be with the "minus" sign, if taxable amounts decreased. Be accurate, the final amounts will be transferred to section 1 line 120 and 121.

Check the report data. It can be sent. The second quarter passes calmly. No additional partitions to create no additional sections. Do not forget only in Section 4, repeat all the data you were filled in preparation of the report for the first quarter.

Look at the 2.1 section, we will need. The third quarter comes. And here it turns out that many accruals made in the first and second quarter are required to cancel.

That is, if any section of the form you remain empty, for example, section 2.4, where the amounts of contributions accrued on additional tariffs are reflected, and you should not accrue and do not charge you, then this section is not necessary to represent this section within the calculation. In mandatory, it must be in the RSV-1 section 1 and subsection 2.1 of section 2, as well as the title page (clause 3 of the RSV-1 filling procedure). The remaining pages are included in the calculation.

For this reason, in the following example of filling out the form of RSV-1, the FIU also have not all sections. Thus, the policyholder first fills in the calculation of the necessary sections, and then it already affixes the through numbering on each page. Filling the RSV-1 report: the title page filling the RSV-1, as well as many other reporting forms, can be started with a title sheet.

Corr. RSV 2016 Mr. verification Example of filling

Attention

From Accounting 2.0.65.48) Attention! When filling out the form of the RSV-1 for the 4th quarter of 2016, the OKVED Code of the OKVED 2 will consider the extremal situation. When preparing a report for the first quarter of 2016, it turned out that adjustment for all quarters of 2015 is required. Start. First, everything is as usual. Create a new report.

Automatically fill the source section 6 data for the first quarter. And now further. Create another section 6. We note that this is "corrective information", and "Corr. Period 1 quarter of 2015. " In the list of insured persons we introduce all whose data should be adjusted.

Fill the data monthly for each employee, do not forget to fill the field "incl. Dincinquent, "where we must specify the difference between the previously accrued and new value. If the amount decreased, the field will be with a minus sign. Next, we create another section 6 for the 2nd quarter of 2015.

If the corps are submitted by the act of documentary inspection, they must be handed over to the deadlines specified in the act. If the term of delivery does not coincide with the report for the current reporting period, the corps for registration must be submitted to the period specified in the act The reporting campaign without an ISXD form. In the formation of such corronices, the reporting period needs to choose the current reporting period, and the corrected period is to choose the one for which the corrections must be made. When the reporting campaign will come for the current reporting period, then to form the current inventory of the ad 6-2 needed, taking into account the previously represented packs of corps. Mower packs with corr-forms do not change, because They are already registered !!! 3.

How to make RSV-1 adjustment and pass the clarified in the FIU? Based on the decision of the Management Board of the Firm dated January 16, 2014 No. 2P LLC "Romashka" in the 1st quarter of 2017, it is obliged to submit a refined calculation in the form of RSV-1. The title page is fill in this way: in the field "Reporting Period (Code)" - the indicator "0"; in the "Calendar Year" field - the indicator "2016"; in the "Clarification number" field - the sequence number of the refinement (001 (if the changes are made for the first time) , 002 - change again, etc.); in the field "Reason for clarification" - the indicator "2". The amount of detachments in the FIU (2000 rubles) reflect in line 120 of section 1 and in the corresponding lines of section 4 forms of RSV-1. In section 6.2 of section 6, it must be specified: in the "Calendar Year" field - the figure "2017"; in the field "Reporting Period (Code) - the indicator" 3 "(1 quarter).

Prednalog.ru.

The type of adjustment is set "corrective" (in subsection 6.3 "Type of adjustment of section 6) for reporting periods (until 01.01.2017), in which the amounts of insurance premiums have changed. And in subsection 6.2 "Reporting period" of section 6 forms of RSV-1, the reporting period is indicated (until 01.01.2017), to which the amounts of accrued insurance premiums are applied.

An example of filling the refinery of the RSV-1 in Romashka LLC was conducted a viscation, as a result of which the amount of documents in the FIU amounted to 2000 rubles. This amount is decisive for payments by employee Rudenko P.R., incl.: 1300 rubles - detachments for March 2014; 700 rubles - detachments for June 2015.

The decision to bring to the responsibility of Romashka LLC entered into force in February 2017.

RSV Adjustment 1 for 2018 in 2018

- with a preliminary payment of the amounts of payments and related to them, but this is happening before the IFNS requested the explanations on deficiently identified by it or reported on the assigned field check (sub. 1);

- after a conducted check, which did not reveal in the reporting for the period of refinement of errors (sub. 2).

The above list of situations indicates the presence of a sufficiently high degree of control by the IFX, carried out at the time of the RSV acceptance. It allows the tax inspectorate already at this stage to identify the most obvious errors in the report and require the submission of the clarification.

Despite the fact that the list of lambs of the RSV since 2018 is expanded, the ability to correct this report without sanctions is preserved.

Correction of section 6 8 RSV 1 for 2018 in 2018

Together with the form of RSV-1, corrective individual information for persons for which adjustments are made are presented. How to hand over the clarified RSV-1 for 2014, 2015, 2016 year? Together with the refined form of RSV-1, individual information on the insured persons, the amount of accruals on which is changed.

The type of adjustment is the "source" (in subsection 6.3 "Type of adjustment of information" of section 6), reflecting information about the changed insurance premiums (in subsection 6.6 "Information on corrective information" of section 6). And in subsection 6.2 "Reporting period" of section 6 forms of RSV-1 indicate the reporting period (after 01.01.2017), to which the date of the submission of updated reporting belongs.

Together with the above documents, individual information on the insured persons, the amount of accruals on which are changed.

I correct mistakes in 4-FSS and RSV-1 for 2016 correctly

The FZ calculations for insurance premiums, including those updated, for reporting (calculated) periods that have expired before January 1, 2017 are submitted to the relevant authorities of the FIU and the FSS of Russia in the manner operating before the specified date. Also on the basis of Art. 20 of the Federal Law No. 250-FZ Control over the calculation and payment of insurance premiums for reporting (calculated) periods that have expired before January 1, 2017, carry out the relevant authorities of the FIU and the FSS of Russia.

Based on the above, if the employee of the organization in January - March 2017 was recalculated for the wages for 2016, the Organization should provide refined calculations for the period 2016 into the territorial bodies of state extrabudgetary funds.

RSV adjustment for the 1st quarter of 2018

In the last since 2017, insurance premiums are equal, the calculation process of which reflects the RSV report. The distribution of the provisions of the Tax Code of the Russian Federation led to the fact that Article was applied to them.

81 of this regulatory act, regulating the issues of making changes to the tax reporting.

Attention

This article divides errors encountered in reports obliging clarifying and does not require this. In the second case, the taxpayer remains the right to remedy reporting.

In addition, Art. 81 of the Tax Code of the Russian Federation considers the situations in which the commissioning of the compulsory report or does not lead to negative for the subsequent consequences at all, or forces the payment of the penalties, but not fine. And a large role in this is set as a time factor. The ability to clarify the RSV without negative consequences in addition to Art.

81 of the Tax Code of the Russian Federation regulates also, paragraph 7 of Art.

Important

Hello! Tell me, PJ, how to fill out the correction form of the RSV-1.ZE 3 quarter and 2016, "zero" RSV-1 were handed over. In fact, there were accruals on GPA in 3 and 4 blocks.

Adjustment of the RSV 1 in 2018 for 2016

- in the interval between the two dates (the completed period of delivery and the uniform period of payment of charges on it), provided that the IFTS did not request explanations on the defaulum detected in the reporting or did not report the designated on-site inspection (paragraph 3 of Art. 81 of the Tax Code of the Russian Federation);

- on time specified to correct the identified IFSs at the time of acceptance of errors made to the RSV in determining individual calculated indicators or in the personal data of the employee, or to eliminate discrepancies in the amounts specified in sections 1 and 3 (clause 7 of Article 431 of the Tax Code of the Russian Federation) .

The penalty will not be accrued in situations where the reporting is specified by the subder after the expiration of the dates of both deadlines is both passing and paying (clause 4 of Art.

IFTS. For their correction, which is not entailing sanctions, the reporting supplier is given a limited period of time. Thus, the operational correction of defects in reporting avoids fines, but in certain cases and penalties. That is why with the presentation of the corrective report (including the RSV corrective report for the 1st quarter of 2018) when the reporting of errors requiring compulsory correction is better not to delay in the initial version of the reporting. Situations that save from sanctions when clarified at all no consequences will have refined reporting, handed over:

- in a situation that does not bind to its delivery, i.e. when the mistakes allowed do not lead to inclination of the amounts accrued in the payment report (paragraph 1 of Article 81 of the Tax Code of the Russian Federation);

- prior to the completion of the deadline established for the transfer of the first version of the report (paragraph 2 of Art.

NK RF. In filling, the refined version of the RSV from the original will distinguish 2 things:

- in a specially designed field on the title page, you need to specify the adjustment number;

- the same adjustment number is affixed in the corrected information in Section 3; At the same time, only the changeable personal information will be included in the refined report, and those that were originally correct, not necessary to re-pass.

Section 1 data should be filled in the usual manner, but making numbers that meet the corrections made. How to pass the updated reporting on contributions for 2017 and for the periods preceding it, read in the article "Corrective Form of the RSV for 2017 - How can I pass?".

The results of the refined RSV variant is required when identifying errors that require adjustments.

Calculations for insurance premiums, including those updated, for reporting (calculated) periods, expired until January 1, 2017, are submitted to the relevant authorities of the FIU and FSS of Russia 14.09.2017 Russian tax portal The company recalculate wages to its employee in March 2017 for the period 2016. An error was previously allowed, and the accountant found a mistake in March 2017.

How to make adjustments to the reports and, the most important question where to pass the updated calculations (RSV-1 and 4-FSS)? As we know, from January 1, 2017, issues of accrual and payment of insurance premiums oversees the Federal Tax Service. Let's turn to the letter of the Federal Tax Service of Russia of 20.04.2017.

Info

BS-4-11 / [Email Protected]In which the tax service tells us about the procedure for clarifying payments. In accordance with Art. 23 of the Federal Law of 03.07.2016

- the first working day, coming after the day of receipt of the report in electronic form;

- 10 working days, also countable from the date of receipt, but for a report banned on paper.

To the refined statement of reporting was adopted by the date of submission of the first (incomprehensible) option, it must be passed to the IFNS no later than:

- 5 working days from the date of notification made by electronic reporting;

- 10 working days from the date of sending notifications on a paper version of the report.

If the report of control in the IFST in acceptance was passed, but the reporting subservation after its delivery independently identified errors requiring clarification (for example, in the calculation did not take into account the income to be taxed, or the income is mistakenly attributed to non-taxable), then the submission of the Correction RSV for 1 The 2018 quarter will be carried out with the use of the Rules contained in Art.

Corrective information

Corrective information is filed with the aim of changing previously filed information about employees / organization if inaccuracies and errors on the acts of cameral / on-site checks or independently are detected. Corrective form indicates information in full, and not just corrected. Information corrective form fully replaces the information of the original form.

The file with sections 1-5 in the package should always be only one.

Correction of data on the organization

To correct the organization data, do the following:

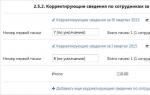

Adjustment of information on employees

Corrective information on employees over the past period are submitted together with the source information during the reporting period, in which inaccuracies were discovered.

Create adjustment of information on employees in two ways:

C main page system

From section 2.5 source information for the later reporting period

In section 2.5 of the source information, click on the Add Corrective Information link link.

In the window that opens, specify the corrected period. If necessary, specify the registration number in the FIU for the corrected period, if it differs from the current registration number.

Click Proceed.

Fill out corrective information according to one cases:

Periods starting with i square meters. 2014

The periods of 2010-13 are adjusted.

To add adjustment to the package, do the following:

Home - Documents

Fill and pass the refined form of RSV-1 PFR

After passing the form of the RSV-1, the PFR accountant may detect that the wrong indicators in the report. There are two ways to fix them, namely:

In the article, we will tell you how to fill out and pass the refined calculation in the form of the RSV-1 of the FIU. And in the next issue - about the second way to correct the error.

The procedure for the accountant will depend on the type of error in the form of RSV-1 of the FIU. We highlight two categories:

Contributions are understated: the error was found by the accountant

Errors affecting the magnitude of insurance premiums can:

- lead to illusion;

- leave it former or enlarge.

Depending on the type of error, the accountant must or is not obliged to submit a "clarified".

Duty to file "clarified"

Refined Calculation of the form of RSV-1 FIU must be applied if the accountant himself found an error that led to undertake the amount of insurance premiums (Part 1 of Art. 17 of the Federal Law of July 24, 2009 No. 212-FZ, further - Law No. 212-FZ).

Deadlines for the submission of "clarified"

Restrictions on the deadlines for the delivery of the refined calculation in the form of the RSV-1 of the FIU in Law No. 212-FZ No. Specialists of the FIU are obliged to accept it at any time.

From August 7, 2015, the procedure for filling the form of the RSV-1 of the FIU, approved by the decision of the Management Board of the FIU of January 16, 2014 No. 2P (hereinafter referred to as the order of filling) is acting in a new edition. The changes are approved by the decision of the Management Board of the FIU of 04.06.2015 No. 194. According to the new rules, the deadline for filing "clarified" and a set of documents are interconnected.

Increased contributions to the FIU. If the refined calculation, the Company submits until the next period of reporting period (for example, until October 1, 2015), in this case the kit includes individual information with the type "source" (Section 6) (paragraph 5. 5.1 p. 5 of the filling order ).

If you do not put on this time, the "clarified" can be surrendered later. But then without section 6 with the type "source" and without subsections 2.5.1 and 2.5.2. At the same time, individual information with the type "corrective" or "canceling" are presented as part of the calculation over the expired reporting period, the submission period of which came (para. 6 sub. 5.1 p. 5 of the filling procedure).

Subscribed contributions to FFOMs. If you decide to submit a refined calculation in the form of the RSV-1 of the FIU (part 1 of article 17 of Law No. 212-ФЗ), it is necessary to submit only sections 1 and 2. Individual information (Section 6) is not necessary to fill out, since the error did not affect the data of the personalized accounting.

Instead of "clarified". Also, the correction of bugs on contributions to the FFR and the FFOMS can be shown in the report for the nearest reporting period (p. 24 of the filling procedure). For example, in the report for 9 months. For this purpose, Row 120 in Section 1 and Section 4 of the Forms of RSV-1 FIR.

Blank for refined calculation

The refined calculation is presented in the same form, according to which the initial calculation was presented (Part 5 of Art. 17 of Law No. 212-FZ, para. 6 sub. 5.1 of paragraph 5 of the filling procedure).

Starting from the reporting for the first quarter of 2014, the form of the form of the RSV-1 of the FIU approved by the Resolution of the RFR Board of January 16, 2014 No. 2P. It reflects information about the accrued and paid pension contributions and health insurance contributions across the company and individual information.

From August 7, 2015, the form of RSV-1 FIU acts in a new edition. Changes approved by the decision of the RFR Board of 04.06.2015 No. 194. They need to be applied since reporting for the 1st half of 2015.

Features of the filling of the title leaf in the "clarified"

When applying a refined calculation on the title page in the "Clarification number" field indicates the sequence number of the refinement. If you first make changes - 001, in the case of re-correction - 002, etc. (paragraph 3 of the sub. 5.1 p. 5 of the filling order).

In the "Reason of Clarification" field, you should specify the code for the cause of the refined form of the RSV-1 of the FIU (paragraph 4 of the sub. 5.1 p. 5 of the filling order). To do this, select one of the values:

- 1 - refinement of indicators while adjusting the amounts of insurance premiums on the OPS, including by complearities subject to listing;

- 2 - Clarification when the sums changes accruedinsurance premiums on the OPS (including additional tariffs);

- 3 - if the clarification touched insurance contributions for OMS or other indicators that do not affect individual accounting for insured persons.

Filling in section 1 and subsection 2.1

In a refined form, you should fill out both the lines where the error is made, and those where the correct numbers were. Moreover, it is not necessary to specify the deviations from the true values, but the correct indicators of the whole.

In a refined calculation, section 4 is not filled (para. 3 p. 24 of the filling procedure).

Example 1. Filling a refined calculation. Error led to inclusion of contributions

On August 31, 2015, the accountant LLC "Vyaz" found that in June 2015, insurance premiums in the FFR and FFOMS were not charged on the non-refundable L.A. Mikhailov accountable amount 5000 rubles.

The company in 2015 applies general rates of insurance premiums, in particular:

- in PFR - 22%;

- in FFOMs - 5.1%.

The company employs:

- Yu.B. Ponomarev - Director General, salary - 100,000 rubles.

- OD Ershova - chief accountant, salary - 70,000 rubles.

- L.A. Mikhailov - manager, salary - 50,000 rubles.

All employees are citizens of the Russian Federation.

Since the error led to the understatement of the taxable base, the company submits a refined settlement for the 1st half of 2015.

What sections need to fill out an accountant, presenting a refined calculation for the 1st half of 2015?

Decision

First of all, it is necessary to show the detachment of insurance premiums in accounting. It reflects the record: Debit 20 (25, 26, 44) Credit 69. The basis for this record will be an accounting certificate.

In the refined form of RSV-1, the FIU must be filled:

- title page;

- sections 1 and 2 (subsection 2.1);

- section 6, specify the type of adjustment - "source" (para. 5 sub. 5.1 p. 5 of the filling order).

Section 4 is not filled.

Samples of filling title sheet, partition 1, subsection 2.1 and partition 6 cm. Below.

Sample 1. Fragment of the title leaf

Sample 2. Section Fragment 1.

Sample 3. Fragment of section 2, subsection 2.1

Sample 4. Section 6 fragment

Before feeding "clarifieds" pay extra fees and penalties

For incomplete payment of insurance premiums, the company may be fined (Art. 47 of Law No. 212-FZ). However, if you yourself found and paid the sum of arrears and penalties, the fine does not threaten you. Therefore, before sending the clarified form of RSV-1 of the FIU, it is necessary to pay the amount of inconsistency of contributions and penalties (paragraph 1 of Part 4 of Article 17 of Law No. 212-FZ).

Penis should be transferred to different payment orders depending on the type of contributions. In the CBC in the 14th category you need to put a digit 2. For example, the CBC for payment of penali:

- on pension contributions to the FIU for the payment of insurance pension - 392 1 02 02010 06 2000 160;

- contributions in FFOMS - 392 1 02 02101 08 2011 160.

Example 2. Calculation of pennel

We use the data of the previous example.

The accountant revealed a mistake - with the amount of 5000 rubles. Not in time listed contributions for June 2015. The accountant was detached contributions to the FIU - 1100 rubles. (5000 rubles. × 22%) and in FFOMS - 255 rubles. (5000 rubles. × 5.1%). They paid on September 1, 2015. It is necessary to calculate the amount of penny. Refinancing rate - 8.25% (indication of the Central Bank of the Russian Federation of September 13, 2012 No. 2873-y).

Decision

The number of calendar days of delay in payment of insurance premiums of penalties are charged for each day of delay, starting from the day following the time of payment of insurance premiums, and on the day of their payment (penalties) inclusive (Part 3 of Art. 25 of Law No. 212-ФЗ).

Since contributions for June 2015, it was necessary to pay no later than July 15, 2015 (part 5 of Art. 15 of Law No. 212-FZ), it means that penalties should be charged for the period from July 16 to September 1, 2015 inclusive.

The number of calendar days of delay is 48 calends. DN. (16 calendar. Day + 31 calends. Day + 1 calend. Day).

The size of the penalty for the period of the rates is 8.25%. The interest rate of the penis - 1/300 in force these days the refinancing rate of the Central Bank of the Russian Federation (part 6 of Art.

Adjustment of individual information of the PFR for previous periods in ZUP 2.5

25 of Law No. 212-FZ).

The amount of foam for the late and incomplete payment of insurance premiums for the period from July 16 to September 1, 2015 will incorporate 17.89 rubles, including:

- in PFR - 14,52 rubles. (1100 rubles. × 48 calendar. Day × 8.25% × 1/300);

- in FFOMS - 3.37 rubles. (255 rubles. × 48 calendar. Day. × 8.25% × 1/300).

The error has not led to inclusion of contributions.

We list errors that do not lead to inclusion of the amount of insurance premiums. For example, in the form of RSV-1, the FIU is incorrectly indicated:

- tariff code;

- payments not included in the taxable base for accrual of contributions;

- registration number in the FIU, the reporting period, the number of insured persons, the mining number of employees of the company, etc.

In such cases, the company has the right to Self decide whether it will file a refined calculation or not (Part 2 of Art. 17 of Law No. 212-ФЗ).

"Clarify" to file do not need

If the error in calculating contributions was revealed by the FIU experts on the results of the cameral or on-site inspection, then the FIU is not necessary to file a refined calculation (p. 3 and 24 of the filling order).

Insurance contributions will be decisive on the basis of a decision on verification. This amount of insurance premiums must be reflected in the form of RSV-1 of the FIU for the current reporting period:

- in line 120 of section 1;

- in section 4.

It is not necessary to submit a "clarified" and if you have found a mistake in the calculation of salaries and detached the worker the missing amount. They are reflected in accounting in the month of accrual of surcharge. In the same month, the amount of surcharge charges insurance premiums. They will need to be reflected in the form of the RSV-1 of the FIU for the reporting period, which includes a month of retaliation of wages.

September 2015

Tax reporting, insurance premiums

Adjustment of personalized accounting information

In accordance with the rules of conducting an individual (personalized) accounting of information, the policyholder has the ability to adjust the previously submitted information about the insured person for a certain reporting period.

Adjustment of information taken into account on the individual personal account of the insured person during the reporting periods since 2010, is made by the forms of SZB-6-1 and SZV-6-2, the type of information "Corrective". Information corrective shape completely replaces the information of the previously filed source form.

To cancel the information submitted during the periods since 2010, the forms of SZV-6-1 and SZV-6-2 type of information "canceling" are used.

The procedure for representing the insured by corrective information on personalized accounting for the reporting periods, starting in 2010, the following.

Correcting individual information, if necessary, should be represented by the insured together with the original individual information of personalized accounting for the reporting period, in which errors were detected by the insured.

A set of individual information (initial corrective, canceling) is accompanied by the form of the ADV-6-2, at the same time no more than one ADV-6-2 form may be presented for each reporting period.

Thus, if the Insured in the current reporting period, it is necessary to adjust the information of personalized accounting for the Insured person in the previous reporting periods, the Form ADV-6-2 submitted by the insureder for the current reporting period should contain data as a whole on the policyholder and accompany packages of documents and registries of source information For the current period and corrective (canceling) information for previous reporting periods.

Examples of filling out individual information If the insured in the current reporting period, it is necessary to adjust the information of individual (personalized) accounting for the insured person for the previous reporting periods is shown in the application.

Download Examples of Filling Corrective Information

(For version 3.0, see here)

Attention ! When filling out the form of the RSV-1 for the 4th quarter of 2016, the OKVED code is indicated 2

Make corrections in RSV-1 reports in two methods:

- Create a clarifying form of RSV-1

- Add a corrective form to current RSV-1

Remind.

To create or edit RSV-1, you need to open the menu / frames / preparation of the PFR data, and here to choose the desired period. From the report log, you can only watch a ready-made report and unload it or send it.

Method No. 1 - Create a clarifying form of RSV-1

This method can only be used while complying with two conditions:

- The error led to inclusion of contributions to payment.

- Since the end of the reporting period (not to be confused with the last term of the reporting) passed no more than two months.

To create a clarifying form of RSV-1, you must open menus / frames / PRESSION data preparation, select the desired period. You will see the selected report.

Next, you must click the "Mark section of the Puttings section 2.5 as received by the FIU" (CAUTION, there is no cancellation of this action), after which the "Reform" button turns into "form". When you click on this button, an additional menu opens where you need to select "Copy as Corrective".

The program uses only the name "Corrective", I specifically use different names "Clarifying" and "Corrective" to emphasize the differences.

As a result, you get a new report open for adjustments.

It is not necessary in this form section 6 to marry "information - corrective".

Method number 2 - Fix errors in the current RSV-1

If the conditions for creating a clarifying form are not performed, then all the fixes are submitted when the next RSV-1 report is submitted, but with an additional bundle of section 6 (or more, if you immediately adjust several reporting periods). The first pack will be for the current period, and even additional packs for each corrected period.

Therefore, first create, as usual, the report for the current period.

To create an additional pack, you must in the section "Composition of section 2.5" click on the "+ Sections 6" button.

Now this pack is chosen "information - corrective", and choose the corrected reporting period.

« Reg. № (Corr)"- After changing the legal address, the FIU may assign the organization a new registration number. If you create an adjustment for the period when you had another old reg.№, then this old reg. No. You must specify in this field.

Corrective information

If you didn't have such adventures - leave this field blank.

In this pack included insured persons only those that will be adjusted. They fill in them the correct data. And note, next to the field "Called contributions to the OPS", you must fill in the field "incl. Dincinquent. " If the amount of accruals decreased, the amount is entered with a minus sign.

And yet, I remind you that these two fields are introduced only with sums that do not exceed the limit value of the base for the accrual of insurance premiums.

ATTENTION. If you have fired employeeIt falls into the corrected period, but there is no it in the current one, it is necessary to add to the package section 6 for the current period with empty data on income and periods. Otherwise, it is not filled by section 6.6 with corrective data.

After selecting the "Show all sections" button, you will find a prepared report.

Going to Section 6, you will see information for the current period. To select another section 6, with adjustments, you must use the arroders in the lower right corner, after the words "Additional Pages". Here you can see what page are you now.

Do not forget to fill in Section 4, the total data from which fall into the section 120 of section 1. And when checking, these data will be checked with the total field data "incl. Dincinquent "for each employee.

If you have a lot of employees, you may have to create a table in Excel to correctly calculate all the amounts for each employee, as well as get the final amounts for each month.

If everything is filled, the report can be unloaded, check in CheckPFR, send, print.

An example of filling the form of the RSV-1 with a corrective section 6 (1C Accounting 2.0)

Sometimes the Pension Fund requests the employer to submit corrective forms of individual information on employees. These have special requirements.

1.1 Corrective form of SZV-6-1 (2), the type of information - the correspondent is created only on those insured persons on which the incorrect source form of SZV-6-1 (2) was previously represented, the type of information - the ISXD (otherwise there is simply nothing to adjust ).

The corpuscular is completely replaced by all data on the personal account recorded earlier by the ISXD form,

Therefore, the correspondent must contain all the completed correct information, and not only the one that was incorrect and adjusted.

1.2 Corresponding for the previous reporting periods are mandatory submitted by the insured together with the ICC reporting for the current reporting period.

In the current reporting period, you can submit corrective information for several previously corrected periods.

When creating a corpuscular, the "reporting period" is indicated, which presents the current reporting ISXD-forms, and the "corrected period" - for which incorrect information is corrected.

In this case, the corrected period should be earlier than the reporting period.

How to conduct RSV-1 adjustment, delivery time, adjustment type

For example, "Reporting Period": 2013-3, "Corrected period" - 2012 -2. In this case, together with ICC forms for the reporting period, the 3rd quarter of 2013 presents corpuscles for the 2nd quarter of 2012.

1.3 ISPC and corps are accompanied by one general form of the ADV-6-2, i.e. A general description of all represented packs, which describes: the name of the package file, the number of insured persons in each pack and the amount of packages.

The ADF-6-2 form is divided into two parts:

- the upper part for the ICM information for the current reporting period, all amounts of accrued and paid contributions are reflected here in the present reporting period.

The final line on all ISXD packs is compared with the submitted RSV-1 form for the current reporting period;

- Lower part - for the corner of information over the past reporting periods, in this part - information about packs with corporations: with the amounts of decisive and checked contributions for each pack,

The final non-zero amounts of detachments and ademp pays for all corpses should be reduced with a refined form of RSV-1 for previous reporting periods.

1.4 in the form of the ADV-6-2, in the case of the pre-form, in terms of "information on corrective (abolishing) information" in the graphs "Danced ...", "Doodle ..." The difference between the amounts of insurance premiums in the wrong IPC should be reflected. forms and correct corrchairs.

The method of sending corrective information depends on the type of packs transmitted, as well as from the period for which the report is applied.

Sending a corrective calculation according to individual information

According to the decree of the Board of the Russian Federation of the Russian Federation of 31.07.2006 No. 192P, corrective individual information is presented in a single package with the initial data of the current reporting period.

If the source data in the package will be in 1 quarter of 2014 and later,that package will consist of two PCB packs and the required number of corrective packs of the CWF:

- RSV-1 (sections 1-5) - data as a whole on the organization (including data from corrective SZV);

- RSV-1 (section 6) - data on insured persons for the initial period;

- Cor2 Cor2 - Corrective information for the period 2.

If the initial data in the package will be for the 4th quarter of 2013 and earlierThe package will consist of the following packs:

- RSV for the initial period;

- SZV for the initial period;

- CR1 - corrective information for the period 1;

- Cor2 SZV - corrective information for the period 2;

- ADV is common in all packs of the SZV.

The current reporting period of the source packs must match.

Five cases when needed adjustments to the FIU

The adjustment period in the SWB bundle should be less than the original reporting period.

Correcting individual information for the first half of 2010 can also be sent by a separate package (Corr. + ADV), indicating the second half of 2010 as the current period.

For example, to form a reporting package in contour-extern, containing corrective data on individual information for 3 and 4 quarters of 2013 (at the same time, the reporting period - the 1st quarter of 2014) must be done as follows:

- To form corrective NWVs and the ADV for the 3rd quarter of 2013 (the current period should be in accordance with the period of the source information, that is, the 1st quarter of 2014).

- to form corrective SWDs and the ADV for the 4th quarter of 2013 (the current period, at the same time, must comply with the period of the source information, that is, the 1st quarter of 2014).

- To form a unified form for the organization and employees of the RSV for the first half of 2014, including adjusting the packs of packs for 3 and 4 quarters of 2013.

The package formation technology will differ depending on which program is used to prepare reporting in the FIU.

Sending the cancellation information of the SZV is similar to sending corrective reports. In the "Contour-Extern" system, it is possible to send canceling and corrective information (with source) in one package.

Sending a corrective calculation for insurance premiums (RSV)

Corrective information on the RSV for 2010-2014 is provided with a separate package.

If the changes in the calculation of insurance premiums entailed changes in individual information for the same period, the corrective information of the NWS will need to be provided with the initial information for the current reporting period.

Also, the RSV correction report can be sent in conjunction with the source data of the SZV + ADV for the period up to 2014. The period for which the RSV adjustment is provided and the period specified in the source individual information should be coincided.

(1C Accounting 2.0.65.48)

Attention! When filling out the form of the RSV-1 for the 4th quarter of 2016, the OKVED code is indicated 2

Consider the extremal situation.

When preparing a report for the first quarter of 2016, it turned out that adjustment for all quarters of 2015 is required.

Start.

First, everything is as usual. Create a new report. Automatically fill source Section 6 data for the first quarter.

In the list of insured persons we introduce all whose data should be adjusted. Fill the data monthly for each employee, do not forget to fill the field "incl. Dincinquent, "where we must specify the difference between the previously accrued and new value. If the amount decreased, the field will be with a minus sign.

Then for 3 and 4 blocks.

Part of the work is done. Dried. And continued.

Click "Show all sections". And proceed to fill out this form.

To begin with, go to section 4.

Here, a separate line must be filled out for each corrected month. Moreover, the sums in graphs 6, 7 and 14 can be with the "minus" sign, if taxable amounts decreased. Be accurate, the final amounts will be transferred to section 1 line 120 and 121.

Check the report data. It can be sent.

The second quarter passes calmly.

No additional partitions to create no additional sections. Do not forget only in Section 4, repeat all the data you were filled in preparation of the report for the first quarter. Look at the 2.1 section, we will need.

The third quarter comes. And here it turns out that many accruals made in the first and second quarter requires to cancel.

First that the program correctly considered taxes and contributions, in July 2016 documents "Accrual of wages" were created with negative sums. These documents completely repeated the required cancellations of the documents, only the date of the document was "07/29/2016" and the amount were with the "minus" sign.

The document "Calling Taxes with Fot" for July month issued many wiring with negative sums. Do not worry, it is correct. Next, we close July, August, September and proceed to filling the RSV-1 for the third quarter.

Now we know how to do it. Will be easy.

Create the source section 6.

Data on July and results for the quarter The program will fill in incorrectly, fill in manual.

And we introduce corrective information on employees. In the field "incl. Dincinquent "amounts will be with a minus.

Create Section 6 to adjust the second quarter.

Everything is done here, click "show all sections."

Go to section 4.

Lines for each corrected month of 2015 must be created here (rewrite from the previous quarter). And on line for each corrected month of 2016. These data rewrite is nowhere.

Go to Section 2.1.

His filling will help us a report for the first half of 2016, put it nearby. Further, we will often have to refer to it in the text, so we will call it an OZP (a report for the half year).

String 200, in column 3 there must be the amount is the same as in the OZP, increased in terms of columns 4, 5 and 6.

Row 203. The excess of the limit amount was in the second quarter, but in the third, after a decrease, the exceedment did not become. Therefore, in column 3 should be the amount as in the OZP. Graphs 4 - 6 empty.

Row 204. Graph 3 \u003d s. 200 - C.203. Graphs 4 - 6 are the same amounts as in line 200.

Row 205. These are the amount of tax calculated from the amount in line 204. Count in the graph.

Row 206. This is the amount of tax calculated from the amount in the string 203.

Rows 207 problems should not be, the amount of us was always the same.

In line 208, even if there was no exceeding in the 3rd quarter, but since we specify corrective data for the second quarter (where there was an exception), we put the number 3.

Rows 210 - 215 are filled in the same rules.

Go to section 1.

In p.100 the same amount as in the OZP. The residue has not changed.

Row 110 is equal to the sum of the strings 205 and 206 of Section 2.1. Rows 111 -113 from there.

In lines 120 and 121, the total data from section 4 should be standing.

In line 130 we add sums from the strings 100, 110 and 120.

In the following lines, we pay and calculate the remnants.

Check. Unload. Send. The report is ready.

Fill and pass the refined form of RSV-1 PFR

After passing the form of the RSV-1, the PFR accountant may detect that the wrong indicators in the report. There are two ways to fix them, namely:

In the article, we will tell you how to fill out and pass the refined calculation in the form of the RSV-1 of the FIU. And in the next issue - about the second way to correct the error.

The procedure for the accountant will depend on the type of error in the form of RSV-1 of the FIU. We highlight two categories:

Contributions are understated: the error was found by the accountant

Errors affecting the magnitude of insurance premiums can:

- lead to illusion;

- leave it former or enlarge.

Depending on the type of error, the accountant must or is not obliged to submit a "clarified".

Duty to file "clarified"

Refined Calculation of the form of RSV-1 FIU must be applied if the accountant himself found an error that led to undertake the amount of insurance premiums (Part 1 of Art. 17 of the Federal Law of July 24, 2009 No. 212-FZ, further - Law No. 212-FZ).

Deadlines for the submission of "clarified"

Restrictions on the deadlines for the delivery of the refined calculation in the form of the RSV-1 of the FIU in Law No. 212-FZ No. Specialists of the FIU are obliged to accept it at any time.

From August 7, 2015, the procedure for filling the form of the RSV-1 of the FIU, approved by the decision of the Management Board of the FIU of January 16, 2014 No. 2P (hereinafter referred to as the order of filling) is acting in a new edition. The changes are approved by the decision of the Management Board of the FIU of 04.06.2015 No. 194. According to the new rules, the deadline for filing "clarified" and a set of documents are interconnected.

Increased contributions to the FIU. If the refined calculation, the Company submits until the next period of reporting period (for example, until October 1, 2015), in this case the kit includes individual information with the type "source" (Section 6) (paragraph 5. 5.1 p. 5 of the filling order ).

If you do not put on this time, the "clarified" can be surrendered later. But then without section 6 with the type "source" and without subsections 2.5.1 and 2.5.2. At the same time, individual information with the type "corrective" or "canceling" are presented as part of the calculation over the expired reporting period, the submission period of which came (para. 6 sub. 5.1 p. 5 of the filling procedure).

Subscribed contributions to FFOMs. If you decide to submit a refined calculation in the form of the RSV-1 of the FIU (part 1 of article 17 of Law No. 212-ФЗ), it is necessary to submit only sections 1 and 2. Individual information (Section 6) is not necessary to fill out, since the error did not affect the data of the personalized accounting.

Instead of "clarified". Also, the correction of bugs on contributions to the FFR and the FFOMS can be shown in the report for the nearest reporting period (p. 24 of the filling procedure). For example, in the report for 9 months. For this purpose, Row 120 in Section 1 and Section 4 of the Forms of RSV-1 FIR.

Blank for refined calculation

The refined calculation is presented in the same form, according to which the initial calculation was presented (Part 5 of Art. 17 of Law No. 212-FZ, para. 6 sub. 5.1 of paragraph 5 of the filling procedure).

Starting from the reporting for the first quarter of 2014, the form of the form of the RSV-1 of the FIU approved by the Resolution of the RFR Board of January 16, 2014 No. 2P. It reflects information about the accrued and paid pension contributions and health insurance contributions across the company and individual information.

From August 7, 2015, the form of RSV-1 FIU acts in a new edition. Changes approved by the decision of the RFR Board of 04.06.2015 No. 194. They need to be applied since reporting for the 1st half of 2015.

Features of the filling of the title leaf in the "clarified"

When applying a refined calculation on the title page in the "Clarification number" field indicates the sequence number of the refinement. If you first make changes - 001, in the case of re-correction - 002, etc. (paragraph 3 of the sub. 5.1 p. 5 of the filling order).

In the "Reason of Clarification" field, you should specify the code for the cause of the refined form of the RSV-1 of the FIU (paragraph 4 of the sub. 5.1 p. 5 of the filling order). To do this, select one of the values:

- 1 - refinement of indicators while adjusting the amounts of insurance premiums on the OPS, including by complearities subject to listing;

- 2 - Clarification when the sums changes accruedinsurance premiums on the OPS (including additional tariffs);

- 3 - if the clarification touched insurance contributions for OMS or other indicators that do not affect individual accounting for insured persons.

Filling in section 1 and subsection 2.1

In a refined form, you should fill out both the lines where the error is made, and those where the correct numbers were. Moreover, it is not necessary to specify the deviations from the true values, but the correct indicators of the whole.

In a refined calculation, section 4 is not filled (para. 3 p. 24 of the filling procedure).

Example 1. Filling a refined calculation. Error led to inclusion of contributions

On August 31, 2015, the accountant LLC "Vyaz" found that in June 2015, insurance premiums in the FFR and FFOMS were not charged on the non-refundable L.A. Mikhailov accountable amount 5000 rubles.

The company in 2015 applies general rates of insurance premiums, in particular:

- in PFR - 22%;

- in FFOMs - 5.1%.

The company employs:

- Yu.B. Ponomarev - Director General, salary - 100,000 rubles.

- OD Ershova - chief accountant, salary - 70,000 rubles.

- L.A. Mikhailov - manager, salary - 50,000 rubles.

All employees are citizens of the Russian Federation.

Since the error led to the understatement of the taxable base, the company submits a refined settlement for the 1st half of 2015.

What sections need to fill out an accountant, presenting a refined calculation for the 1st half of 2015?

Decision

First of all, it is necessary to show the detachment of insurance premiums in accounting. It reflects the record: Debit 20 (25, 26, 44) Credit 69. The basis for this record will be an accounting certificate.

In the refined form of RSV-1, the FIU must be filled:

- title page;

- sections 1 and 2 (subsection 2.1);

- section 6, specify the type of adjustment - "source" (para. 5 sub. 5.1 p. 5 of the filling order).

Section 4 is not filled.

Samples of filling title sheet, partition 1, subsection 2.1 and partition 6 cm. Below.

Sample 1. Fragment of the title leaf

Sample 2. Section Fragment 1.

Sample 3. Fragment of section 2, subsection 2.1

Sample 4. Section 6 fragment

Before feeding "clarifieds" pay extra fees and penalties

For incomplete payment of insurance premiums, the company may be fined (Art. 47 of Law No. 212-FZ). However, if you yourself found and paid the sum of arrears and penalties, the fine does not threaten you.

Therefore, before sending the clarified form of RSV-1 of the FIU, it is necessary to pay the amount of inconsistency of contributions and penalties (paragraph 1 of Part 4 of Article 17 of Law No. 212-FZ).

Penis should be transferred to different payment orders depending on the type of contributions.

How to pass the adjustment to the FIU?

- on pension contributions to the FIU for the payment of insurance pension - 392 1 02 02010 06 2000 160;

- contributions in FFOMS - 392 1 02 02101 08 2011 160.

Example 2. Calculation of pennel

We use the data of the previous example.

The accountant revealed a mistake - with the amount of 5000 rubles. Not in time listed contributions for June 2015. The accountant was detached contributions to the FIU - 1100 rubles. (5000 rubles. × 22%) and in FFOMS - 255 rubles. (5000 rubles. × 5.1%). They paid on September 1, 2015. It is necessary to calculate the amount of penny. Refinancing rate - 8.25% (indication of the Central Bank of the Russian Federation of September 13, 2012 No. 2873-y).

Decision

The number of calendar days of delay in payment of insurance premiums of penalties are charged for each day of delay, starting from the day following the time of payment of insurance premiums, and on the day of their payment (penalties) inclusive (Part 3 of Art. 25 of Law No. 212-ФЗ).

Since contributions for June 2015, it was necessary to pay no later than July 15, 2015 (part 5 of Art. 15 of Law No. 212-FZ), it means that penalties should be charged for the period from July 16 to September 1, 2015 inclusive.

The number of calendar days of delay is 48 calends. DN. (16 calendar. Day + 31 calends. Day + 1 calend. Day).

The size of the penalty for the period of the rates is 8.25%. The interest rate of the Penies is 1/300 by the refinancing rate of the Central Bank of the Russian Federation (part 6 of Art. 25 of Law No. 212-ФЗ).

The amount of foam for the late and incomplete payment of insurance premiums for the period from July 16 to September 1, 2015 will incorporate 17.89 rubles, including:

- in PFR - 14,52 rubles. (1100 rubles. × 48 calendar. Day × 8.25% × 1/300);

- in FFOMS - 3.37 rubles. (255 rubles. × 48 calendar. Day. × 8.25% × 1/300).

The error has not led to inclusion of contributions.

We list errors that do not lead to inclusion of the amount of insurance premiums. For example, in the form of RSV-1, the FIU is incorrectly indicated:

- tariff code;

- payments not included in the taxable base for accrual of contributions;

- registration number in the FIU, the reporting period, the number of insured persons, the mining number of employees of the company, etc.

In such cases, the company has the right to Self decide whether it will file a refined calculation or not (Part 2 of Art. 17 of Law No. 212-ФЗ).

"Clarify" to file do not need

If the error in calculating contributions was revealed by the FIU experts on the results of the cameral or on-site inspection, then the FIU is not necessary to file a refined calculation (p. 3 and 24 of the filling order).

Insurance contributions will be decisive on the basis of a decision on verification. This amount of insurance premiums must be reflected in the form of RSV-1 of the FIU for the current reporting period:

- in line 120 of section 1;

- in section 4.

It is not necessary to submit a "clarified" and if you have found a mistake in the calculation of salaries and detached the worker the missing amount. They are reflected in accounting in the month of accrual of surcharge. In the same month, the amount of surcharge charges insurance premiums. They will need to be reflected in the form of the RSV-1 of the FIU for the reporting period, which includes a month of retaliation of wages.

September 2015

Tax reporting, insurance premiums